Hesai Group (HSAI), a Shanghai-based maker of lidar sensors, reported that a long-running legal battle with U.S. competitor Ouster Inc. (OUST) has come to an end.

In its first-quarter earnings report released Tuesday, Hesai said a patent infringement complaint filed by Ouster with the U.S. International Trade Commission (ITC) has been dismissed, with no penalties or restrictions placed on Hesai.

The original complaint accused Hesai of stealing proprietary lidar technology from Ouster and using it in its own competing products.

Ouster claimed Hesai had violated five of its patents and sought to block the company from selling in the U.S. market. It also filed a separate lawsuit in federal court in Delaware.

“This marks the end of all existing IP-related actions against us and validates our long-standing efforts to develop and protect our proprietary technologies,” Hesai Group CEO David Li said in a statement.

“We are proud that the strength of our IP portfolio and research and development has withstood legal scrutiny and prevailed,” he added. “No amount of legal maneuvering can undo that.”

Hesai also noted that it had filed for arbitration last year to enforce an earlier settlement agreement with Ouster. An arbitration panel issued a confidential ruling confirming that the agreement was valid and binding, though the exact terms remain undisclosed.

Business keeps growing

With the legal battle behind it, Hesai is turning its focus on growth. The company reported Q1 revenue of $72.4 million, up 50% from a year ago. Product revenue came in at $70.4 million, a 44.7% increase, and it shipped nearly 200,000 lidar units during the quarter.

Hesai also trimmed its net loss to $2.4 million, down 84% year-over-year.

For the next quarter, the company expects revenue to reach between $93.7 million and $99.2 million, which would translate to a year-over-year jump of 48% to 57%.

While the U.S.-China trade war has hit some companies hard, Li told CNBC in March that the U.S. only accounts for around 10% of Hesai’s annual sales.

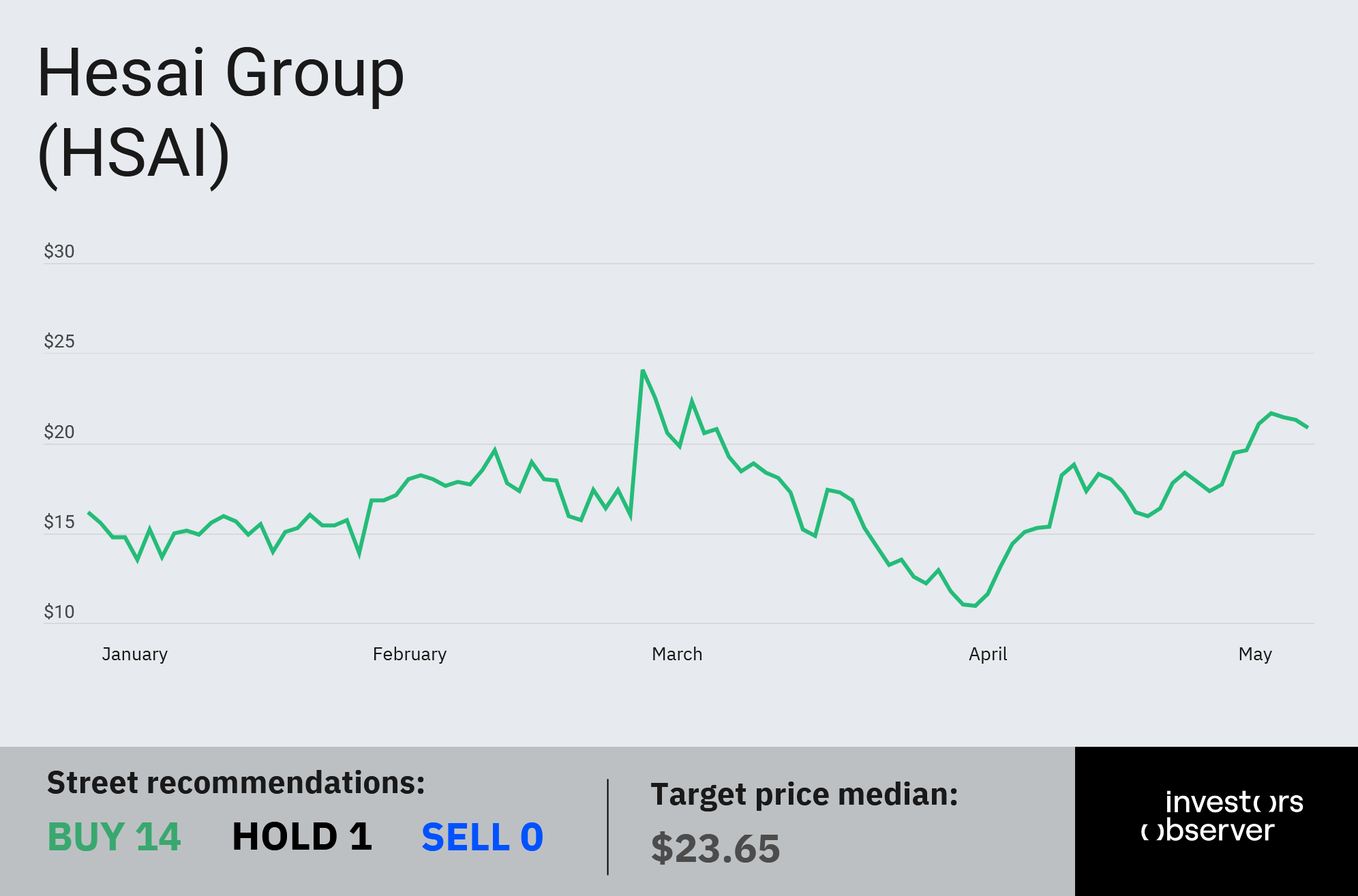

That has helped cushion the impact of the trade war on the stock price, which is up 41.6% so far this year.

Hesai remains a major supplier for China’s booming robotaxi industry, with customers including Pony AI (PONY) and WeRide (WRD).

The company also reported in March that it signed an exclusive, multi-year lidar supply deal with Mercedes-Benz, making it the first Chinese tech firm to power foreign vehicles sold outside China, according to Reuters.

Your email address will not be published. Required fields are markedmarked