Bed Bath & Beyond was once a home goods empire and later a poster child for meme-stock mania.

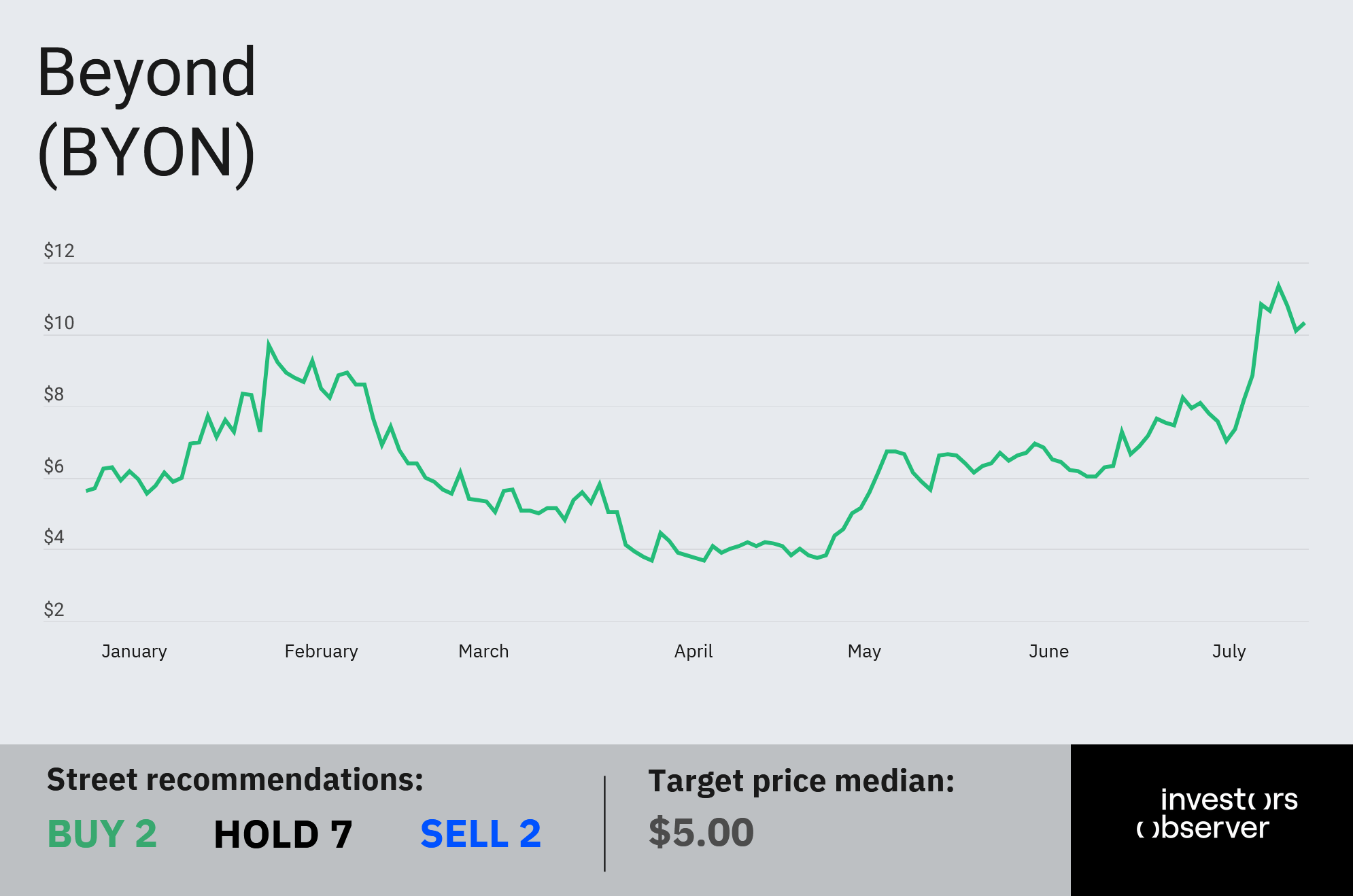

Now reborn as Beyond (BYON), the company is reinventing itself as an e-commerce player with a blockchain twist. So far, Wall Street’s buying it, with BYON stock surging 109% this year.

But while investors have warmed to the operational turnaround, questions linger over how quickly Beyond can cash in on its blockchain bets.

From retail giant to meme frenzy

The downfall of Bed Bath & Beyond followed the broader decline of big-box retailers in the age of Amazon. As shoppers moved online, the brand slipped out of favor, eventually finding itself swept into meme-stock lore.

In 2022, Chewy (CHWY) co-founder and GameStop (GME) chairman Ryan Cohen bought a big stake in BBBY and launched an activist campaign that sent retail traders into a buying frenzy.

The stock spiked, Cohen cashed out with a $60 million gain, and the shares promptly crashed.

By 2023, Bed Bath & Beyond was bankrupt and all physical stores shuttered. The brand name and operations were acquired by Overstock.com, which rebranded as Beyond and pivoted to an online-focused model.

Blockchain bets

Beyond’s e-commerce transformation isn’t just about online shopping.

The company also holds major stakes in two blockchain firms: tZero, which provides digital solutions for issuers looking to tokenize their cap tables, and GrainChain, an ag-tech platform applying blockchain to agricultural supply chains.

In its Q2 earnings report Monday, executive chairman Marcus Lemonis said Beyond is “actively unlocking value in our blockchain asset portfolio.” He pointed to the newly enacted GENIUS Act, which provides regulatory clarity for digital assets, as a catalyst for tapping into the technology’s potential.

“With regulatory certainty now in place, the proprietary technology and innovative practices both tZERO and GrainChain bring to the business ecosystem are significant,” Lemonis said.

Activists push harder

Not everyone thinks Beyond is moving fast enough. Eric Ebert of Shay Capital praised the “remarkable turnaround” of Beyond’s core retail assets but said he is “deeply concerned by the lack of progress in monetizing” its blockchain holdings.

In a letter to Beyond’s board, Ebert noted that shareholders have poured more than $400 million into tZero and GrainChain over the past decade, yet the balance sheet undervalues these assets.

Shay Capital is pushing for an IPO or SPAC merger for tZero to raise capital for further acquisitions.The fund also suggested transferring Beyond’s GrainChain stake into a special purpose vehicle (SPV), then spinning it out as a dividend to shareholders.

That tracker stock could list on the NYSE under ticker “BYONS,” giving investors direct exposure to GrainChain’s growth.

Your email address will not be published. Required fields are markedmarked