Alphabet (GOOGL) stock plunged as much as 10% Wednesday after new court filings suggested Apple may be preparing to launch its own AI-powered search engine, a direct threat to Google’s core business.

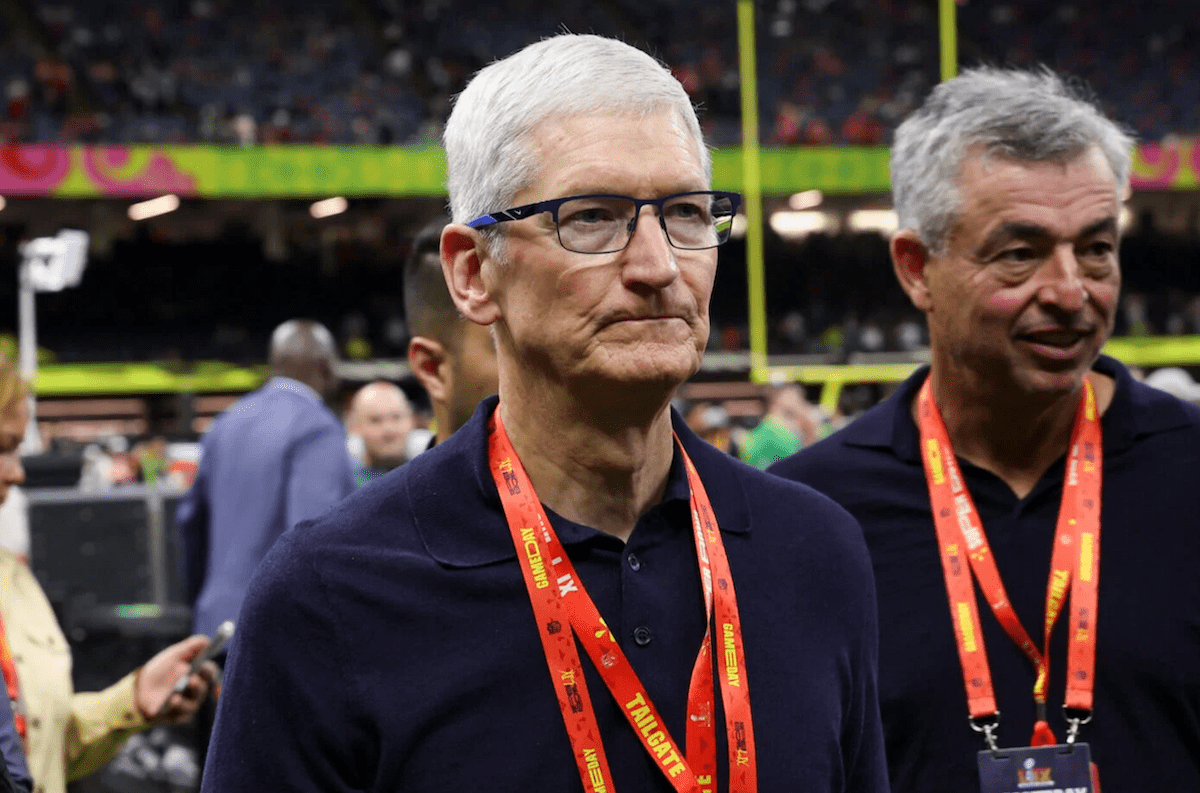

The bombshell came during the U.S. v. Google trial, during which Apple executive Eddy Cue testified that the company is exploring AI-powered alternatives to Google Search within its Safari browser.

Cue’s testimony raised eyebrows not just because of Apple’s long-standing deal with Google, reportedly worth $20 billion annually, but also because he confirmed that Safari users are making fewer Google searches.

The scoop sowed fears that Google’s grip on the search market slipping.

The company’s global search market share dipped below 90% in late 2024 for the first time since 2015, sending a message to investors that competitors are catching up to Google.

Chrome’s dominance under threat?

Apple has remained tight-lipped about its AI ambitions, but Cue’s remarks suggest it may be closer to making a move that could unwind Google’s long-held dominance in search.

That’s particularly concerning given that much of Google’s dominance comes from default placement in Apple products.

After the news broke, Alphabet stock went into freefall at the open, with The Kobeissi Letter noting there wasn’t “a single 10-minute green candlestick in 2 hours.”

Truly incredible:

undefined The Kobeissi Letter (@KobeissiLetter) May 7, 2025

Alphabet, $GOOGL, extends losses to over -9% on the day as Apple explores AI search in its browser.

Not a single 10-minute green candlestick in 2 hours. pic.twitter.com/gQRStej2Tl

GOOGL closed down 7.3% at $151 on Wednesday, extending its year-to-date decline to over 20%. The selloff also dragged Alphabet’s market cap below the $2 trillion mark, now sitting at $1.84 trillion.

The company joins other so-called Magnificent Seven stocks under pressure in recent weeks as AI competition, trade uncertainty, and earnings concerns weigh on Big Tech.

A solid quarter, but an uncertain future

Fading search engine dominance fears aside, Alphabet’s financials remain strong.

On April 24, the company reported $90.23 billion in quarterly revenue and earnings of $2.81 per share (both above analyst estimates.)

Its “Search and Other” segment, which includes core advertising revenue, generated $59.7 billion in Q1 — up 9.8% year over year. The company cited solid ad demand across finance, retail, travel, and healthcare.

That said, Alphabet executives didn’t pull any punches, openly acknowledging rising uncertainty, particularly around Trump’s agenda.

“We’re not immune to the macro environment,” said Google CBO Philipp Schindler, pointing to the impact of Trump’s trade policies. “But we have a lot of experience managing through uncertain times.”

He added that Google’s edge lies in “providing deep insights into changing consumer behavior that is relevant to [our clients’] business.”

Your email address will not be published. Required fields are markedmarked