Ford Motor (F) has warned that tariffs will likely remain in place for at least three years, disrupting automotive supply chains and pushing up prices on vehicles once seen as affordable.

In an interview with CNBC, CEO Jim Farley said it’s “easy to see” tariffs adding $5,000 or more to the sticker price of new cars starting this summer.

“If we build everything in the U.S., American consumers won’t have those affordable new vehicles like Ford is growing. So that’s the balancing act here,” Farley said.

Ford’s first-quarter results already show signs of strain. The carmaker’s profit fell nearly two-thirds to $473 million, down from $1.33 billion a year earlier, while revenue dropped 5% to $40.66 billion.

On its latest earnings call, the company warned that tariffs could slash $1.5 billion from profits this year alone, forcing Ford to withdraw its full-year guidance.

What’s notable is that Ford is considered better insulated than many of its rivals.

Roughly 80% of its U.S. vehicles are assembled domestically, including all F-Series trucks sold stateside. But even for a "Made in America" brand, the trade environment is proving costly.

Ford stock holds steady, for now

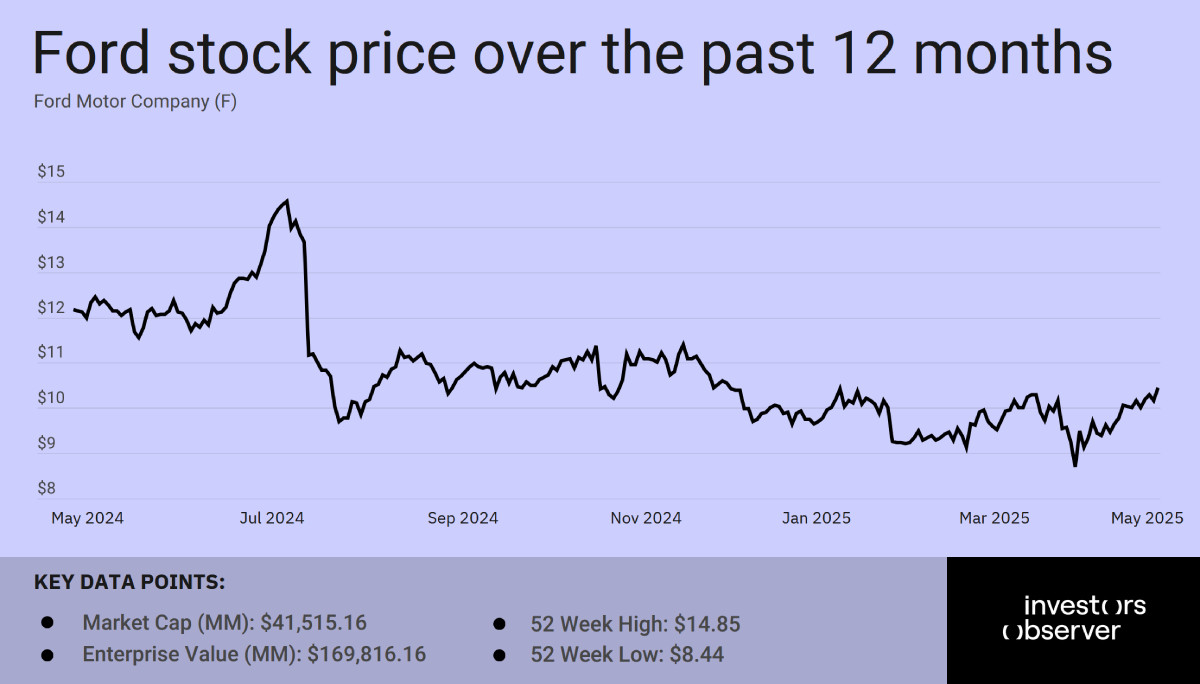

Despite the tariff gloom and doom, Ford (F) stock has gained 5% year-to-date and currently trades around $10.50. Still, the stock is down more than 16% over the past 12 months.

Citigroup analysts say the stock is fairly valued at current levels, while Piper Sandler sees more downside, with a $9 price target.

The bigger question for investors may be whether Ford can continue sourcing key raw materials. One of the biggest risks ahead involves rare earth imports from China, critical components for electric vehicles and advanced electronics.

“The rare earth materials from China… not just for us, but for the entire industry, has become rather complicated over the last few weeks,” said COO Kumar Galhotra.

“It would take only a few parts to potentially cause some disruption into our production,” he added.

If rare earth supply is disrupted, it could trigger ripple effects across the entire auto sector and make traditional valuations models nearly useless in the face of production chaos.

Your email address will not be published. Required fields are markedmarked