As the second-quarter earnings season winds down, Wall Street is walking away with two big takeaways: Trump’s tariffs haven’t yet dented bottom lines, and mega-cap tech remains the engine driving the S&P 500.

In a recent Linkedin post, Goldman Sachs’ David Kostin noted that aggregate S&P 500 earnings per share grew 11% year over year, smashing the 4% consensus forecast.

The catch, he added, is that the upside was flattered by a low bar after analysts slashed estimates in the spring.

“Of the companies that have reported, 60% surpassed consensus EPS forecasts by more than a standard deviation of analyst estimates,” Kostin wrote.

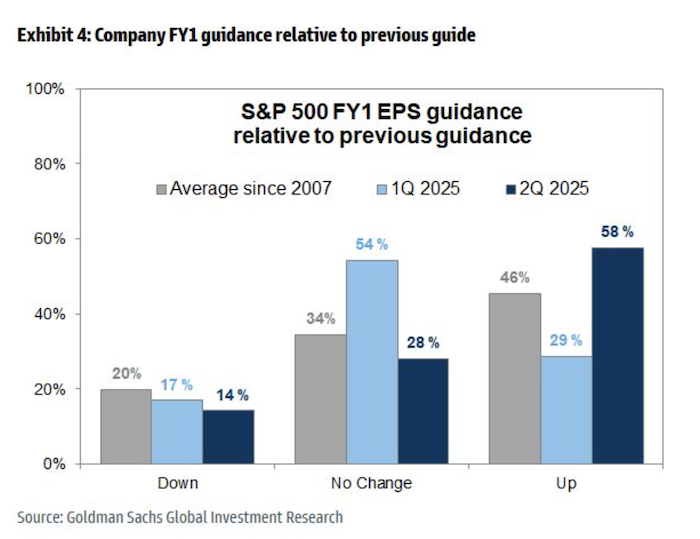

After Q1’s tariff shock had several companies pulling their full-year guidance, Q2 brought a notable shift.

Kostin said 58% of companies raised their 2024 outlooks, double the number that did so in the first quarter. Analysts also lifted earnings estimates for the back half of 2025 and into 2026, though growth is still expected to slow from 11% in Q2 to 7% in the second half of 2025.

Mega caps dominate the market

The strongest performance came from the mega-cap tech cohort.

Even excluding Nvidia, Kostin estimated that the “Magnificent 7” delivered 26% EPS growth, beating consensus by 12 percentage points.

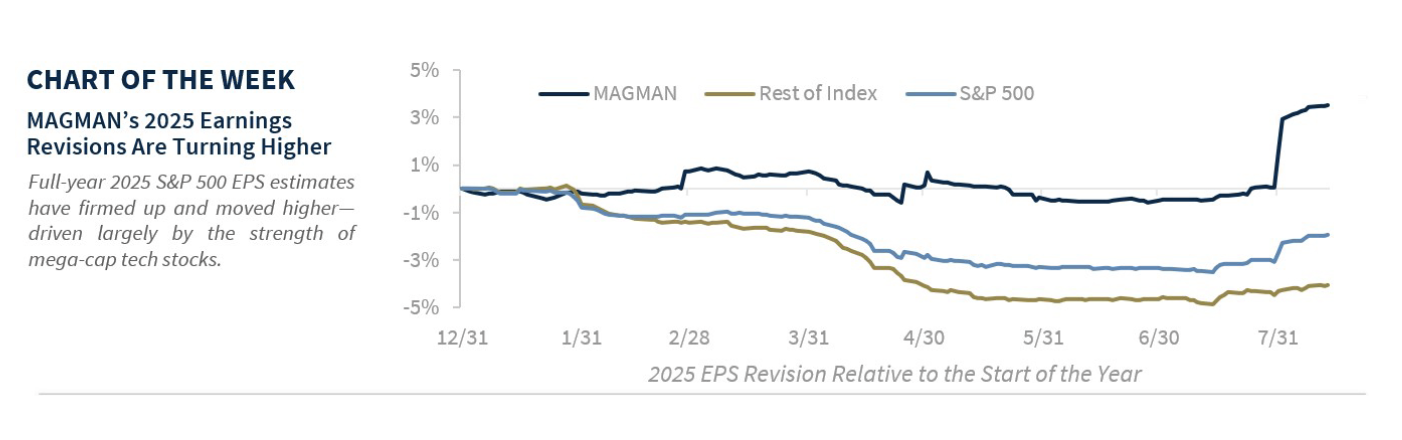

Meanwhile, Raymond James CIO Larry Adam noted that the S&P 500 is on pace for a third straight quarter of double-digit growth. What he dubs the “MAGMAN” stocks are up 50% year-to-date, compared to 21% for the rest of the index.

MAGMAN earnings are expected to rise 27% this quarter, marking their 10th consecutive beat over the broader S&P (+7%).

Adam also flagged a brighter tone from management. “Recession” mentions by CEOs dropped to their lowest level since 2007, while “inflation” mentions fell about 50% from last quarter.

Whistling past the graveyard?

Not everyone is convinced the bullishness will last. LPL Financial’s Jeffrey Buchbinder argued that Q2’s outperformance was flattered by pessimism in April, when analysts lowered the bar on fears of tariffs.

He acknowledged the strength of corporate America in delivering double-digit growth despite trade headwinds, but warned that tariffs are still in the early innings.

Many industries — especially banks and firms sourcing domestically or through Mexico and Canada under USMCA — have avoided the worst so far.

Perhaps the biggest feat of the quarter, he suggested, was convincing analysts that forecasts for this year and next were far too low.

Kostin expressed the same concerns, saying consensus expectations now “embed an unrealistic magnitude of margin expansion.” But as Buchbinder noted, with more tariffs, “the risk is that margins fall short of analysts’ optimistic expectations.”

For now, earnings season has put recession fears on hold. But if the pendulum has swung too far toward optimism, Q3 could be the quarter where reality bites back.

Your email address will not be published. Required fields are markedmarked