Tempus AI (TEM) — a health-tech firm that positions itself as an “AI operating layer” for the U.S. healthcare system — has largely flown under the radar, but it may not stay that way for long.

And after quietly embedding more than 1,000 AI agents directly into the electronic health record (EHR) systems used by hospitals and doctors, Wall Street is starting to pay attention.

Shares of Tempus surged 18% on Monday after the company announced the rollout of its xM technology for tracking patient treatment responses in real time.

That roll-out came one day after the company revealed its EHR integrations, sending a clear message that Tempus is accelerating its push into agentic AI.

“Tempus just embedded 1,000+ AI agents directly into EHR systems,” wrote health-tech analyst Shay Boloor. “It’s a major step toward becoming the AI operating layer for healthcare.”

$TEM UP 7% AFTER LAUNCHING IMMUNOTHERAPY ASSAY & EMBEDDING AI AGENTS INTO HOSPITAL EHRs

undefined Shay Boloor (@StockSavvyShay) June 2, 2025

Tempus just embedded 1,000+ AI agents directly into EHR systems -- it’s a major step toward becoming the AI operating layer for healthcare 😏 pic.twitter.com/1xY2FgO14L

These AI agents are built to automate time-consuming data entry tasks, speed up patient monitoring, and connect physicians to clinical trial data on demand, all of which can streamline workflows and improve patient outcomes.

According to Oracle, agentic AI could unlock tens of billions in healthcare value. Industry estimates peg the 2024 market at $15–27 billion, with a compound annual growth rate (CAGR) above 38% through 2030.

A healthcare AI giant in the making?

The company generated $693 million in revenue last year, up 30.4% from 2023. That growth accelerated in Q1 2025, with Tempus reporting $256 million in revenue, a 75.4% year-over-year surge. Gross profit nearly doubled to $155 million.

Despite the strong top-line momentum, Tempus had a net loss of $68 million. Roughly $28 million of that came from stock-based compensation, the company said.

Even so, Tempus is guiding for a breakout 2025.

Executives expect revenue to soar 80% to $1.25 billion, with adjusted earnings turning slightly positive. That would represent a $110 million year-over-year improvement in profitability.

CEO Eric Lefkofsky credited Tempus’ performance to its aggressive AI strategy, including new partnerships with AstraZeneca and AI drug discovery firm Pathos.

Those deals will pay Tempus $200 million in data licensing and model development fees over the next three years, all toward building a foundation model for oncology.

“These investments uniquely position us to advance what is possible in diagnostics and drug development,” Lefkofsky said.

Tempus’ model has broad implications. By embedding AI directly into the tech that powers hospitals, it’s attempting to make itself indispensable by becoming part of the infrastructure.

And Wall Street appears to be buying into the strategy.

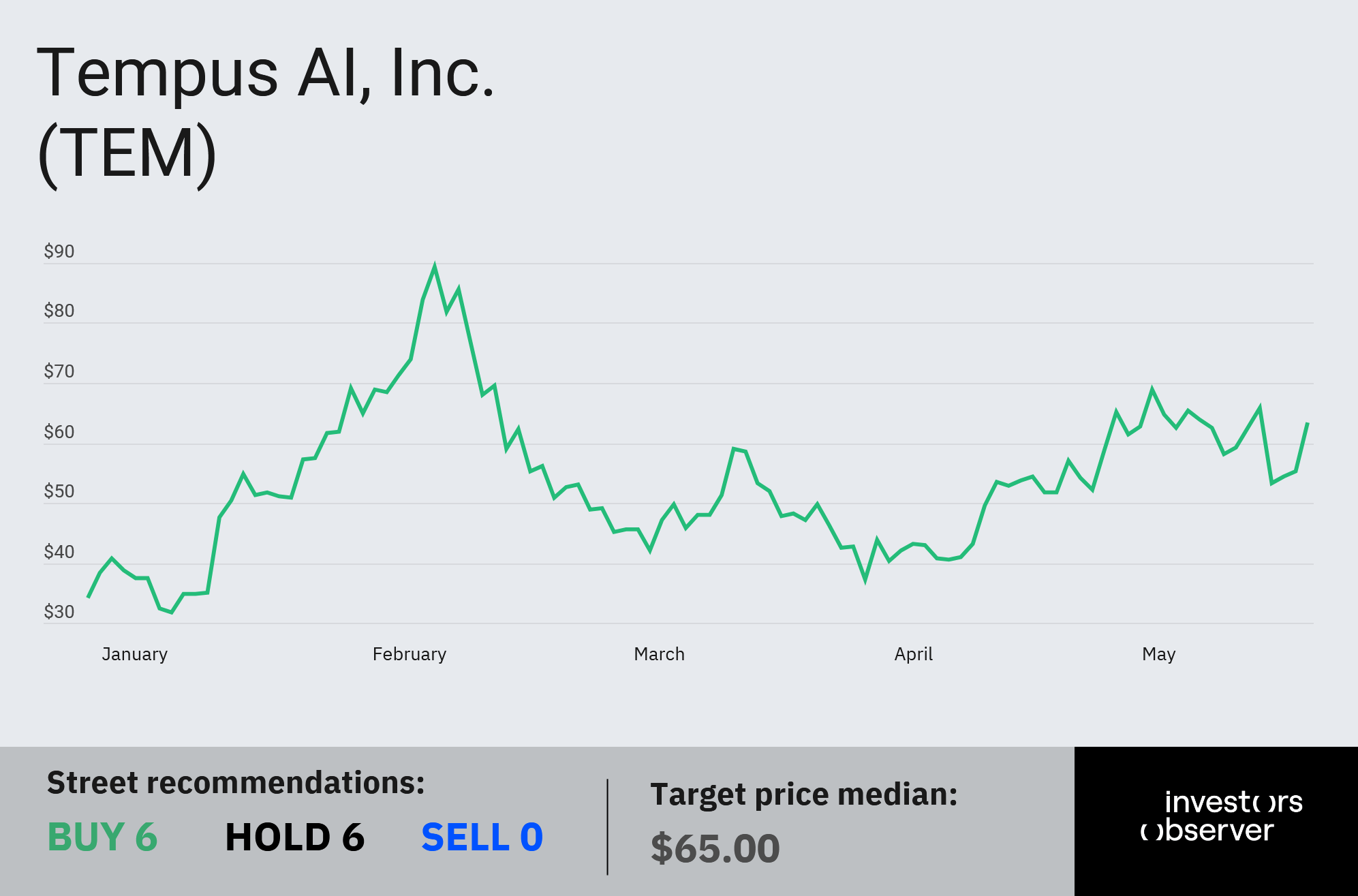

TEM stock is now up 88% year-to-date. If Tempus' agentic AI rollout continues at this pace and the company cements itself as the backbone of AI infrastructure in healthcare, this year's rally could be just a warm-up.

Your email address will not be published. Required fields are markedmarked