Global trading platform Moomoo announced this week that it will begin offering cryptocurrency trading services to its American users. The new product, called Moomoo Crypto, will debut with 32 digital coins.

The company says it will start with “major cryptocurrencies” like bitcoin (BTC) and ethereum (ETH), before expanding its coin lineup in the coming months.

To power the rollout, Moomoo is partnering with Coinbase (COIN) and using the exchange’s Crypto-as-a-Service (CaaS) platform.

“As digital assets continue to gain mainstream adoption, we saw a clear opportunity to apply our expertise in creating accessible yet sophisticated investment tools for the crypto space,” said Neil McDonald, CEO of Moomoo U.S.

“With Moomoo Crypto, we’re bridging the gap between traditional and digital finance, providing our users with the tools and insights they need to navigate this dynamic market.”

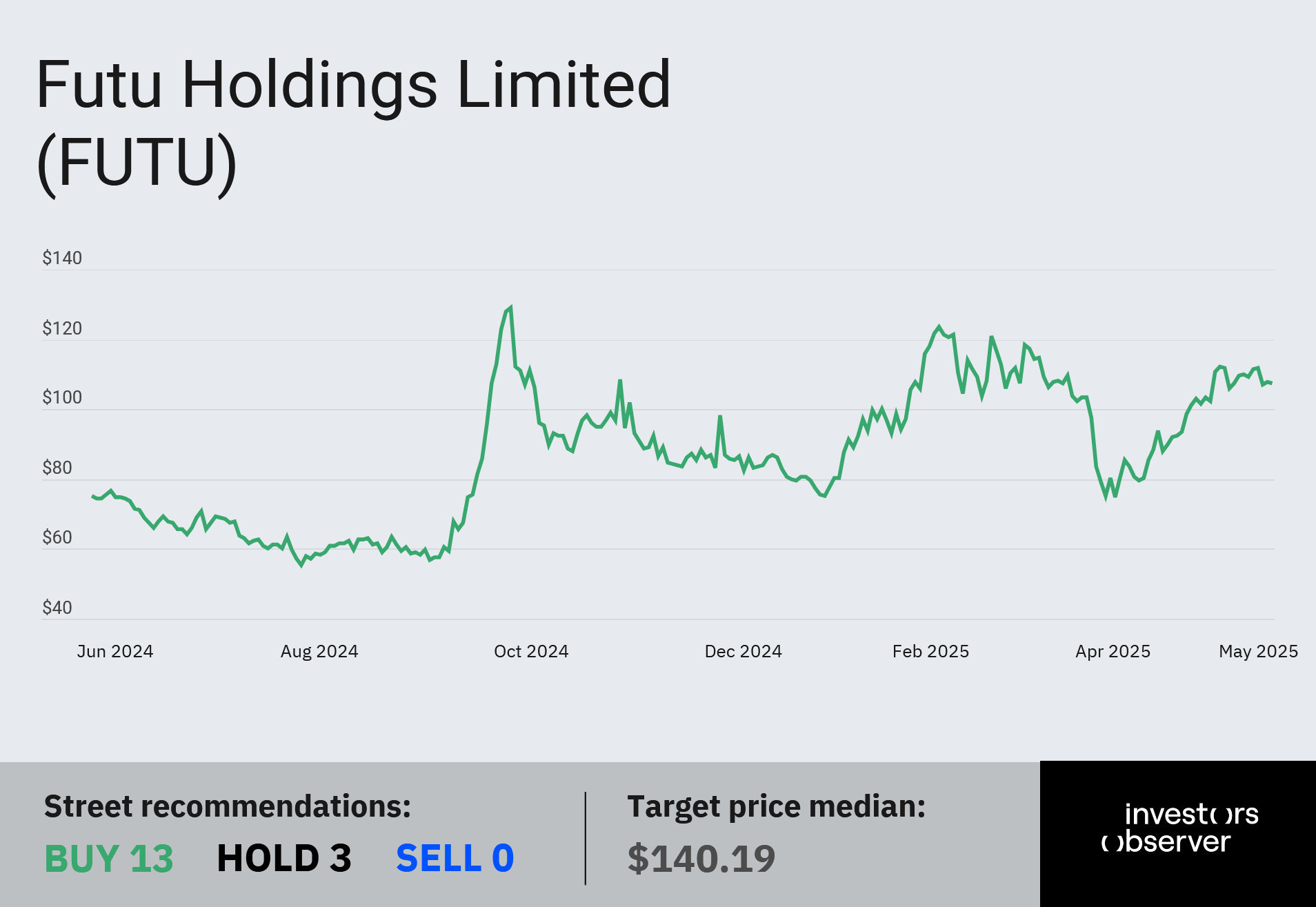

Futu Holdings makes crypto push in the U.S.

Moomoo is a subsidiary of Hong Kong-based Futu Holdings (FUTU).

The platform says it will offer crypto-specific tools — including copy trading — by early September, in addition to features like advanced charting and spot pricing.

“We’re seeing growing demand from platforms like Moomoo as crypto becomes increasingly mainstream,” said Brian Foster, global head of CaaS at Coinbase.

“Our Crypto-as-a-Service offering is designed to help bridge traditional and digital finance, giving partners the infrastructure, security, and tools they need to confidently build in crypto and serve a wide range of users.”

Coinbase also recently partnered with Webull, another trading platform using its CaaS infrastructure to offer crypto trading.

Meanwhile, Futu reported a strong first quarter. Revenue rose 81.1% year-over-year to $603.4 million, while gross profit jumped 85.9% to $507.2 million.

Total funded accounts hit 2.67 million as of March 31 — up 41.6% from a year ago — while brokerage accounts increased 30% to nearly 5 million.

“In Japan, new funded accounts enjoyed robust growth and reached a historic high, as we [also] solidified our position as the go-to broker for U.S. stock trading,” said Futu CEO Leaf Hua Li.

“Funded account growth accelerated in the U.S. as we enhanced our offerings for active traders and our high-profile advertising campaigns boosted brand visibility.”

The company says it has already reached one-third of its full-year target for new funded accounts in the U.S., and still expects to hit 800,000 by the end of 2025.

Futu’s stock is up 33.3% year-to-date and 35.6% over the past 12 months.

Your email address will not be published. Required fields are markedmarked