GE Vernova Hitachi Nuclear Energy (GVH), the nuclear power unit of GE Vernova (GEV), has an “early works agreement” with Fortum on the potential deployment of the company’s BWRX-300 small modular reactor (SMR) in Finland and Sweden.

Fortum, a Nordic energy company, completed a nuclear feasibility study in March and has selected the BWRX-300 as one of the technologies it is considering for potential deployment in both nations.

GVH said in a press release that it will be working with Fortum on pre-licensing and engineering activities for site adaption in both Finland and Sweden.

The deployment of the BWRX-300 SMR is expected to happen in the second half of the 2030s.

“After diligently evaluating several aspects of SMR technologies over the past two years Fortum concluded that the BWRX-300 is a technology for potential deployment in Finland and Sweden,” Nicole Holmes, chief commercial officer of GVH, said in a statement. “We have a long history supporting the nuclear industry in the Nordics and we look forward to working with Fortum as it continues to develop its capabilities for new nuclear.”

The Province of Ontario and Ontario Power Generation (OPG) also announced in May the approval to proceed with construction of the first BWRX-300 at OPG’s Darlington site near Toronto.

Four BWRX-300s are planned for the site with construction of the first unit expected to be complete by the end of the decade.

Also in May, Tennessee Valley Authority (TVA) announced that it has submitted an application to the U.S. Nuclear Regulatory Commission to construct the first BWRX-300 in the U.S.

More deals in the works

Meanwhile, Bloomberg recently reported that GE Vernova is currently working with advisors on the potential sale of its industrial software business, which is called Proficy.

Proficy produces electrification software which has become in high demand due to the power needs of AI data centers, as Bloomberg notes.

GE Vernova’s earnings from electrification software was up 9% to $224 million in the first quarter.

A sale of its Proficy business could net the company as much as $1 billion, according to Bloomberg.

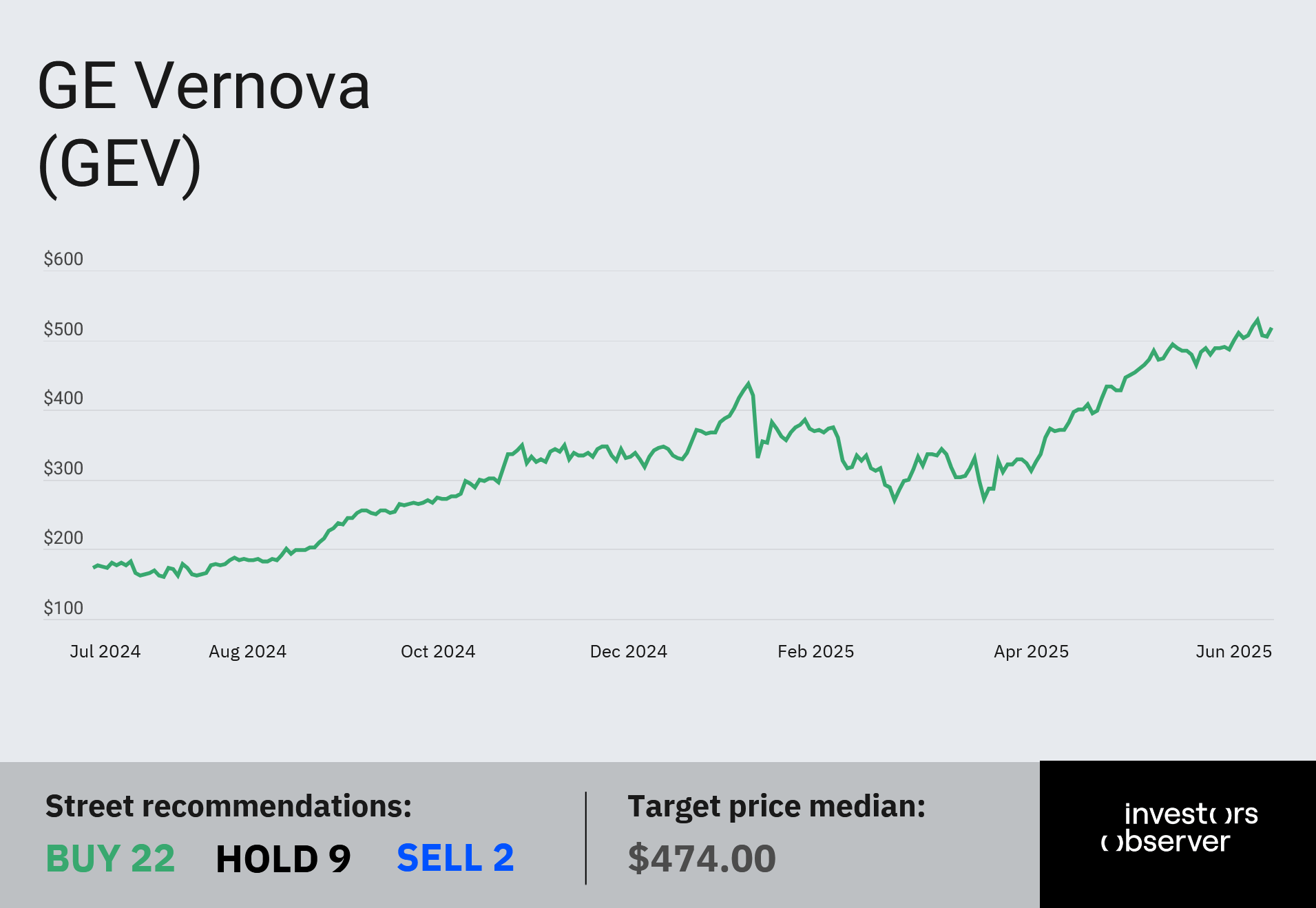

GE Vernova has been on a tear since it was spun off from General Electric Co. last year, with its shares almost quadrupling.

The company’s market cap is now at $141.1 billion.

GE Vernova also landed up to $14.2 billion in new deals with Saudi Arabia as part of President Trump’s dealmaking trip to the Middle East in May.

The company will be working with Saudi Arabia to support its net-zero emissions target by 2060.

Although GE Vernova has been landing a lot of new business this year, CNBC stock analyst Jim Cramer said that the company will need to scale its operations even more in order to meet the growing demand for energy.

“I think that they have to open up their pocketbook and start building more plant[s] so that they can have more turbines,” he said.

Investors at least seem to be bullish with what GE Vernova has been doing up to this point.

Its stock has surged 57.2% YTD and 199.4% over the past year.

Your email address will not be published. Required fields are markedmarked