After decades as net sellers, global central banks have been aggressively accumulating gold since around 2010, marking the longest and largest buying spree in modern history, and potentially signaling an ominous shift in global monetary strategy.

According to Bank of America Global Research, central bank gold purchases have surged since 2022, exceeding 1,000 tons annually. In 2025, central banks are projected to remain strong net buyers, though at a slightly slower pace than in the past three years.

This wave of demand has helped fuel a generational bull market for the yellow metal, which has climbed more than 50% this year to surpass $4,000 per troy ounce for the first time in history.

Central banks typically accumulate gold for reasons such as reserve diversification and financial stability. However, this latest spree also reflects deeper concerns, ranging from persistent inflation and mounting sovereign debt to escalating geopolitical tensions.

Several countries, led by China, appear to be pursuing a broader strategy to reduce their dependence on the U.S. dollar. As JPMorgan Chase noted, China’s dollar reliance has been declining since 2017.

“This is not surprising, as this was around the time when U.S.–China relations began shifting into their current state, marked by the trade war and growing diplomatic, security and geopolitical tensions,” said JPMorgan’s fixed income strategist Jonny Goulden.

All told, the trend remains bullish for gold but may be bearish for confidence in the global financial system, underscoring rising unease over the sustainability of global debt levels and the durability of the current monetary order.

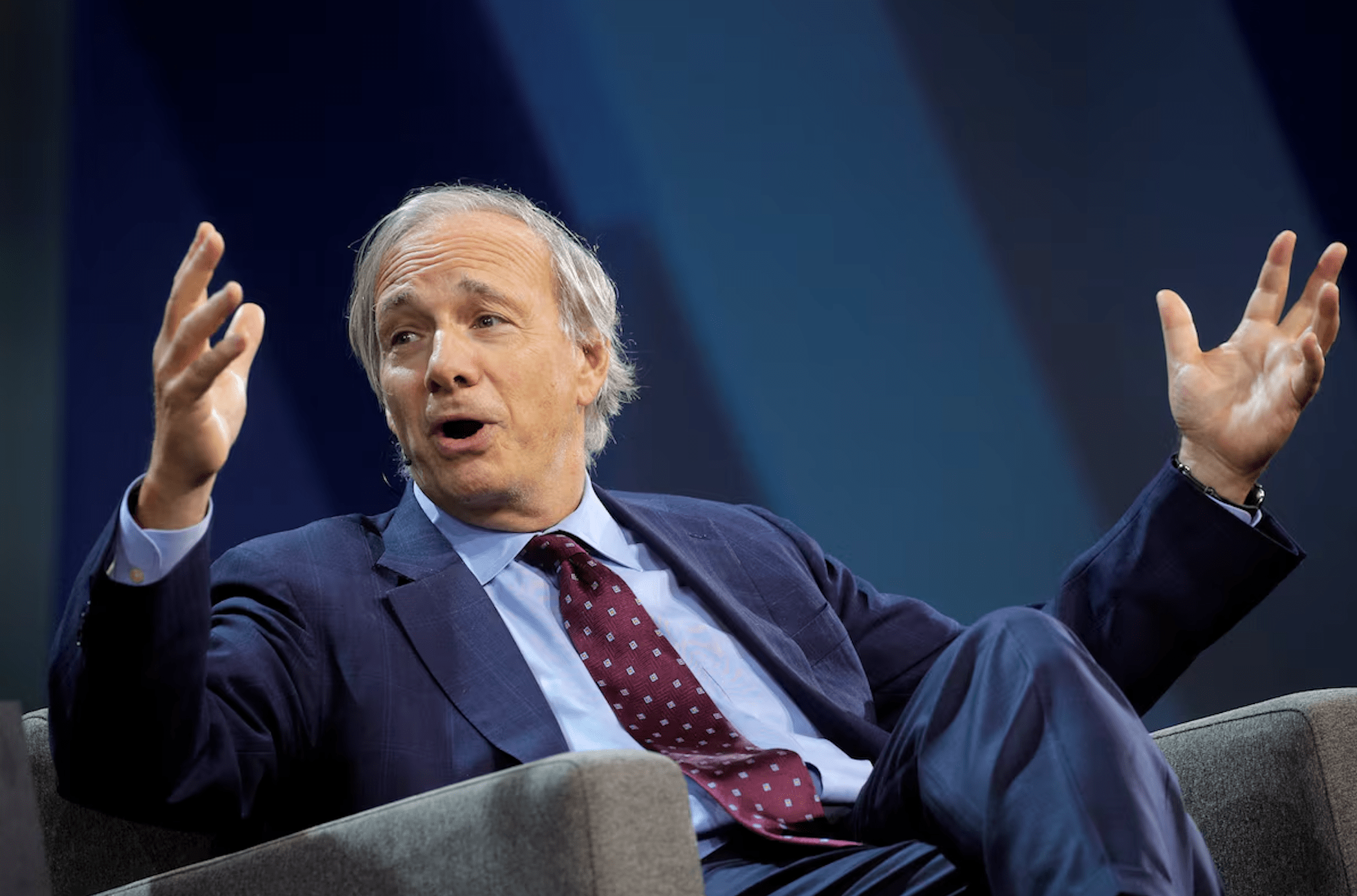

Ray Dalio compares today's monetary climate to the 1970s

Central banks’ historic accumulation of gold should serve as a warning sign for investors, according to Bridgewater Associates founder Ray Dalio, who says it’s time to significantly increase portfolio exposure to bullion.

“Gold is a very excellent diversifier in the portfolio,” Dalio said at the Greenwich Economic Forum last week, recommending that investors allocate about 15% of their portfolios to the yellow metal.

“It’s very much like the early ’70s,” Dalio added, drawing parallels between today’s environment of rising inflation, expansive fiscal policy, and mounting government debt and the stagflationary period that followed the collapse of the Bretton Woods system.

Billionaire investor Jeffrey Gundlach, CEO of DoubleLine Capital and often dubbed the “Bond King,” has made similar arguments, recently suggesting investors consider holding as much as 25% of their portfolios in gold.

Dalio, in particular, has long warned of the gradual debasement of the U.S. dollar, arguing that successive administrations have failed to rein in federal spending or address the ballooning deficit. In his view, these conditions could erode confidence in the currency and the broader financial system.

Your email address will not be published. Required fields are markedmarked