Bank of America analysts flagged GE Vernova (GEV) in February as one of the six manufacturing stocks most exposed to Trump’s new tariffs.

That warning quickly came true in April when China hit back with tariffs, knocking GEV stock lower. But the stock has already bounced back.

And, somewhat ironically, it’s now getting a lift from Trump himself.

Saudi’s deal with GE Vernova

Among the biggest wins from Trump’s Middle East tour was up to $14.2 billion in new Saudi deals for GE Vernova.

That includes $2 billion in existing backlog, with additional contracts and MOUs spread across the next four years.

GE Vernova, which makes clean-energy equipment like wind turbines and gas-powered turbines, will be working with Saudi Arabia to support its net-zero emissions target by 2060.

In a statement, GE Vernova emphasized that it has had operations in the Kingdom for nearly 90 years.

While the company was only spun out of General Electric’s energy division in 2024, it inherited GE’s full energy legacy.

That includes the GEMTEC campus in Dammam, which houses turbine repair, component manufacturing, and R&D facilities.

In a LinkedIn post following the trip, GE Vernova CEO Scott Strazik said the new initiatives in Saudi Arabia would focus on power generation and grid stability, including heavy duty gas turbines and synchronous condensers.

“These efforts will help advance the Kingdom’s energy security and strengthen the economic prosperity and competitiveness of both nations,” he wrote.

Strazik also hinted at broader trade dynamics, saying GEV was proud to help “balance global trade efforts with our electrification equipment.”

“This is a clear example of the important role global manufacturers can play in reinforcing ties between countries and driving international growth,” he said.

GE Vernova expands in India

GE Vernova also announced last week that it would invest $16 million in India to expand its electrification and engineering footprint.

The expansion will prioritize technologies that help stabilize power grids, reduce transmission losses, and improve access to renewable energy like solar and wind.

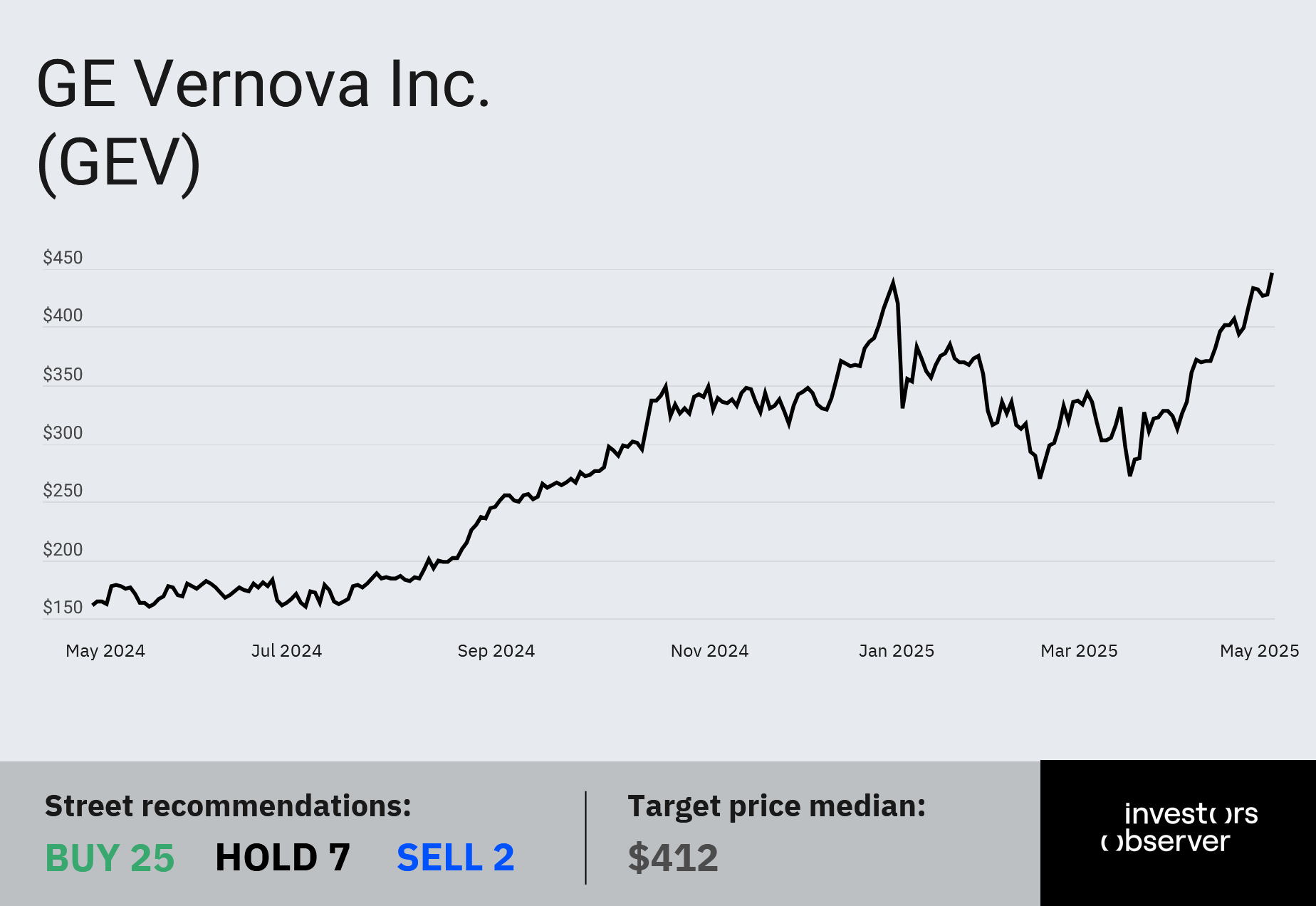

GE Vernova shares are up 35.8% year-to-date and have surged 174.6% over the past 12 months.

Your email address will not be published. Required fields are markedmarked