The tech industry’s insatiable need for enormous amounts of energy in order to power its AI data center plans in the coming years has led to the unlikely resurgence for the nuclear power industry in the U.S.

The industry essentially lost support following the worst nuclear accident in the country’s history at the Three Mile Island nuclear reactor in 1979, coupled with the rise of cheaper energy sources like natural gas.

Which arguably makes the best symbol of the industry's renaissance the fact that Microsoft will be reopening a portion of Three Mile Island beginning in 2028 as part of a 20-year agreement with Constellation Energy (CEG).

The resurgence of nuclear power makes sense because it is a clean energy source that can be deployed in a rather cost-effective manner – especially with small modular reactors (SMRs).

This has led to a proliferation of publicly traded SMR companies generating a lot of hype lately – including Constellation, Oklo (OKLO), NuScale Power Corporation (SMR) and Nano Nuclear Energy (NNE).

And yet, despite the clear momentum for the industry, all of these stocks sank this week.

NuScale dropped 7.5% on Tuesday, Oklo fell 6.7%, Nano declined 5.5%, and Constellation lost 4.6%.

So what gives?

U.S. government picks its winners

The U.S. Department of Energy (DOE) on Tuesday announced that it had selected two companies to perform the first tests in the Demonstration of Microreactor Experiments (DOME) at the Idaho National Laboratory, and both of them are privately held nuclear microreactor firms.

The DOE bypassed all of the public companies and instead chose Westinghouse and Radiant to perform the tests at DOME, which is the world’s first microreactor test bed, and is meant to fast-track American microreactor technologies.

“Microreactors will play a big role in expanding the use of nuclear power in the United States,” Mike Goff, the acting assistant secretary for Nuclear Energy, said in a statement. “Thanks to President Trump’s leadership, these DOME experiments will test new reactor designs that will be counted on in the future to reliably power our homes, military bases, and mission critical infrastructure.”

It’s interesting to note that the DOE is led by Secretary of Energy Chris Wright, who is a former board member for Oklo.

But having a friend in high places didn’t help the startup this time.

One of the issues facing most of these publicly traded SMRs is that they are years away from going online with their technology.

Oklo, for instance, is not expected to launch its first SMR until early 2028.

Meanwhile, Westinghouse bills itself as the “only SMR based on advanced reactor technology that’s already licensed and operating.”

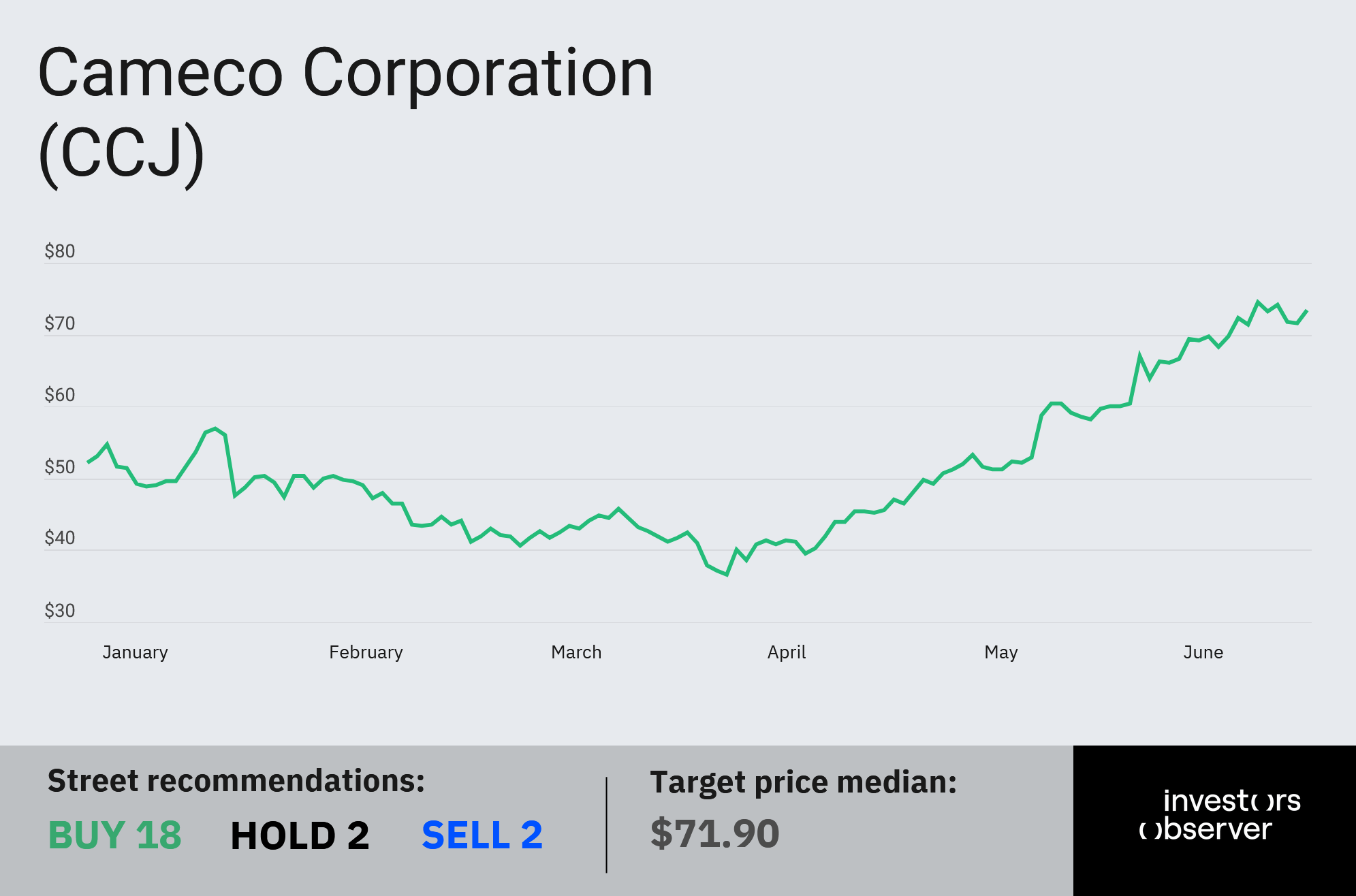

However, the DOE’s selection of Westinghouse means that there was one winner among the publicly traded nuclear stocks this week: Cameco (CCJ), which happens to own 49% of the privately held company.

While Cameco dropped 4% on Tuesday along with all the other public nuclear stocks, it could be because many investors are not aware of its stake in Westinghouse.

One person who is aware of this ownership stake is Ark Invest founder Cathie Wood, whose ARK Autonomous Tech ETF (ARKQ) owns about $17.6 million in shares of CCJ.

Beyond scoring big on the DOE contract, Cameco already expects $170 million in additional adjusted EBITDA this year from its stake in Westinghouse, citing gains from nuclear projects in the Czech Republic.

And The Financial Times reported recently that Westinghouse is in talks with the U.S. government to roll out 10 new large nuclear reactors in response to Trump’s executive orders.

According to TD Cowen, the full project could carry a price tag of $75 billion, which would be a massive boost to Cameco’s long-term value.

Cameco’s stock is up 43.1% so far this year.

Your email address will not be published. Required fields are markedmarked