Wolfspeed’s (WOLF) bankruptcy filing last week may have sounded like a death knell, but it’s led to the exact opposite.

The stock has exploded more than 530% in five days, tacking on another 9.1% Tuesday after the company named a new chief financial officer.

The new hire, Gregor van Issum, brings a resume tailor-made for turnarounds.

Wolfspeed described him as a restructuring veteran with more than 20 years of experience across tech, most recently as EVP and group controller at European sensor and lighting giant ams-OSRAM.

“In this new role, my priority will be providing Wolfspeed's investors with transparency and clarity,” van Issum said in a statement.

He added that his experience restructuring companies and navigating complex cycles would help shape a more agile capital structure.

The rally comes just days after Wolfspeed filed for Chapter 11 protection at the end of June, a move CEO Robert Feurle said would allow the company to “move faster on our strategic priorities” and keep its edge in the fast-growing silicon carbide market.

The filing is expected to slash Wolfspeed’s total debt by 70% — about $4.6 billion — and cut annual cash interest payments by 60%. The company expects to exit bankruptcy by the end of Q3.

Pain before the pop

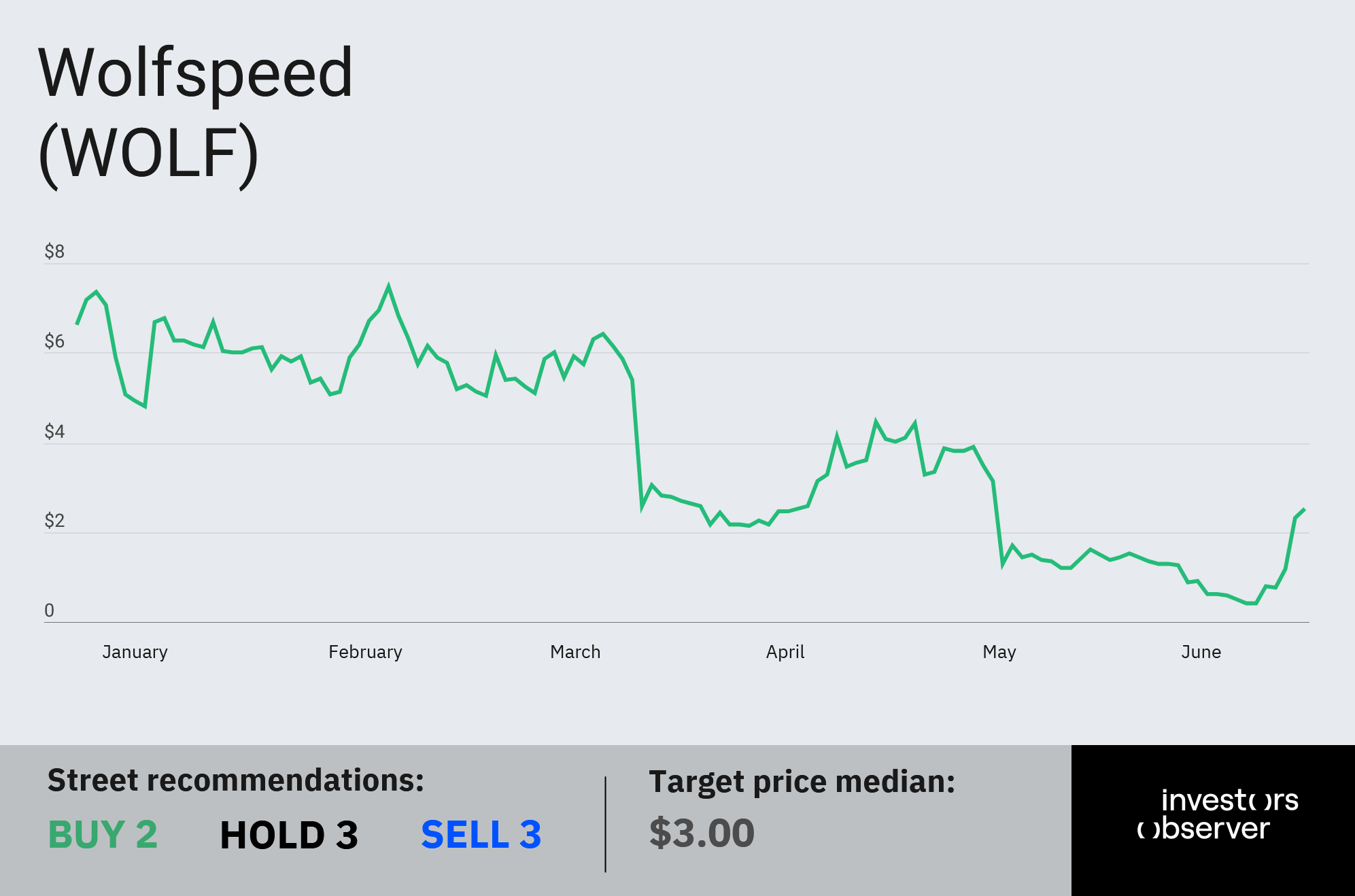

Wolfspeed’s sudden rebound follows a year of deep turmoil.

The company fired CEO Gregg Lowe last November, cut 20% of its workforce, shuttered a North Carolina plant, and scrapped plans for a new facility in Germany.

Its debt ballooned as it scaled, and a $750 million CHIPS Act grant, the largest allocation under the program, remains frozen in political limbo under the Trump administration.

The money had been approved during Biden’s term but never disbursed.

The filing may also be a nod to activist pressure. Jana Partners had previously called for a “comprehensive review of strategic alternatives.” Now, it seems Wolfspeed listened.

Despite the five-day rally, WOLF is still down 62.2% year to date. But if its restructuring plan works — and the CHIPS money finally lands — this surprise bankruptcy bounce might just be the beginning.

Your email address will not be published. Required fields are markedmarked