Rocket Lab (RKLB) is doubling down on U.S. manufacturing to expand semiconductor capacity and shore up supply chains for national security space missions.

The launch and space systems company announced it will boost investments after receiving a $23.9 million award from the U.S. Department of Commerce under the CHIPS and Science Act.

Passed during the Biden administration, the CHIPS Act was designed to revive domestic semiconductor manufacturing. And in Rocket Lab’s case, that means more space-grade solar cells and electro-optical sensors.

In a press release, Rocket Lab called the move "a strategic response to the increasing demand for a robust domestic supply chain of space-grade solar cells and electro-optical sensors for spacecraft and satellites."

Over the next five years, its capital investments will target strengthening its role as both a top-tier satellite manufacturer and an end-to-end mission provider for commercial and defense clients.

Brad Clevenger, the company’s VP of Space Systems, said the expansion will "increase production capacity, strengthen supply chains, create new jobs, and develop economic opportunities across the states where we operate."

Rocket Lab also highlighted its rare position in the market: only two companies in the U.S. specialize in high-efficiency, radiation-hardened, space-grade semiconductors.

Old short report spooks investors

Despite the upbeat announcement, Rocket Lab shares tumbled 11.7% on Tuesday. The culprit was a short report from Bleeker Street Research that suddenly resurfaced on social media.

The odd part is that the report was published back in February.

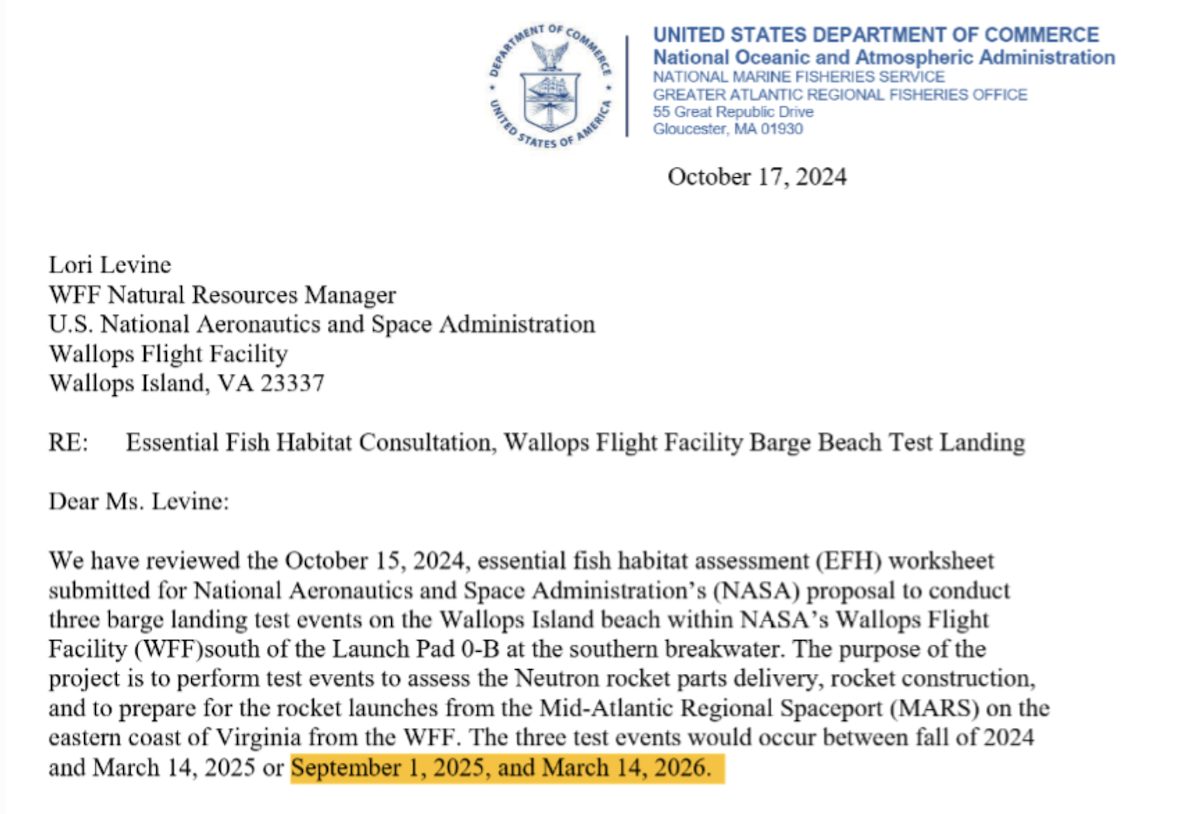

The report accused Rocket Lab of overpromising on its Neutron rocket, suggesting insiders expected a delay of one to two years beyond the company’s original mid-2025 target.

But despite the criticism, CEO Peter Beck has kept his cool. On the company’s August earnings call, Beck reiterated that Rocket Lab is still aiming for a Neutron launch by year-end.

"We continue to push extremely hard for an end-of-year launch," Beck said. He admitted the schedule is a "green-light" one — meaning every milestone has to go right — but stressed that any slip would likely be a matter of months, not years.

"We’re not going to rush and take stupid risks," he added.

Neutron progress

Far from stalling, Rocket Lab is ticking off milestones. Just last week, the company opened Launch Complex 3 in Virginia, a dedicated test and landing site for Neutron.

That progress hasn’t gone unnoticed. Roth Capital analysts, led by Suji Desilva, raised their price target on RKLB to $60 from $50. They pointed to the fully built-out Neutron infrastructure — assembly, carbon manufacturing facilities, barge transport, and launch pad support — as proof the program is advancing.

Desilva also noted that Rocket Lab has now in-sourced much of its manufacturing, reducing reliance on third-party vendors that slowed the timeline in the past.

Offense and defense

Rocket Lab is trying to play both offense and defense: ramping up U.S. semiconductor manufacturing to secure CHIPS Act money, while also pushing its flagship Neutron program closer to liftoff.

The resurfaced short report may have knocked the stock short term, but with real infrastructure coming online and analysts raising targets, the company is showing it’s still very much in the launch window.

Your email address will not be published. Required fields are markedmarked