As bitcoin mining becomes less profitable, many mining firms are chasing growth by pivoting to AI.

But Miami-based Hut 8 (HUT) is charting a different course. It’s leaning into bitcoin while also building out its high-performance computing and AI infrastructure.

The company is currently developing a 205-megawatt facility called Vega in the Texas Panhandle, designed to host both bitcoin mining and AI data center operations.

“Hut 8 envisions a middle ground between traditional Bitcoin mining and AI data centers,” the company wrote earlier this year.

“This strategic approach not only enhances energy efficiency but also positions the company to capture emerging market demands, especially as GPU technology evolves.”

The Vega facility is expected to go live in Q2.

The Trump connection

In March, Hut 8 launched American Bitcoin Corp., a new mining venture majority-owned by Hut 8 and created with Eric Trump. Formerly known as American Data Centers, the company was initially founded by Eric and Donald Trump Jr.

Earlier this month, Hut 8 announced a deal to take American Bitcoin public via a merger with Gryphon Digital Mining (GRYP).

The stock-for-stock transaction is expected to close in Q3, and the combined entity will trade on the Nasdaq under the ticker ABTC.

“This transaction marks the next step in scaling American Bitcoin as a purpose-built vehicle for low-cost Bitcoin accumulation at scale,” said Hut 8 CEO Asher Genoot.

“By taking American Bitcoin public, we expect to unlock direct access to dedicated growth capital independent of Hut 8’s balance sheet,” he added.

AI meets the Bitcoin reserve strategy

Hut 8’s latest earnings report showed Q1 revenue of $21.8 million and a net loss of $134.3 million, a steep drop that Genoot described as a “deliberate and necessary phase of investment.”

The company ended the quarter with a bitcoin reserve of 10,264 BTC, valued at $847.2 million as of March 31.

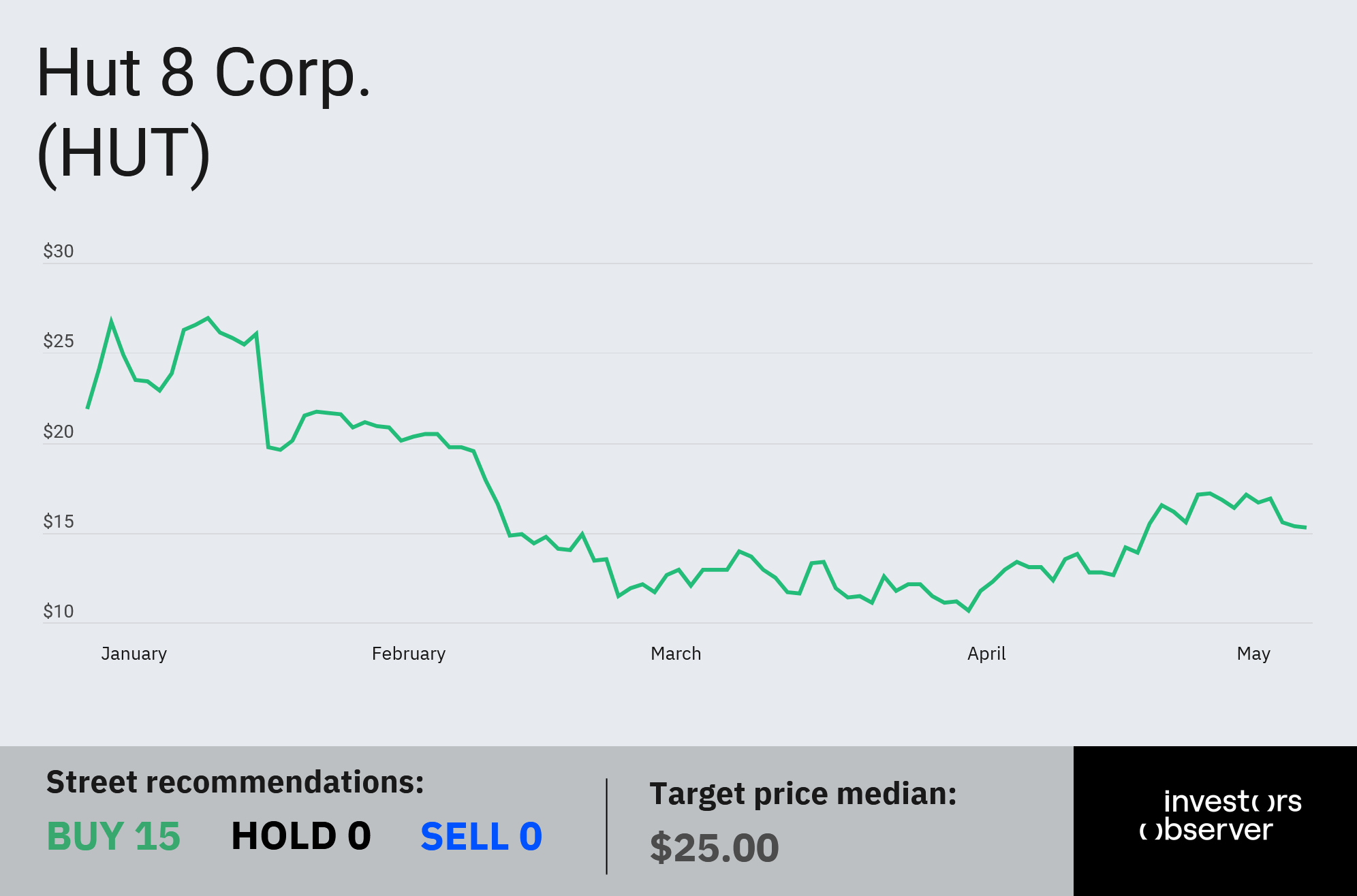

Analyst Joseph Vafi at Canaccord Genuity reiterated a Buy rating in May and maintained his $32 price target for Hut 8, which closed Friday at $15.27.

Vafi said he’s encouraged by Hut 8’s entry into AI infrastructure and sees the American Bitcoin strategy as a treasury-style play similar to MicroStrategy’s bitcoin accumulation model under Michael Saylor.

Hut 8 stock is down 25.9% year-to-date.

Your email address will not be published. Required fields are markedmarked