Back in March, IonQ’s (IONQ) newly appointed CEO Niccolo de Masi made a bold claim at a Morgan Stanley conference: his company had become the “800-pound gorilla of the quantum computing business.”

That’s a hefty title for a sector that’s still years (or even decades) away from proving it can turn a consistent profit. But IonQ is doing everything it can to make the label stick.

On Monday, the company announced a $1.075 billion deal to acquire Oxford Ionics, a move that expands IonQ’s footprint into the UK and marks one of the largest transactions in quantum to date. The deal includes $1.065 billion in IonQ stock and roughly $10 million in cash.

Oxford Ionics co-founders Dr. Chris Ballance and Dr. Tom Harty are expected to stay on post-acquisition, as IonQ ramps up hiring in Oxford and tries to cement the UK’s status as a quantum hub.

The combined company is targeting quantum systems with 256 physical qubits and 99.99% accuracy by 2026. By 2027, it aims to surpass 10,000 physical qubits with 99.99999% logical accuracy—well into fault-tolerant computing territory.

That’s not just tech fantasy. The 256-qubit milestone is considered the point where quantum machines begin outperforming classical supercomputers. And IonQ says it’s just getting started, with a target of 2 million physical qubits and 80,000 logical qubits by 2030.

“IonQ’s vision has always been to drive real-world impact in every era and year of quantum computing’s growth,” de Masi said. “Today’s announcement accelerates our mission.”

Oxford Ionics is just one of several puzzle pieces IonQ is snapping into place.

Last week, it completed its acquisition of Lightsynq Technologies, a Boston-based startup focused on photonic interconnects and quantum memory. That deal came with more than 20 patents and applications related to quantum memory—giving IonQ a stronger moat in quantum IP.

In May, IonQ finalized its deal for ID Quantique, a global leader in quantum-safe networking and detection systems. That acquisition added another 300 granted and pending patents to IonQ’s portfolio.

The company also has a pending acquisition of Capella Space, a top-secret signals platform with defense and commercial clients. IonQ plans to launch the world’s first space-based quantum computer and quantum key distribution network, positioning itself at the intersection of cybersecurity, space tech, and quantum.

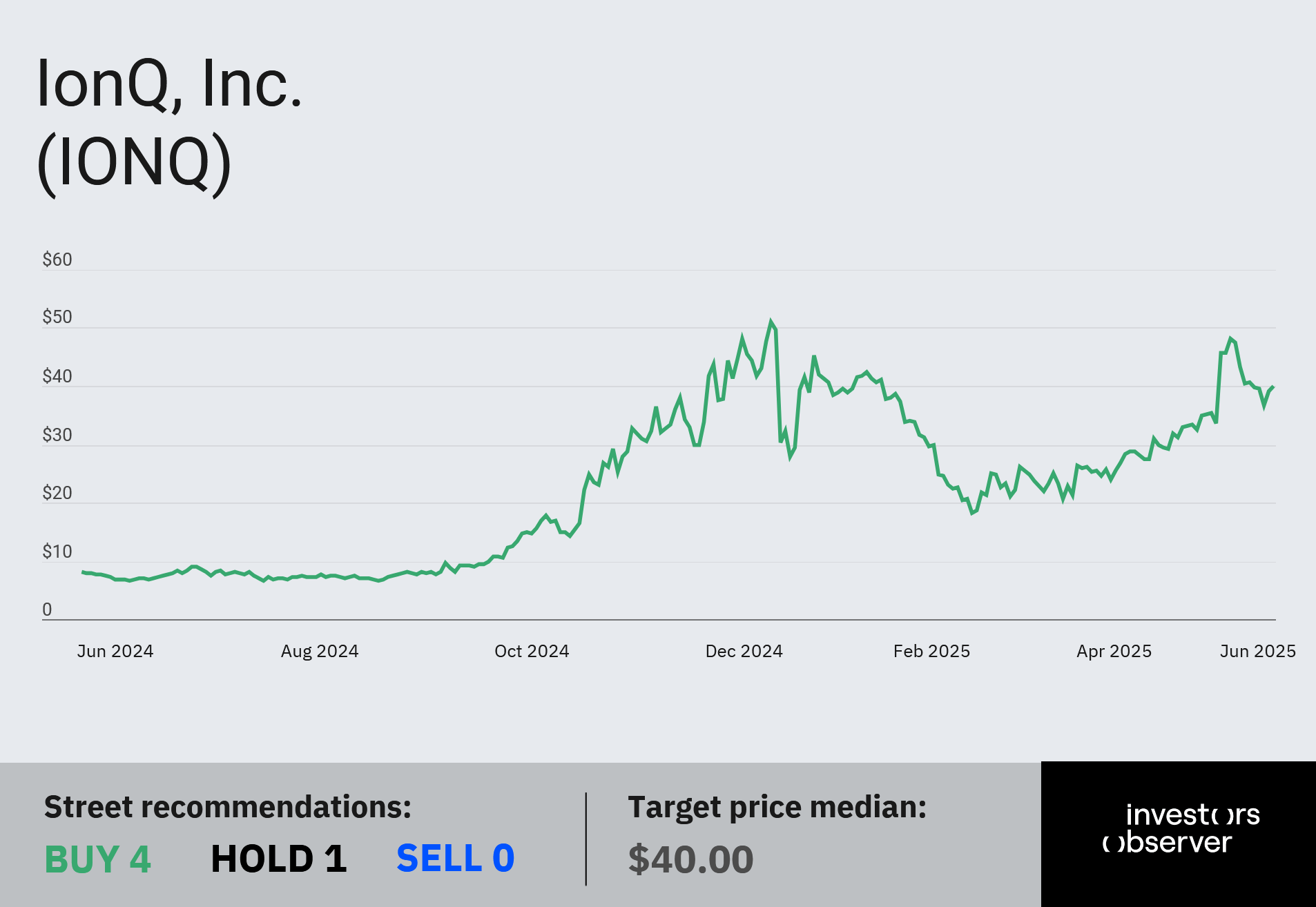

Despite the shopping spree, IonQ’s stock moved just 2.7% on Monday. Shares are down 4% year-to-date but have skyrocketed 410% over the past 12 months—one of the best runs in tech.

The muted reaction could reflect lingering Wall Street skepticism over quantum’s path to revenue. But IonQ’s CEO isn’t fazed.

In a recent NYSE interview, de Masi said “every Fortune 100 CEO has a quantum strategy” now. He argued that quantum processing units (QPUs) will do for compute what GPUs did in the 2010s—take it far beyond the limitations of CPUs.

“QPUs will solve problems that CPUs and GPUs either never will, or will require so much energy that it’s just not practical,” de Masi said.

Your email address will not be published. Required fields are markedmarked