Tempus AI (TEM) shares have been on a tear, and this week, the company gave investors another reason to stay bullish.

Tempus announced it’s expanding its AI-powered clinical platform, Tempus Next, into breast cancer care.

The system, already in use for lung cancer treatments, helps physicians close biomarker testing gaps by using real-time data from patient records and clinical guidelines to improve treatment decisions.

The rollout includes collaboration with Mercy, one of the largest healthcare systems in the U.S., which has already integrated Tempus Next for lung cancer and will now adopt it for breast cancer.

“Keeping up with rapidly evolving clinical guidelines is nearly impossible for physicians — especially in high-volume community settings,” said Chris Scotto DiVetta, SVP of AI Applications at Tempus.

“We’re designing custom integrations to meet providers where they are and help optimize care.”

Ark Invest doubles down

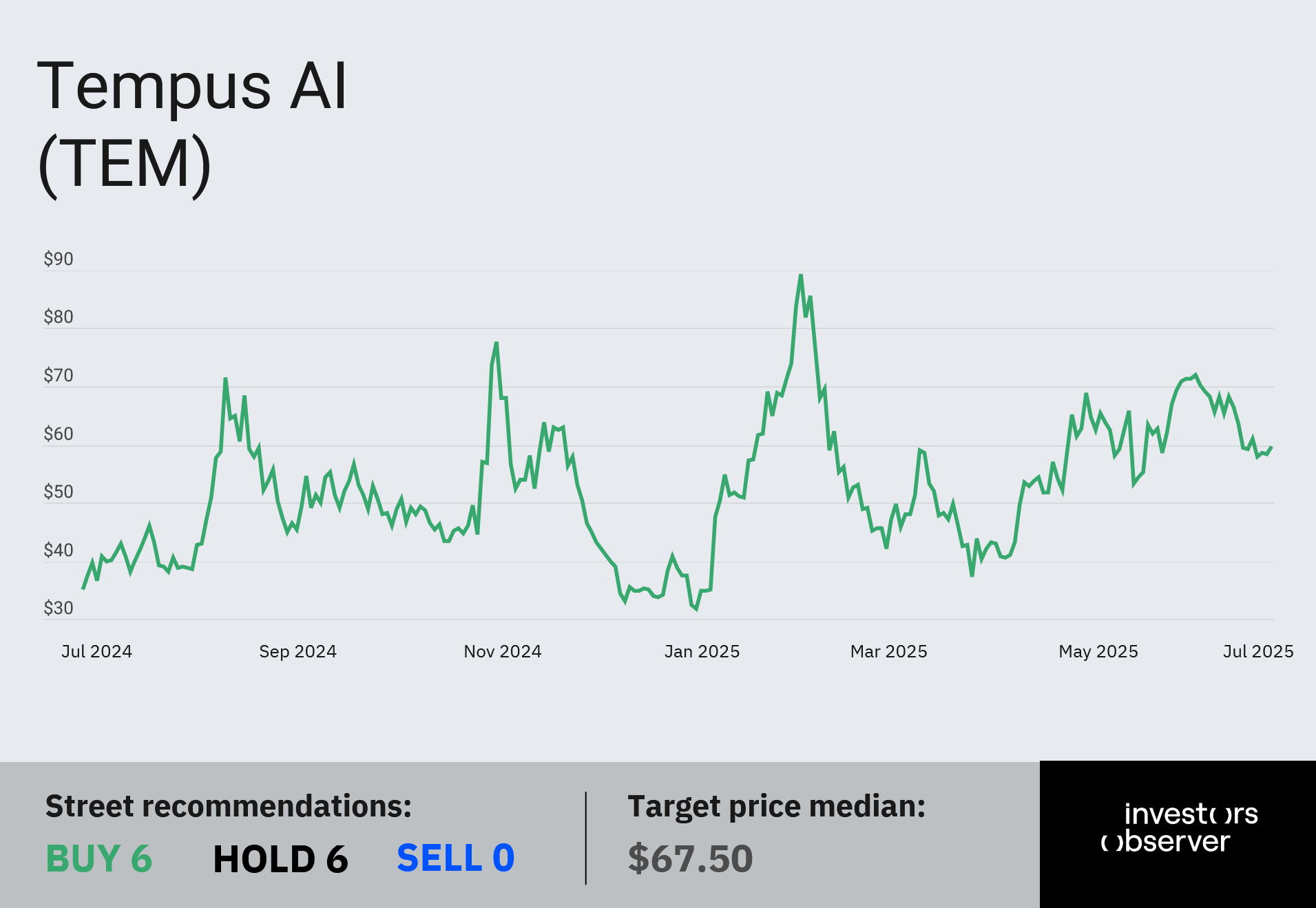

Tempus shares have surged 76.5% year-to-date and 70.3% over the past 12 months, thanks in part to strong support from Cathie Wood’s Ark Invest.

Wood now holds $305.3 million worth of TEM in her flagship ARK Innovation ETF (ARKK), and just added another 150,563 shares worth about $8.8 million this week.

She’s long argued that healthcare is the most overlooked opportunity in AI.

“The most underappreciated application of AI is healthcare,” Wood told CNBC in February. “Data is the name of the game.”

Guggenheim analyst Subbu Nambi agrees. He recently reiterated his “buy” rating on Tempus and raised his price target from $65 to $75, citing the company’s ability to scale its platform across specialties, now including oncology and neuroscience.

Last month, Tempus inked a multi-year collaboration with Northwestern University’s Abrams Research Center on Neurogenomics to apply its AI tech to Alzheimer’s research.

The Chicago-based company claims to operate the world’s largest clinical and molecular database, with its tools now used by cardiologists, oncologists, pharmaceutical companies, and academic researchers.

In a Bloomberg interview in May, Wood said AI could restore healthcare R&D returns — which have dropped to low single digits — to upwards of 40% by dramatically cutting the cost of innovation.

Your email address will not be published. Required fields are markedmarked