One thing to know is that Occidental Petroleum (OXY) stock is widely viewed as one of Warren Buffett’s rare misfires when it comes to stock picking.

According to Barron’s April report, Buffett’s investment — 256 million shares for a 28% stake — has left Berkshire Hathaway with a $5 billion paper loss.

But as tensions between Israel and Iran (and fears of oil supply disruptions) grow, Buffett’s oil bet is starting to pay off.

Over the past five days, Exxon Mobil Corp. (XOM) is up 6.3%, Occidental has gained 4.7%, and Chevron Corp. (CVX) has added 3.4%.

The question now is whether the rally has staying power.

“Israel and Iran are attacking each other, Trump is saying he knows where Iran's Supreme Leader is hiding, and the US is deploying fighter jets to the Middle East,” global market analyst The Kobeissi Letter wrote on X.

“Yet, oil prices are ~10% below last week's high. What does the market know here?"

This is interesting:

undefined The Kobeissi Letter (@KobeissiLetter) June 17, 2025

Israel and Iran are attacking each other, Trump is saying he knows where Iran's Supreme Leader is hiding, and the US is deploying fighter jets to the Middle East.

Yet, oil prices are -10% below last week's high.

What does the market know here? pic.twitter.com/R05NAKSb97

On Tuesday, President Trump demanded the “unconditional surrender” of Iran’s Supreme Leader Ayatollah Ali Khamenei in a post on Truth Social, warning that America’s “patience is wearing thin.”

What if Iran closed the Strait of Hormuz?

While it remains unclear whether the U.S. will escalate militarily in support of Israel, some analysts argue the oil market’s muted response reflects abundant global supply.

“Saudi Arabia has been producing more, as have Guyana, Brazil and Canada. U.S. production hit a record 13.5 million barrels a day in March,” The Wall Street Journal’s Elliot Kaufman noted on X.

But not everyone is convinced the market has fully priced in the risk. Energy consultant Jessica Obeid pointed out that oil prices rose 4% on Tuesday alone.

“The market is pricing an escalation of the conflict,” she said.

Oil prices are up by 4%.

undefined Jessica G. Obeid (@Jessica_Obeid) June 17, 2025

The market is pricing an escalation of the conflict... pic.twitter.com/vS7TxL19DU

A serious flashpoint in the conflict would be Iran's blockade of the Strait of Hormuz, a critical chokepoint that handles 20% of global oil supply.

That scenario would likely send energy prices soaring and give OXY stock a tailwind.

Occidental's balance sheet would use a touch-up

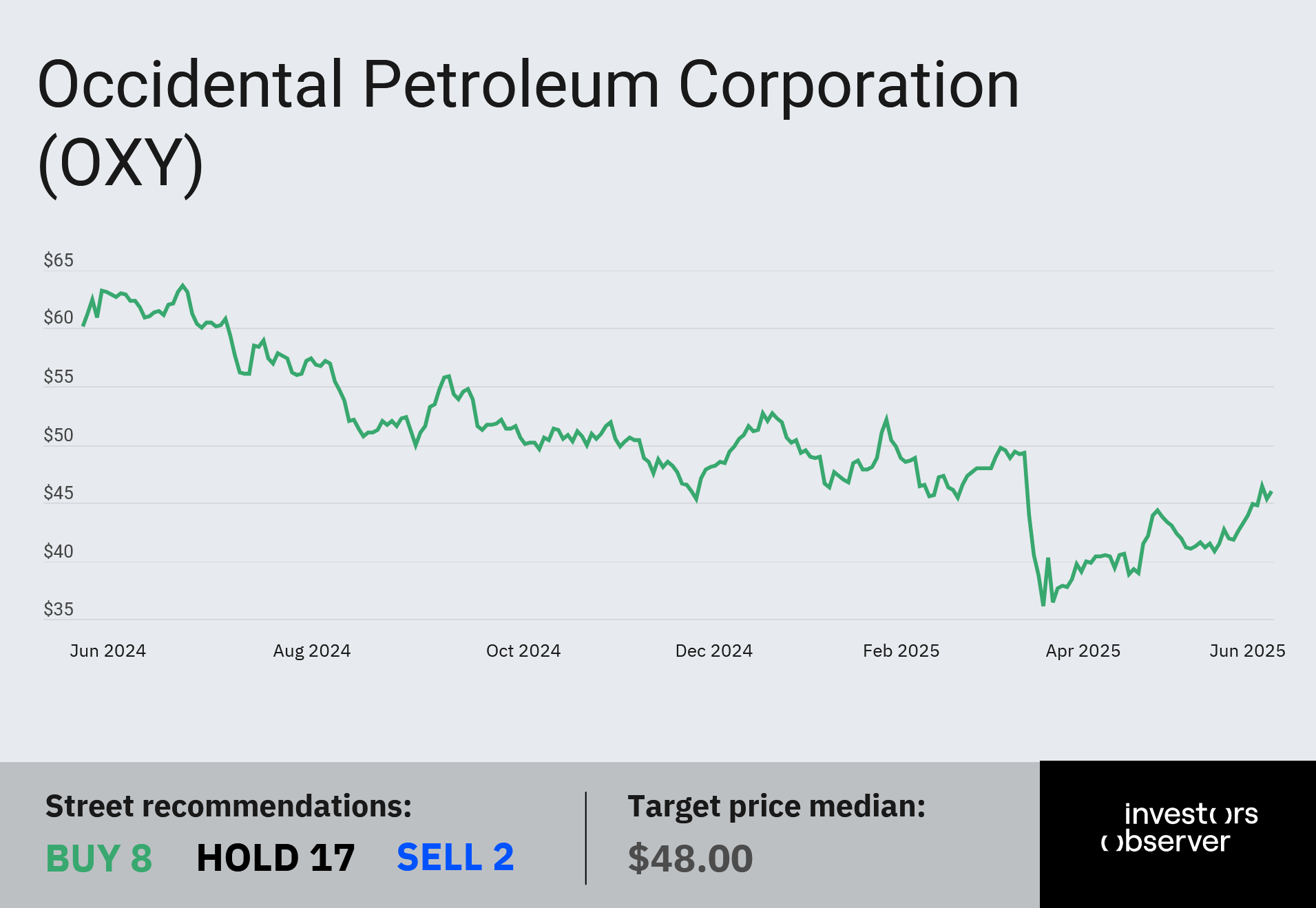

Occidental shares are still down 6.9% this year and 23.6% over the past year. Much of the drag stems from its heavy debt burden, which stood at $24 billion at the end of 2024.

That debt ballooned from Occidental’s “penchant for serial acquisitions,” including its massive $50 billion purchase of Anadarko Petroleum in 2019.

The deal was partially funded by issuing $8.5 billion in preferred stock to Buffett’s Berkshire Hathaway.

But some analysts say the balance sheet is slowly improving.

Raymond James analyst John Freeman noted that Occidental has reduced its debt by $2.4 billion year-to-date, and by $6.8 billion since Q3 2024.

Your email address will not be published. Required fields are markedmarked