After enduring a brutal stretch marked by mass store closures and rising medical costs, CVS Health (CVS) is finally turning a corner, and investors are starting to notice.

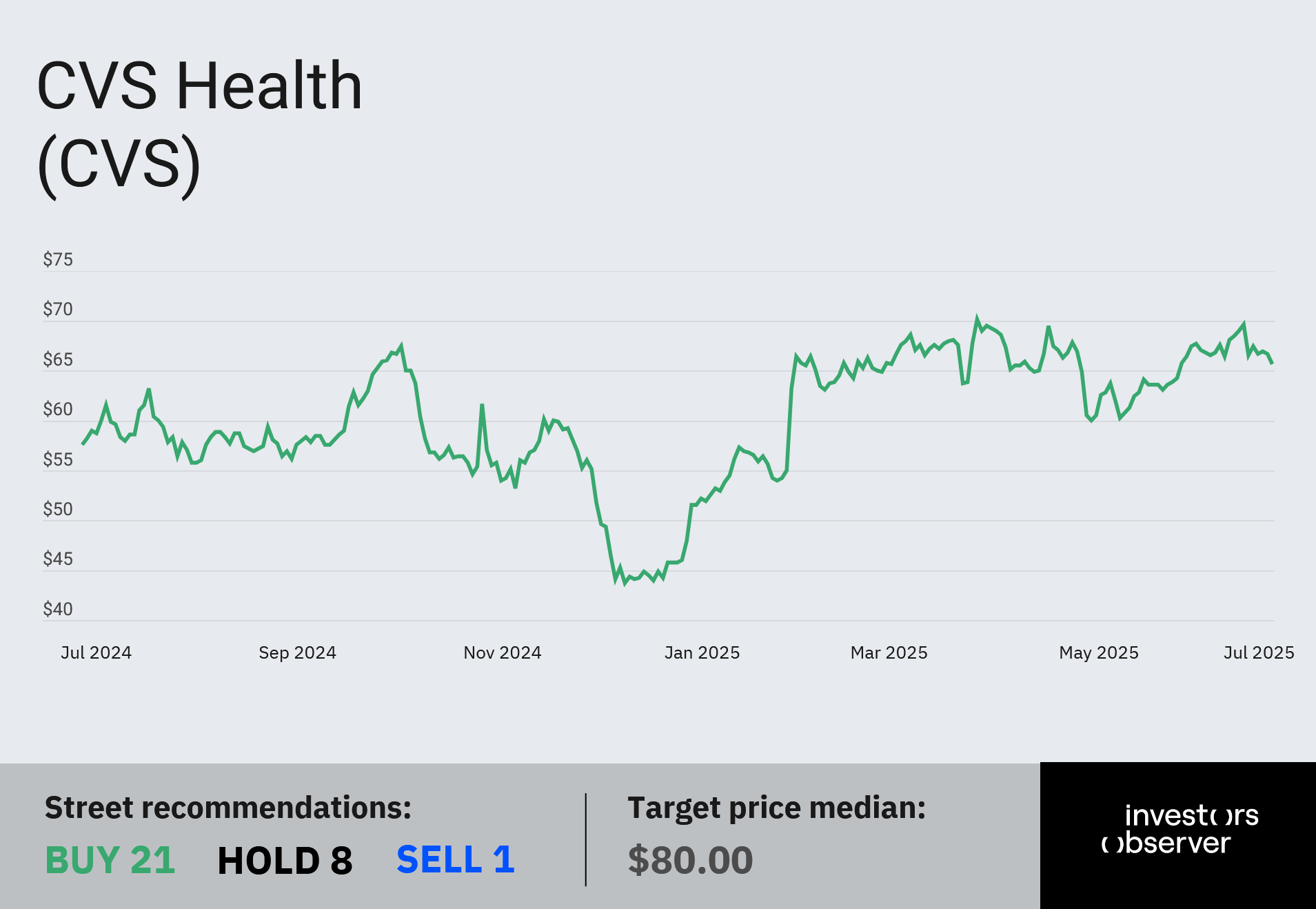

CVS stock is up more than 50% in 2025, bouncing back from a nearly 60% drop from its post-pandemic high of $104 per share, pushing the company’s market cap to $84 billion.

The comeback is a result of better-than-expected first-quarter results and a series of strategic leadership changes that have restored some confidence in the company’s long-term plan.

Revenue rose 7% year-over-year to $94.6 billion, while adjusted earnings jumped to $2.25 per share, up from $1.41 a year ago.

CVS also pulled double-digit growth in its pharmacy and wellness division (+11%) and an 8% revenue increase in its health services business.

In April and May, CVS reshuffled its executive team, appointing a new CFO, VP, and chief medical officer, which signaled clearer direction.

CVS took a hit from the "retail apocalypse"

Like many large chains, CVS was forced to rethink its physical footprint after the pandemic.

Between 2022 and 2024, the company shut down 900 stores, including roughly 300 last year, many of them located inside Target locations.

The closures led to about 5,000 layoffs, according to The Wall Street Journal.

A CVS spokesperson told the paper the decision followed a careful “evaluation of changes in population, buying patterns, and future health needs.”

Despite the downsizing, CVS still operates more than 9,000 stores nationwide.

Aetna woes and the pivot ahead

The company also struggled last year with rising medical expenses at its insurance arm, Aetna, which saw net income fall from $8.4 billion to $4.6 billion.

But the first quarter of 2025 showed signs of recovery. Aetna generated $34.81 billion in revenue, an 8% increase that beat analyst expectations.

On its Q1 earnings call, CVS said Aetna will exit the Affordable Care Act exchanges beginning in 2026. The move is part of CEO David Joyner’s broader effort to stabilize the unit and restore financial discipline.

CVS is expected to report second-quarter earnings at the end of July, according to Nasdaq.

Your email address will not be published. Required fields are markedmarked