As Covid swept across the globe, a few unexpected winners emerged from the chaos.

Peloton (PTON) became a Wall Street darling, with its stock soaring to $171 and its market cap topping $50 billion as gyms closed and home workouts exploded.

But the gains didn’t stick. With people eager to return to fitness centers, Peloton now trades at just $7, with a market cap of $2.8 billion.

Zoom (ZM) briefly surpassed Exxon Mobil (XOM) in value as remote work became the norm. At its peak, Zoom’s market cap hit $140 billion. While still a fixture of hybrid work, growth has stalled. Zoom’s current valuation sits at $23.6 billion, compared to Exxon’s $484.7 billion.

And then there’s Crocs (CROX), the rubber clog brand that became a lockdown uniform and pandemic punchline all in one.

Speaking on the company’s Q1 earnings call this May, CEO Andrew Rees credited the pandemic era for “the emergence of the Crocs brand as an icon of popular culture.”

Unlike other pandemic darlings, Crocs didn’t fade.

It wasn’t a “one-hit wonder,” and didn’t crash once workers headed back to offices. In fact, Crocs posted record revenue of $640.8 million in 2024, which is proof that comfort didn’t go out of style.

But the next threat to Crocs has nothing to do with taste. It’s tariffs.

Crocs in the tariff crosshairs

While the pandemic helped catapult Crocs into mainstream fashion, President Trump’s escalating trade war could hit the brand where it hurts: its supply chain.

During last month’s earnings call, Rees outlined the company’s sourcing breakdown: 47% from Vietnam, 17% from Indonesia, 13% each from China and India, and 5% each from Mexico and Cambodia.

If Trump’s proposed 145% tariff on Chinese goods remains in effect, along with a 10% tariff on all other sourcing countries, Crocs could face $130 million in additional costs on an annualized cash basis.

The company says it’s working on diversifying its supply chain and would be ready to pivot within 6 to 12 months if the tariffs stick.

But despite the political risks, some investors see the recent dip as a buying opportunity.

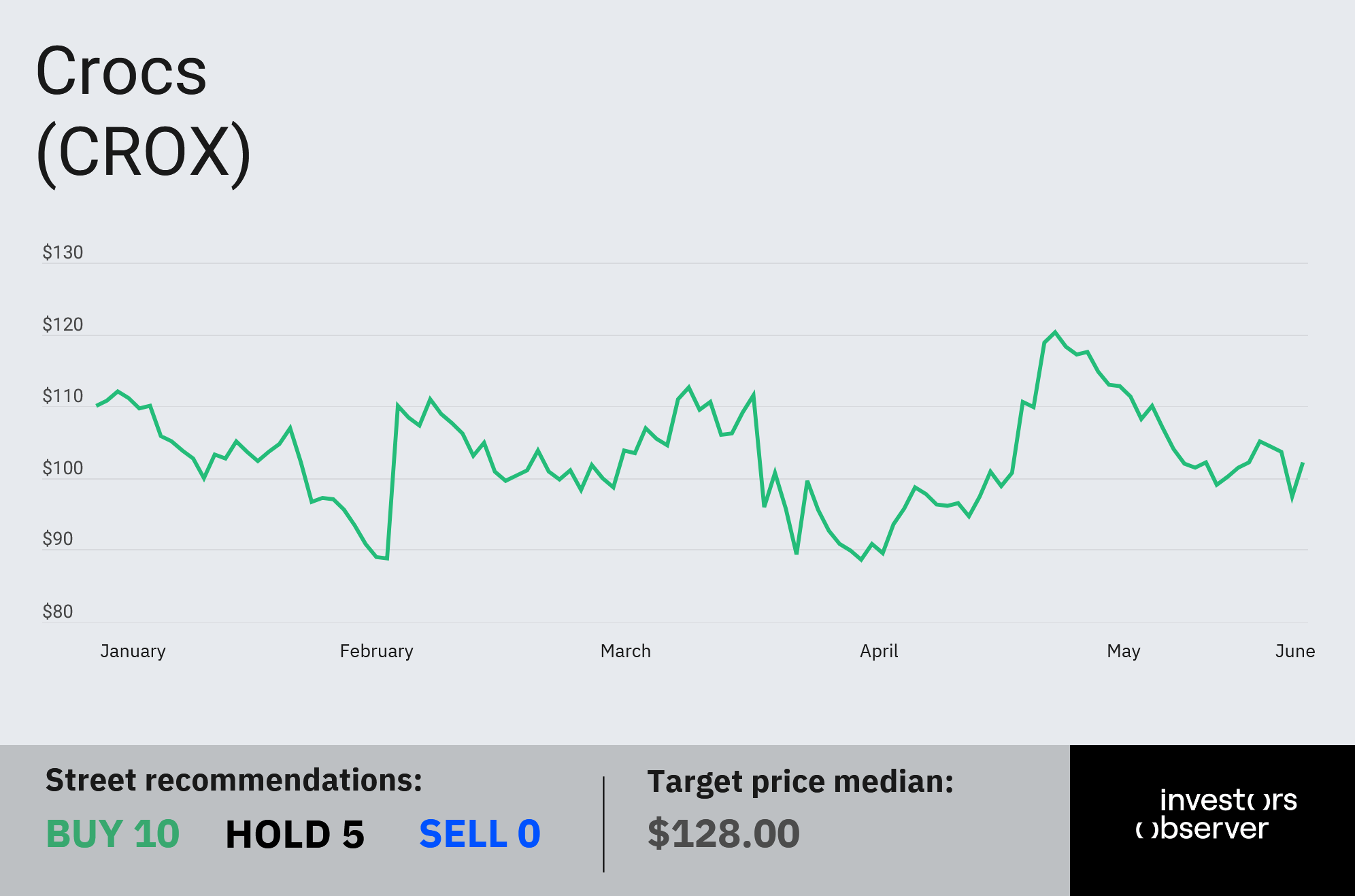

Crocs is trading just above $102, and at that price, it’s “very inexpensive,” according to Simon Erickson, founder and CEO of 7Investing.

“The stock is trading at just 7x earnings and 6.5x free cash flow, but it’s generating a 70% return on equity and a 25% return on invested capital,” Erickson said on X. “There’s a pretty clear disconnect there. Crocs’ core business is solid and profitable. Yet the market is pricing it as a fad that’s in a permanent decline.”

While the company’s $2.5 billion acquisition of HEYDUDE hasn’t lived up to expectations with younger consumers, Crocs is trying to revamp its image.

It recently tapped Hollywood star Sydney Sweeney as brand ambassador in a bet that more fashion-forward marketing can reignite growth.

“If the company’s new marketing efforts pay off,” Erickson added, “this inexpensive stock might be worth snapping your jaws on as one of the stock market’s most compelling opportunities.”

Crocs shares are down 7.1% year to date. But if it can survive a global shutdown, a tariff war might not be its final boss.

Your email address will not be published. Required fields are markedmarked