Analysts have long questioned Uber’s ability to build a sustainable business beyond subsidized rides and food delivery, but the company’s turnaround appears to have silenced many critics, thanks to one key metric: free cash flow.

Free cash flow, often seen as the clearest indicator of a company’s financial health, measures the money generated from operations after deducting capital expenditures.

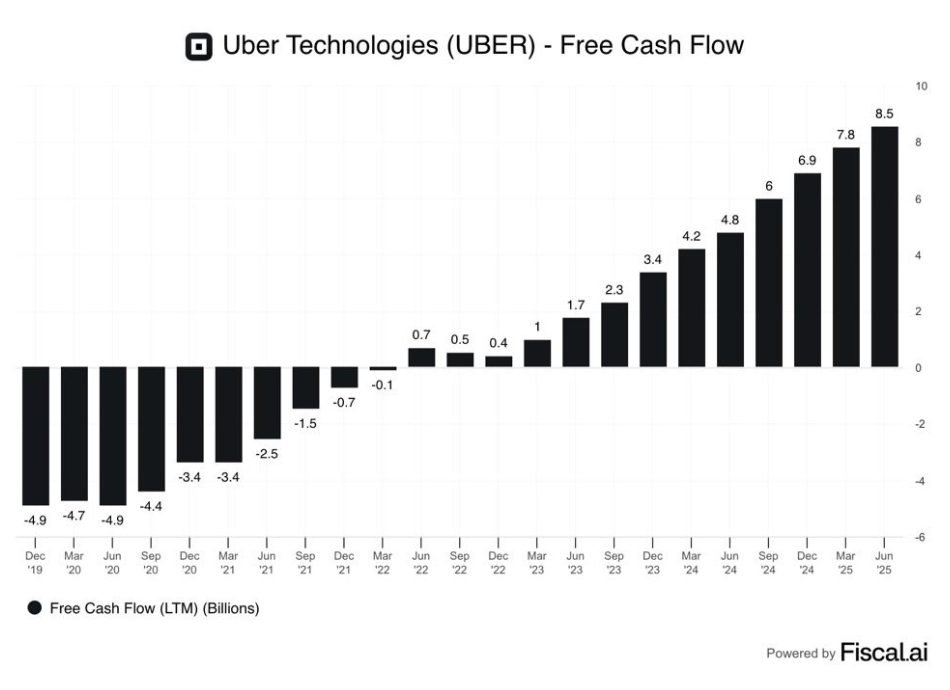

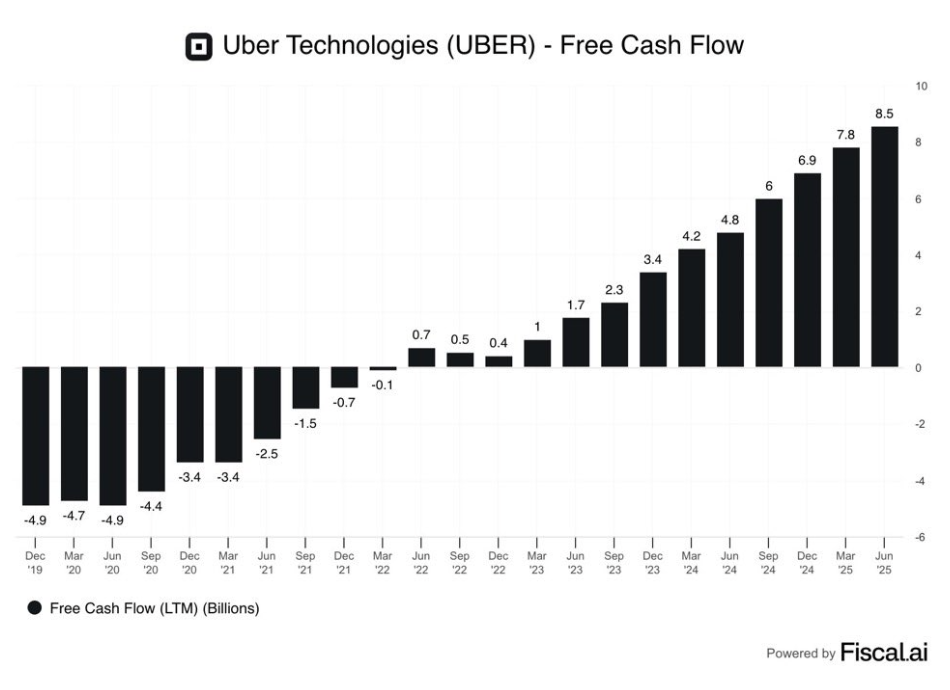

For Uber, this figure has surged tenfold in just three years, from $700 million in June 2022 to $8.5 billion in June 2025, according to data from Fiscal.ai.

That marks a dramatic reversal from years of negative free cash flow, which once fell as low as $4.9 billion, meaning the company was spending far more than it was generating from its core operations.

The shift underscores Uber’s maturation. In its early years, the company relied heavily on subsidies, offering below-cost rides, discounted delivery fees, and other incentives to attract riders and drivers.

With competition mounting, long-term profitability looked doubtful until Uber began reworking its business model.

As InvestorsObserver noted, the turnaround was years in the making. Uber boosted operational efficiency, expanded its membership program, and opened new revenue streams, including advertising.

Much of that growth has come with controversy. Uber has raised prices for riders while keeping driver pay flat, or in some cases lower, across both its ride-hailing and Uber Eats platforms.

Even as Uber squeezes its drivers, shareholders have reaped the rewards, with the stock surging over the past year.

From rides to recurring revenue: Uber shifts growth playbook

Uber’s stock has surged to record highs following its turnaround, trading above $95 a share and pushing the company’s market capitalization close to $200 billion. The stock is up more than 58% year-to-date, far outpacing the S&P 500 and Nasdaq Composite.

Investors are betting on new growth engines beyond ride-hailing and delivery. Uber’s advertising business has become a standout, with an annual run rate of $1.5 billion.

The company’s second-quarter earnings also highlighted the rapid expansion of its Uber One subscription program, which grew 60% year-over-year to 36 million members.

In the U.S., Uber One costs $9.99 per month or $99.99 annually, with student and promotional discounts available.

While the fees may look modest, subscription revenue can scale quickly. Costco’s membership model, for instance, has fueled its long-term growth and investors see echoes of that playbook in Uber’s strategy.

Your email address will not be published. Required fields are markedmarked