Intel (INTC) has staked the revitalization of its manufacturing revenue on its latest 18A chipmaking process, which is seen as crucial to jump-starting its Intel Foundry.

While the company has always assumed most of the initial 18A production would be for Intel’s own chips, CEO Lip-Bu Tan said it would need at least two high-volume external customers in order to give the foundry the business it needs to scale to be profitable.

But speaking at a J.P. Morgan conference in May, CFO David Zinser said that "the conversations have been good," with potential customers, the company still hadn't landed any clients for its foundry division.

And now Tan, who was brought on as CEO in March, appears to be pivoting away from the 18A manufacturing process.

Instead, Reuters is reporting that Intel would be offering outside customers “a newer generation of technology” that can help it try and land major clients like Nvidia (NVDA) and Apple (AAPL), while competing against rivals like Taiwan Semiconductor Manufacturing (TSMC).

This would mean abandoning its plans to sell 18A and its variant 18A-P to external customers.

After having already invested billions in the process, Intel would be taking a write-off.

Sources told Reuters that Tan began to express concerns in June that the company’s 18A manufacturing process “was losing its appeal to new customers.”

The 18A manufacturing process was seen as one of the pillars of Intel’s comeback by Tan’s predecessor Pat Gelsinger, who was ousted as CEO by the company’s board in December after a four-year run in which sales fell by nearly 30% and the stock plunged by 61%.

In addition to the launch of Intel’s 18A chipmaking process, Gelsinger also saw the Intel Foundry as being the other crucial pillar of the company’s comeback.

Unlike the traditional model where Intel manufactures chips solely for its own designs, Gelsinger wanted the Intel Foundry to open its fabs to other companies.

Today, most of the industry is split: companies like NVIDIA design chips, while firms like TSMC manufacture them.

Gelsinger wanted Intel to do both.

In fact, he recently expressed frustration about not being allowed to finish what he started with the 18A process and the foundry business.

Although Tan appears ready to abandon the strategy started by Gelsinger, Reuters noted that Intel will still “make chips via 18A in cases where its plans are already in motion” with external customers.

This reportedly includes “a relatively small volume of chips” that it has agreed to manufacture for Amazon (AMZN) and Microsoft (MSFT).

Intel has spent years falling behind rivals like TSMC and Samsung, while watching its stock plummet 67% over the past five years.

As part of Tan’s plan to right the ship, Intel announced in April that it was laying off more than 20% of its workforce.

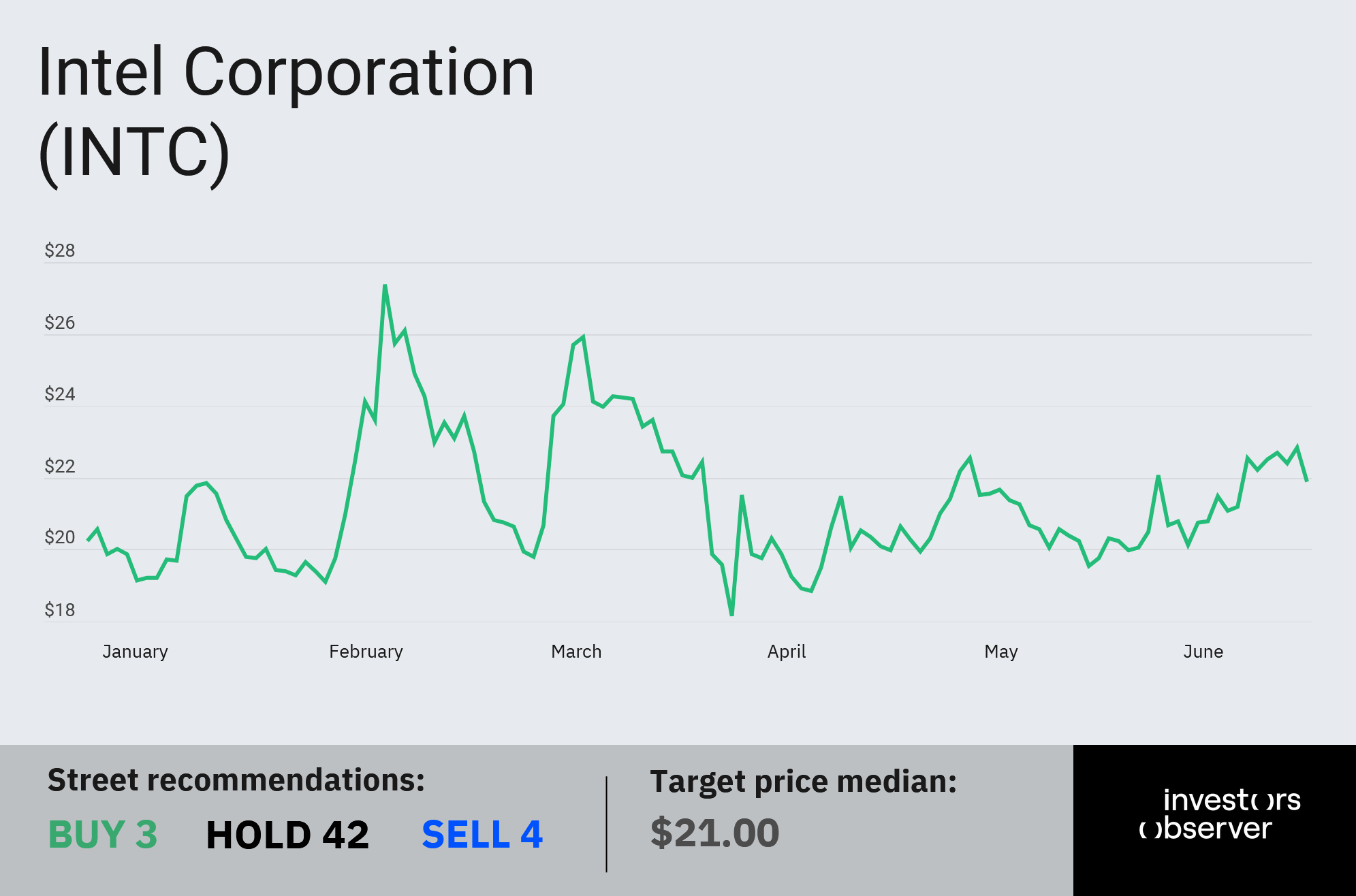

The company’s stock is up 9.1% YTD.

Your email address will not be published. Required fields are markedmarked