Biotech startup Grail (GRAL) is making progress on revenue and cost control, but that wasn’t enough to calm investor concerns about how quickly it’s burning through cash.

The Menlo Park–based company, which is developing early cancer screening tests for symptom-free patients, reported $31.8 million in Q1 revenue, up 19% year-over-year.

Its $3.10 per-share loss beat expectations for a $4.26 loss, and its net loss narrowed 51% to $106.2 million from $112.7 million a year ago.

But investors were more concerned about something else. Grail burned through $90 million last quarter and expects to spend another $320 million by year’s end.

CEO Bob Ragusa said part of the spending spike was due to annual bonuses paid out during Q1. Even so, the pace of cash usage raised questions, especially with key regulatory approvals still pending.

Grail ended the quarter with $677.9 million in cash, but Wolfe Research analyst Doug Schenkel pressed management on whether that would be enough to keep the company going.

That’s because, in his view, approvals for its lead product, the Galleri multi-cancer early detection (MCED) test, may take longer than expected.

“You’ve done a good job extending the runway,” Schenkel said on the earnings call, “but there are still concerns you can get there, especially given where we are with the MCED bill and FDA approval.”

Waiting game with the FDA and Congress

The company is still waiting for FDA approval for Galleri, along with a decision from NHS England on whether the test can be used in the UK.

Grail is also watching a bill in Congress that would allow Medicare coverage of MCED tests, a critical step to making them more accessible.

With so much riding on those outcomes, Schenkel questioned why the company didn’t raise money while its stock was surging.

“What was the calculus at the board level to not raise money to de-risk the outlook?” he asked. “It seems that would've been a prudent move to maybe allow you to play offense a little more aggressively.”

Ragusa responded that while the board did consider it, they decided the company had enough runway to reach several near-term milestones.

“We think getting through some of these milestones de-risks the business and creates value,” he said. “And knowing we had the cash runway to get through those was the deciding factor.”

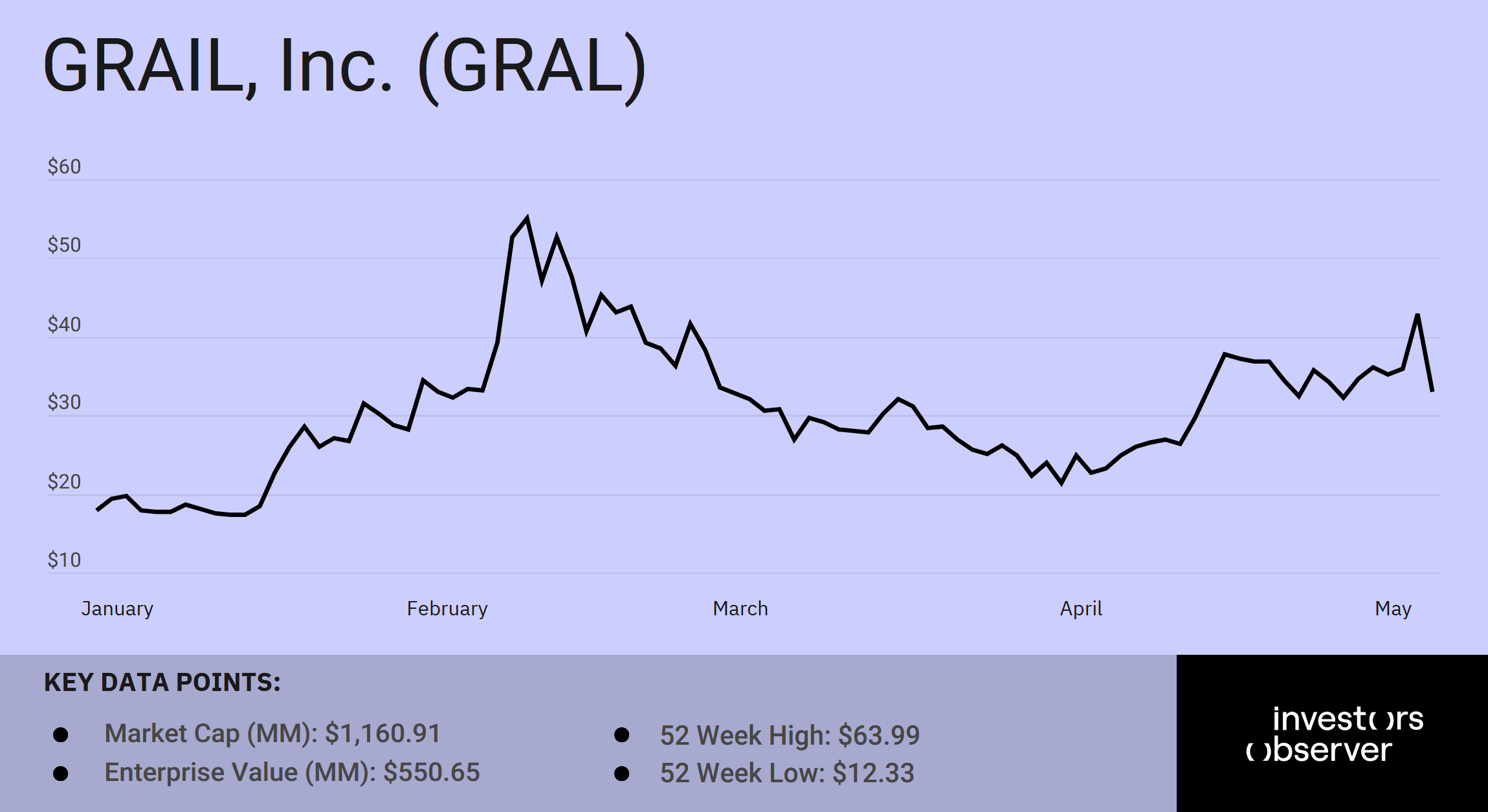

Grail shares fell 23.3% on Wednesday following the call. The stock is still up 84.3% year-to-date.

Your email address will not be published. Required fields are markedmarked