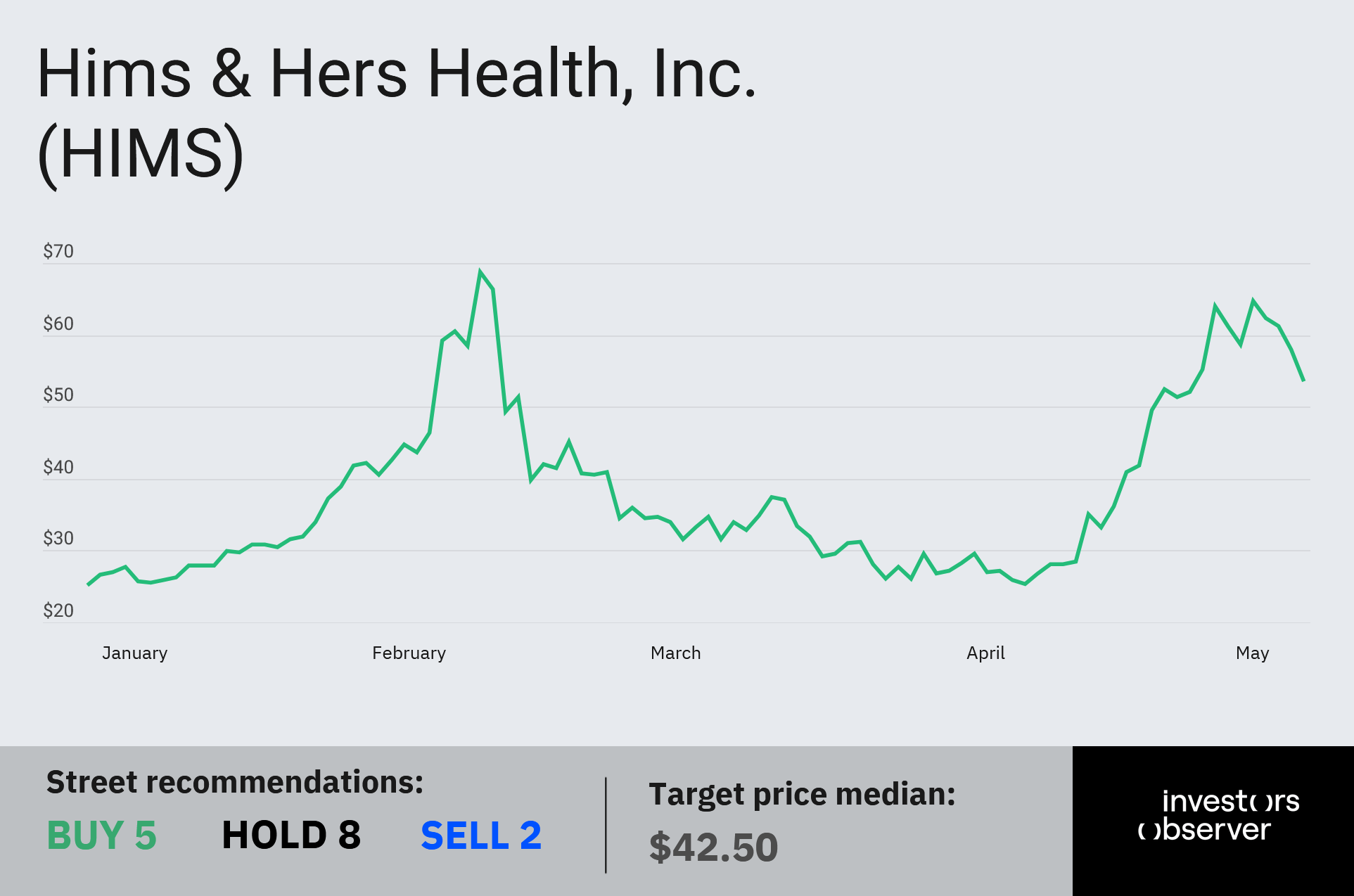

Shares of Hims & Hers (HIMS) fell sharply on Thursday, dropping more than 11% after the New York market opened, leaving investors puzzled over the cause.

The stock began sliding in pre-market trading, where it was down over 9%, and eventually closed the day down 7.7% at $53.52.

This marks the fourth consecutive day of losses for HIMS, following a month-long rally that had brought shares closer to their February all-time high. The company currently holds a market capitalization of $13 billion.

The pressure on Hims & Hers stems from news that health insurer Cigna had struck a copay agreement with Novo Nordisk (NOVO) for its GLP-1 weight loss drugs Wegovy and Zepbound.

Hims had only recently added Zepbound to its telehealth platform alongside Wegovy and Ozempic, both developed by Novo Nordisk.

Why this development triggered a sell-off in HIMS shares remains unclear. The investor group Hims House commented, “The Street is convinced Hims is a GLP-1 company, so any and all GLP-1 news will trigger a 10%+ move.”

Hims & Hers and Novo Nordisk have had a complex relationship, moving from competitors to collaborators.

At one point, Hims offered compounded versions of Novo’s GLP-1 drugs during supply shortages. However, following the FDA’s announcement that the shortage had ended, Hims disclosed it would no longer be able to sell the compounded versions.

HIMS’ growth story

Hims & Hers has been one of Wall Street’s standout growth stories this year. Despite the recent sell-off, the stock is still up over 100% year-to-date, fueled by an expanding business model and a shift toward a new paradigm in healthcare services.

As Investors Observer reported, Hims more than doubled its revenue in the first quarter as its active subscriptions surged by 38% to 2.37 million.

In the company’s most recent earnings report, it forecast full-year revenues of up to $2.4 billion and adjusted earnings of between $295 million and $335 million.

Hims expects revenues to nearly triple by 2030, with a roadmap that includes reaching “tens of millions of users.”

To achieve that growth, Hims is expanding its personalized healthcare solutions and offering new treatment specialties, including low testosterone and menopause care.

CEO Andrew Dudum said the company will expand from “hundreds of personalized treatments today to potentially thousands” in the foreseeable future.

Hims’ growth comes alongside a significant breakthrough in the telehealth market, with researchers forecasting the industry to reach between $160 billion and $180 billion by 2030.

JPMorgan’s head of healthcare payments said telehealth companies are taking market share from traditional healthcare providers that “fail to develop effective digital channels [...] especially amongst younger generations.”

Your email address will not be published. Required fields are markedmarked