Hims & Hers Health (HIMS) has been one of Wall Street’s best performers this year, and now, it’s drawing attention from an entirely new market: South Korea.

Since its recent listing, HIMS has quickly become one of the top 50 most-traded stocks in South Korea, which is an impressive feat considering it didn’t appear on local data feeds until earlier this month, according to data analyst Jonathan Stern.

“HIMS wasn’t listed as of May 17, meaning inflows must have been massive this past week,” Stern noted on May 22.

South Korean investors are known for their appetite for risk, particularly when it comes to U.S. stocks. As Acadian Asset Management observed in a March 2025 report, they often view the U.S. market as a “casino.”

The firm even compared the Korean retail investor market to Squid Game, describing a trading environment where participants are “often unaware of the rules and not particularly qualified to play.”

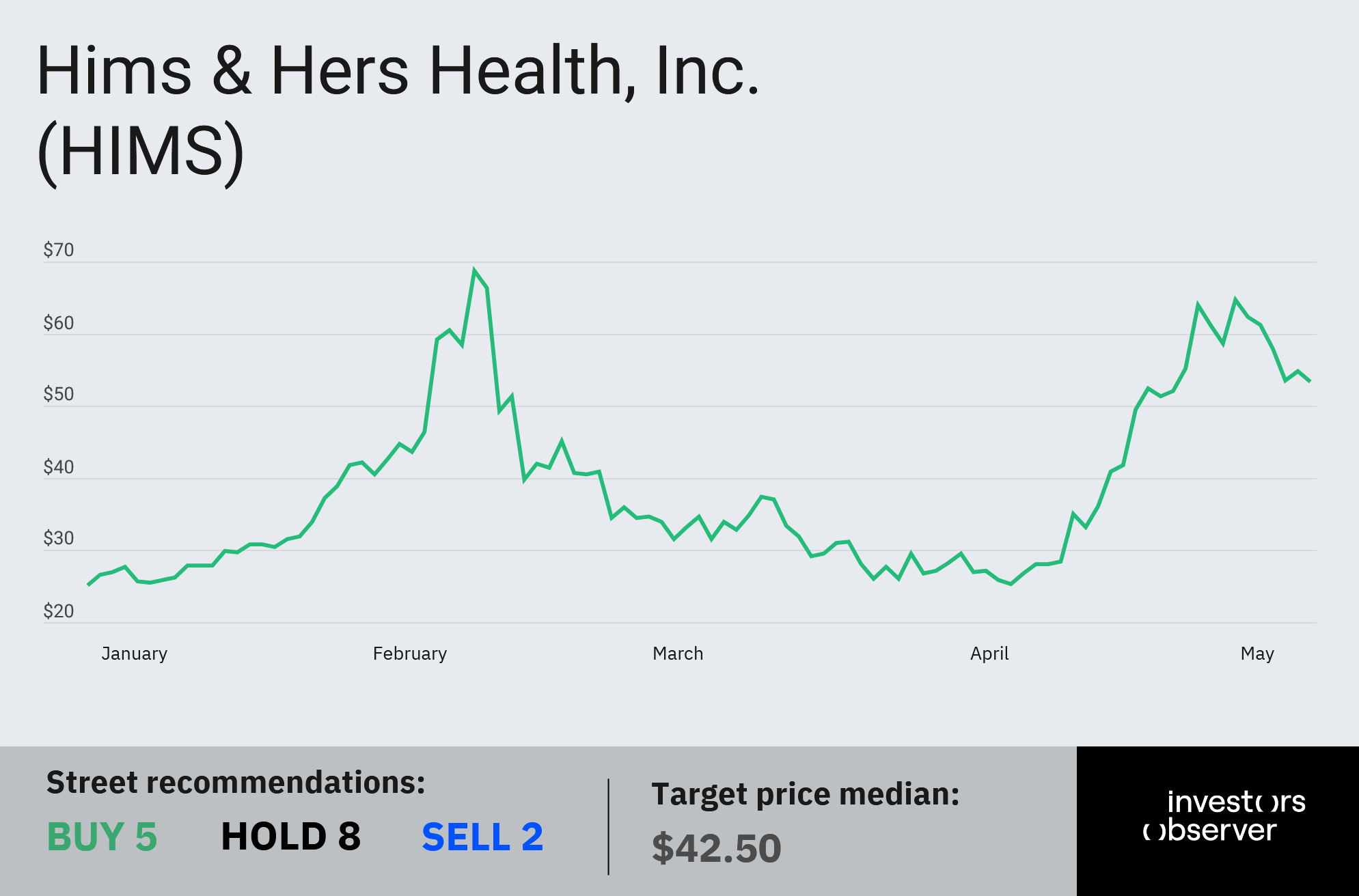

Despite strong year-to-date performance, HIMS has pulled back in recent days, sliding from around $64 per share in mid-May to roughly $53 on Tuesday.

Even so, the stock has returned 87% over the past month and is up 111% year-to-date, bringing its market capitalization to nearly $12 billion.

HIMS is driving retail euphoria

As Investors Observer recently reported, HIMS’ surge has been fueled by a broader shift in American healthcare toward personalization and direct-to-consumer models.

Analysts also noted that Hims’ management is “playing offense” by raising $800 million through an upsized bond offering, providing the company with additional capital to support future growth.

Hims & Hers has a strong understanding of the American consumer, which is why it doubled down on offering GLP-1 drugs for weight loss.

The company strategically began selling compounded versions of popular medications like Ozempic, taking advantage of widespread drug shortages in the years following the pandemic.

Combined with its telehealth platform, which includes pharmacy services and personalized care, Hims has successfully positioned itself within a rapidly expanding market.

This largely explains why Hims was able to more than double its revenues during the first quarter, from $278.1 million to $586 million.

At $576.3 million, Hims’ online revenue accounted for the vast majority of companywide sales.

Hims also reported $49.5 million in net income, up from $11.1 million one year earlier. Its free cash flow position also improved to $50.1 million from $11.9 million in the first quarter of 2024.

Your email address will not be published. Required fields are markedmarked