Shares of SoundHound AI (SOUN) jumped last week after analysts at Piper Sandler initiated coverage with a bullish outlook.

But while the "overweight" rating grabbed headlines, a closer look at the report reveals a more important growth signal: a rock-solid balance sheet and revenue guidance that could drive major upside over the next two years.

In the note, analysts James E. Fish and Caden Dahl set a $12 price target and called SoundHound an “early leader” in the fast-growing conversational AI space, a market they expect will hit $30 billion by 2027.

SoundHound pulled in $84.7 million in revenue in 2024 — up 85% year-over-year — but that’s still just a sliver of the total addressable market.

Management believes that gap gives them room to scale, and they’re forecasting nearly $167 million in revenue by the end of 2025.

That optimism is backed by one of the strongest cash positions in the space: nearly $250 million in net cash and no debt, as of the most recent quarter.

That gives the company plenty of runway for growth, or for strategic acquisitions if opportunities emerge.

Q1 revenue grew 151% year-over-year to $29.1 million. The company also launched Amelia 7.0, its next-gen enterprise AI platform, and expanded restaurant partnerships with Casey’s, Firehouse Subs, Five Guys, and Burger King UK.

Wall Street takes notice

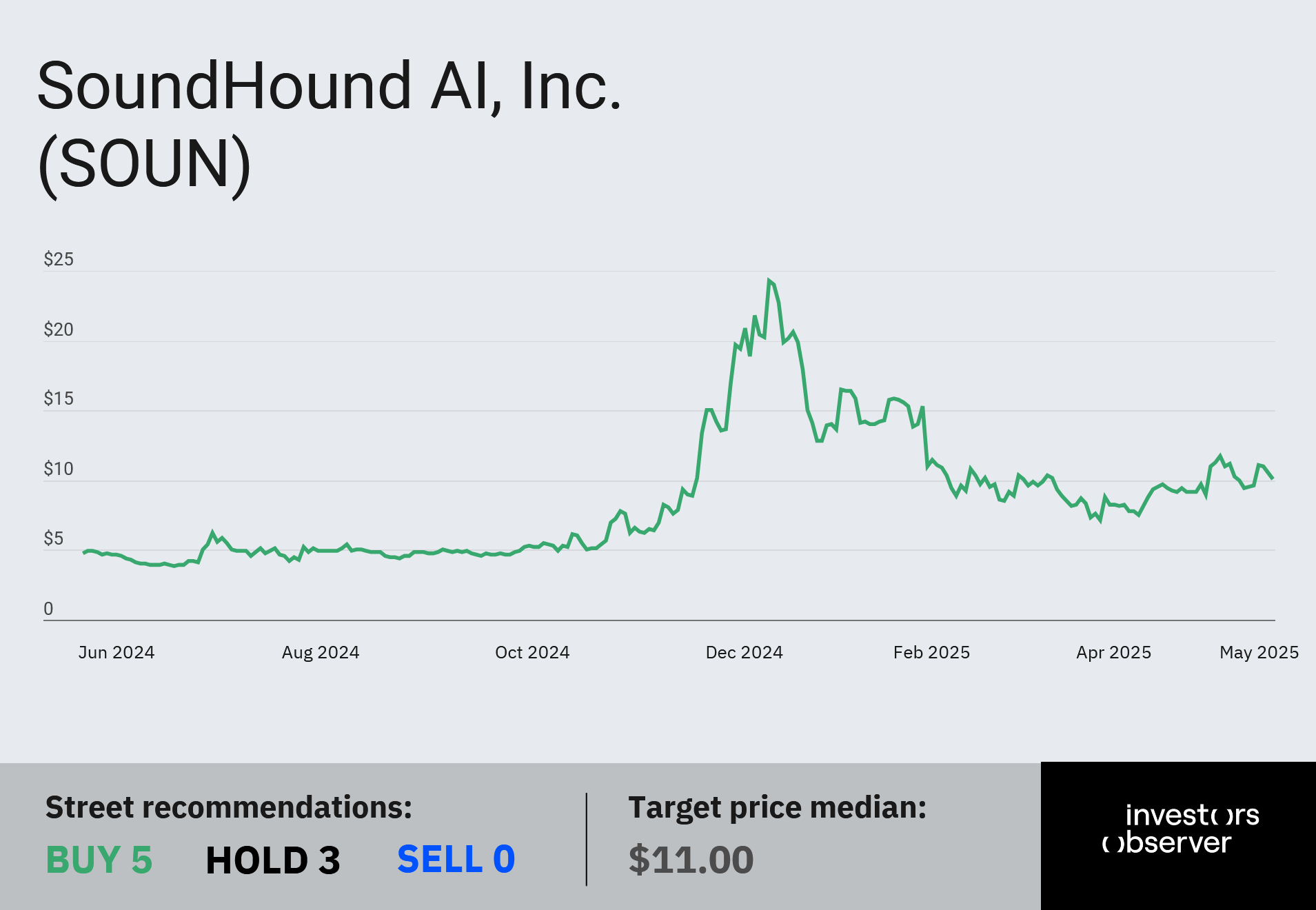

Following the Piper Sandler call, SOUN stock surged 16% intraday and closed the week up 8.4%, briefly approaching the analysts’ $12 target.

Even with that bump, the stock remains down almost 50% year-to-date as part of a broader correction that has swept up many AI names after 2024’s huge run.

From its peak above $24, SoundHound shares are off nearly 60%, pulling its market cap down to about $4 billion.

The pullback could be healthy in the long run, though.

SOUN valuation was stretched heading into 2025, and the reset may give SoundHound more breathing room to grow into its long-term vision, especially as it builds out recurring revenue channels and leverages its strong balance sheet.

SoundHound isn’t trying to turn a profit just yet. It’s still in growth mode, betting that early leadership in voice AI can turn into long-term dominance.

That makes for a bumpy ride in the short term, but for investors who believe in the AI voice frontier, this could be a rare second chance.

Your email address will not be published. Required fields are markedmarked