IonQ (IONQ) stock jumped nearly 13% last week after the company said Friday it had made progress in applying its quantum systems to AI and machine learning tasks.

While the announcement stirred up fresh hopes about quantum computing, the path to real-world commercialization remains murky at best. And for investors, the near-term risks are hard to ignore.

The spike in IONQ shares mirrored a similar rally last November when Google's Quantum AI team announced an advance in quantum error correction, a critical step toward making quantum computing viable at scale.

Yet even those closest to the tech remain cautious. Nvidia CEO Jensen Huang, speaking in January, summed up the uncertainty:

“My understanding is that it's still quite a ways off from being a truly practical paradigm,” he said, estimating real-world use cases could be decades away.

While Huang acknowledged he’s not a quantum specialist, his remarks underscored the deep divide between promise and reality, especially when it comes to enhancing AI systems in the near future.

Bleeding money, diluting shareholders

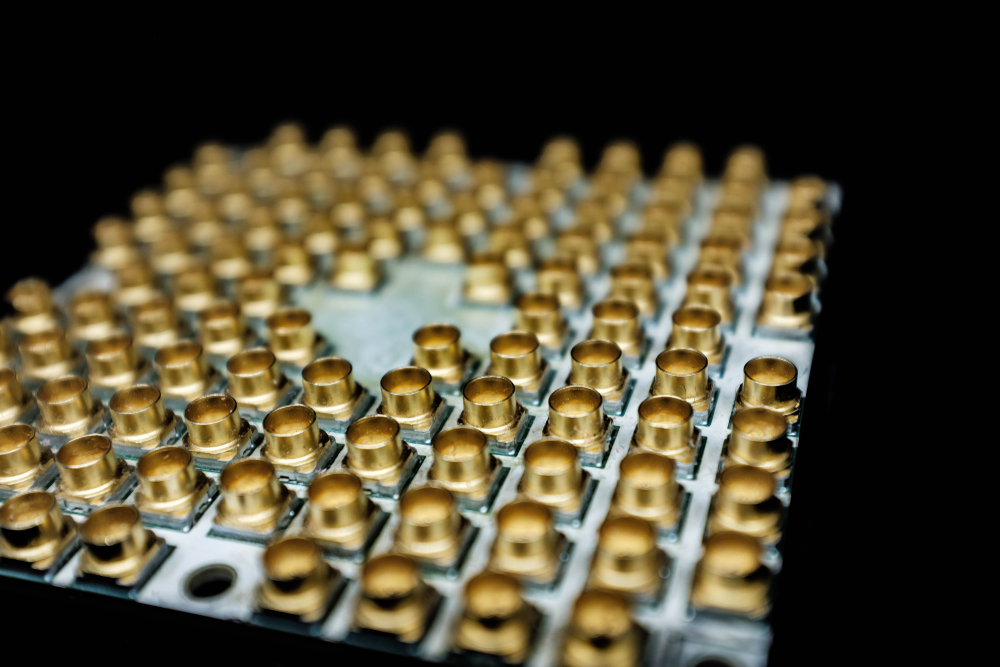

IonQ builds scalable quantum computers designed to help industries solve complex problems. Its flagship systems — IonQ Aria and the more advanced IonQ Forte — are among the most accessible in the space.

Unlike many quantum startups, IonQ actually generates revenue. But it’s way too little to even chart a path to profitability.

The company posted a net loss of $202 million in Q4 2024, pushing its full-year loss to $331.6 million — more than double the $157.8 million it lost in 2023.

Revenue for the quarter came in at just $11.7 million, with full-year revenue totaling $432.1 million.

So, until quantum technology becomes commercially viable, IonQ is still running on hype and likely to continue bleeding money while relying on share dilution to fund its operations.

In February, in fact, the company announced a $500 million at-the-market stock offering, aimed at funding R&D and expanding manufacturing but also likely to further dilute shareholders.

IonQ has long-term potential, especially if it can stay ahead of rivals in a sector that's still largely experimental. But in the short to medium term, the stock may be running too hot.

Shares are up more than 240% over the past 12 months, a run-up that could limit upside for new investors and leave little margin for error if quantum’s commercialization timeline stretches out even further.

In a space defined by breakthroughs without business models, IonQ will eventually need to deliver something more than headlines.

Your email address will not be published. Required fields are markedmarked