When Lip-Bu Tan was named the new CEO of Intel (INTC) in March, one of his major initiatives was to revamp the company's Intel Foundry business through its new 18A chipmaking process.

Central to Tan's strategy for jumpstarting Intel Foundry is landing at least two major clients that would give the business the scale it needs to be profitable.

So far, that hasn't happened.

Speaking at a J.P. Morgan conference last week, Intel CFO David Zinser said that while "the conversations have been good," the company still hasn't landed any clients for its Foundry division.

"We have the traditional pipeline modeling," Zinser explained. "We have a bunch of potential customers and then we get test chips. Some customers fall out during testing, and a certain number hang in there."

But, he added, "committed volume is not significant right now for sure."

Zinser said Intel will likely need to "partly prove ourselves with our own product," referring to the 18A process. The company always assumed most of the initial 18A production would be for Intel’s own chips, with the hope of bringing in high-volume external customers later.

Executives previously told Reuters that Intel had been in talks with Broadcom and other companies about using the Foundry, but it’s unclear if those discussions are still active.

Zinser acknowledged that Intel faces a unique challenge as both a chipmaker and a competitor to the companies it wants as Foundry clients.

“We have to make sure they feel confident that their IP is getting protected but maybe more importantly, that their supply is getting protected.”

One bright spot is Intel’s advanced packaging business, which Zinser said will start generating revenue in the second half of the year.

He called it “a great opportunity” and “a good vehicle to get customers in the door.”

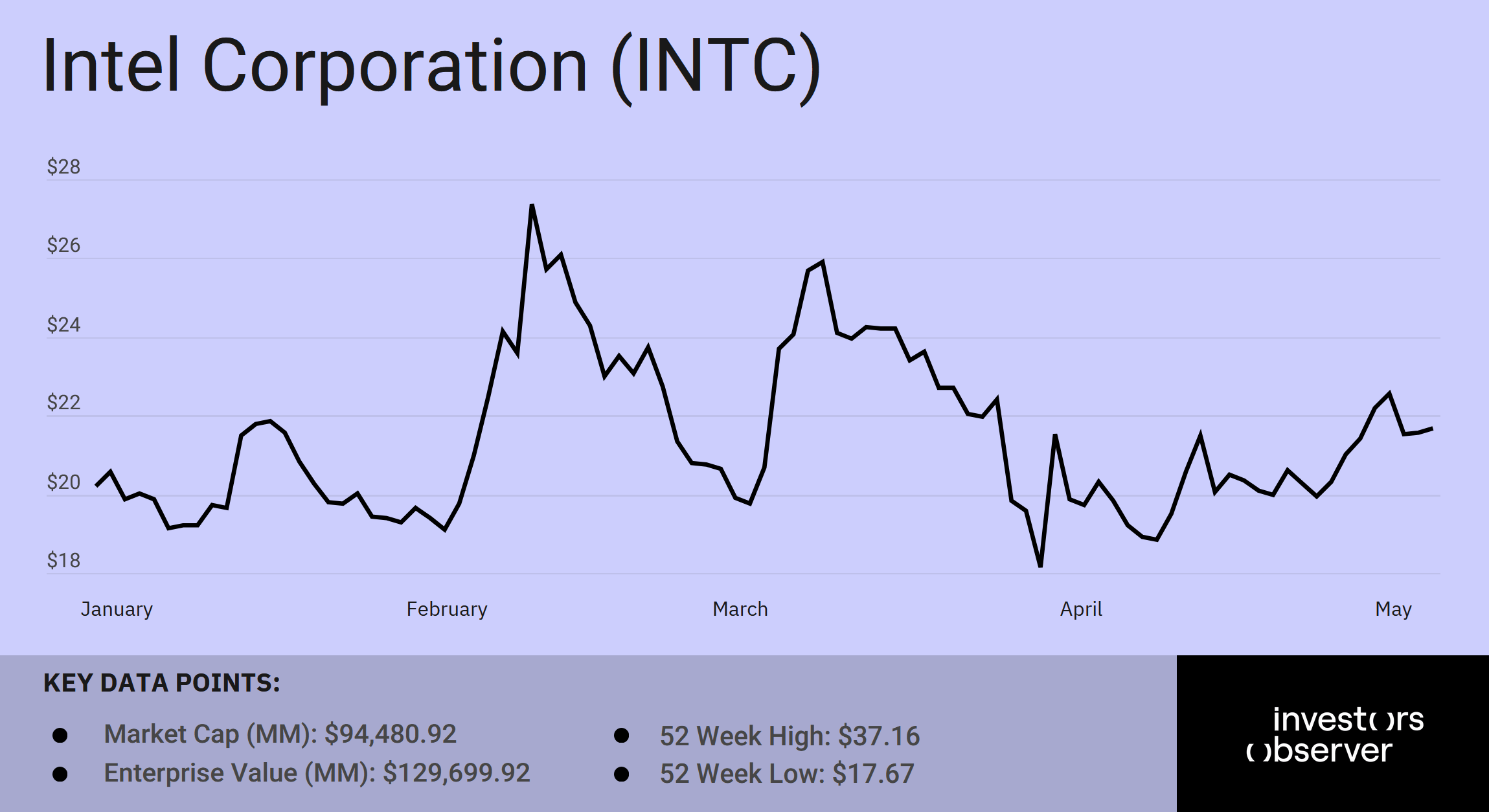

Intel has spent years falling behind Taiwan Semiconductor (TSMC) and Samsung. Its stock has dropped 67% over the past five years.

However, under Tan’s leadership, the company is undergoing a reorganization. Zinser said that Tan has flattened the company’s structure, with both the data center and client businesses now reporting directly to him.

Tan believes Intel’s core problem is execution, Zinser said. Poor communication with customers has also hurt the company.

“What I also think has hurt us is that we somewhat developed the technology independent of what we’re hearing from customers,” Zinser said. “We were bringing out products that weren’t addressing all of their needs.”

Intel’s stock is up 8% year to date.

Your email address will not be published. Required fields are markedmarked