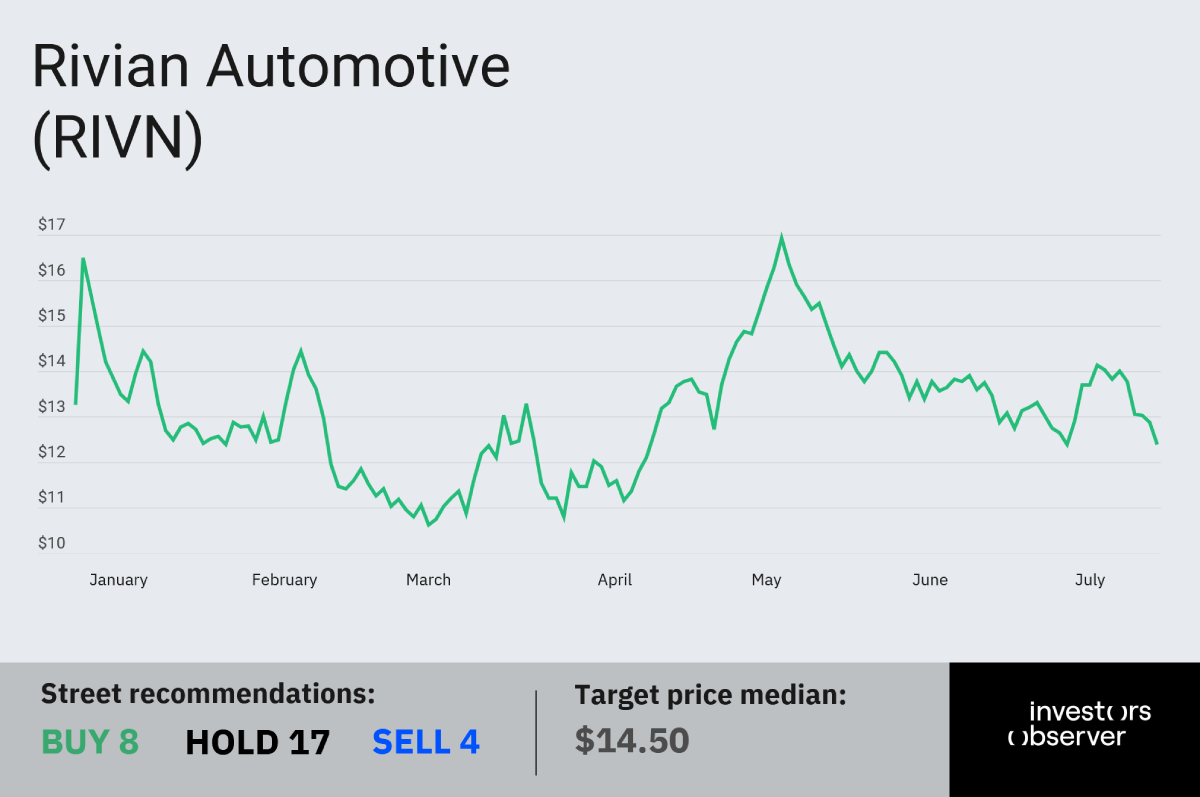

Electric vehicle maker Rivian (RIVN) plunged more than 11% last week, driven by investor doubts over the company’s ability to hit delivery targets. But while Wall Street is leaning bearish, Rivian is quietly ramping up production plans for a model that could define its future.

On July 29, automotive publication Autoevolution spotlighted Rivian’s manufacturing facility for the upcoming R2 compact crossover, a new vehicle that will enter production in 2026.

Unlike Rivian’s high-priced R1T pickup and R1S SUV, the R2 is designed to capture a broader market, a move that could finally push the EV startup toward long-term profitability.

According to Car and Driver, Rivian has slashed production costs for the R2 to roughly $32,000, which is about half the cost of its current models. That gives Rivian room to price the R2 in the $45,000 range, significantly undercutting its existing lineup.

At its Normal, Illinois plant, Rivian is already producing pilot R2 models, with plans to reach full volume production early next year.

This focus on cost competitiveness is critical for survival in a crowded EV market dominated by Tesla, fast-growing Chinese players, and traditional automakers that have aggressively expanded electric and hybrid offerings.

In the first quarter, EVs made up 7.5% of new car sales in the U.S., up slightly from 7% a year earlier. But Rivian isn’t benefiting from that growth.

Data from Cox Automotive shows brands like Toyota, GMC, Subaru, Volvo, Chevrolet, and Volkswagen saw EV sales surge between 55% and 196% year-over-year, while Rivian’s volume dropped 37%.

By the numbers

Wall Street grew more cautious on Rivian after the company flagged weaker demand earlier this year and lowered its full-year delivery outlook to 40,000–46,000 units, down from 46,000–51,000.

Even after topping Wall Street expectations last quarter, management admitted the company is “not immune to the impacts of the global trade economic environment.”

For context, Rivian reported a loss per share of $0.41 on $1.24 billion in revenue.

There was one bright spot in the last earnings report, though. Rivian delivered its second consecutive quarter of gross profit and reiterated guidance for a “modest positive gross profit” by year-end.

But at the bottom line, the company still expects an adjusted loss of $1.7–$1.9 billion for 2025.

After peaking above $17 in May, RIVN has slid roughly 27% and now trades below $13, putting its market cap at about $14.8 billion.

Your email address will not be published. Required fields are markedmarked