As earnings season rolls on, one question remains front and center: how exposed is your supply chain to Trump’s new tariffs?

ATI Inc. (ATI) addressed it right out of the gate on last week’s earnings call.

“While the headlines continue to shift, we remain confident in our view that ATI is uniquely positioned to handle the evolving trade and tariff landscape,” said CEO Kimberly Fields.

The company, which makes specialty metals used in jet engines and military equipment, produces most of its materials in the U.S. That gives it a layer of protection from the latest round of tariffs.

Still, Fields acknowledged ATI imports some raw materials that aren’t available domestically. She said the company has enough flexibility in its supply chain to switch to lower-cost options when needed.

“We’ve got multiple levers we can pull,” she said. “We’re able to shift supply depending on how the trade deals play out.”

She also pointed out that ATI’s customer contracts already include protections to help offset inflation, raw material costs, and tariffs. “Frankly, we started building this back in 2017 and 2018, during the first Trump administration,” Fields said.

Defense work drives strong quarter

ATI’s sales rose 10% in the first quarter to $1.14 billion, powered by a 23% jump in aerospace and defense orders.

Profit came in at $97 million, up 47% from a year ago. Earnings per share rose to $0.67 from $0.46. Cash flow also improved: adjusted EBITDA (a rough measure of operating profit) climbed 29% to $195 million.

ATI spent $70 million buying back its own shares in the first quarter and plans to spend up to $250 million more in Q2.

“We see clear value in our current share price and recognize the opportunity to capture it,” Fields said.

So far, tariffs haven’t made much of a dent in ATI’s defense business. The company still has a strong backlog of orders and said there have been no cancellations.

Fields, however, warned that it’s too early to say what the impact will be at the end of the day, especially if the economy dips into a recession.

“If there is a recession, the industrial market will feel it,” she said, adding that trade talks will affect both U.S. and overseas demand.

ATI kept its full-year forecast unchanged. It expects to earn between $0.67 and $0.73 per share in the second quarter, and $2.87 to $3.09 for the full year. It’s aiming for operating profits of $800 million to $840 million in 2025.

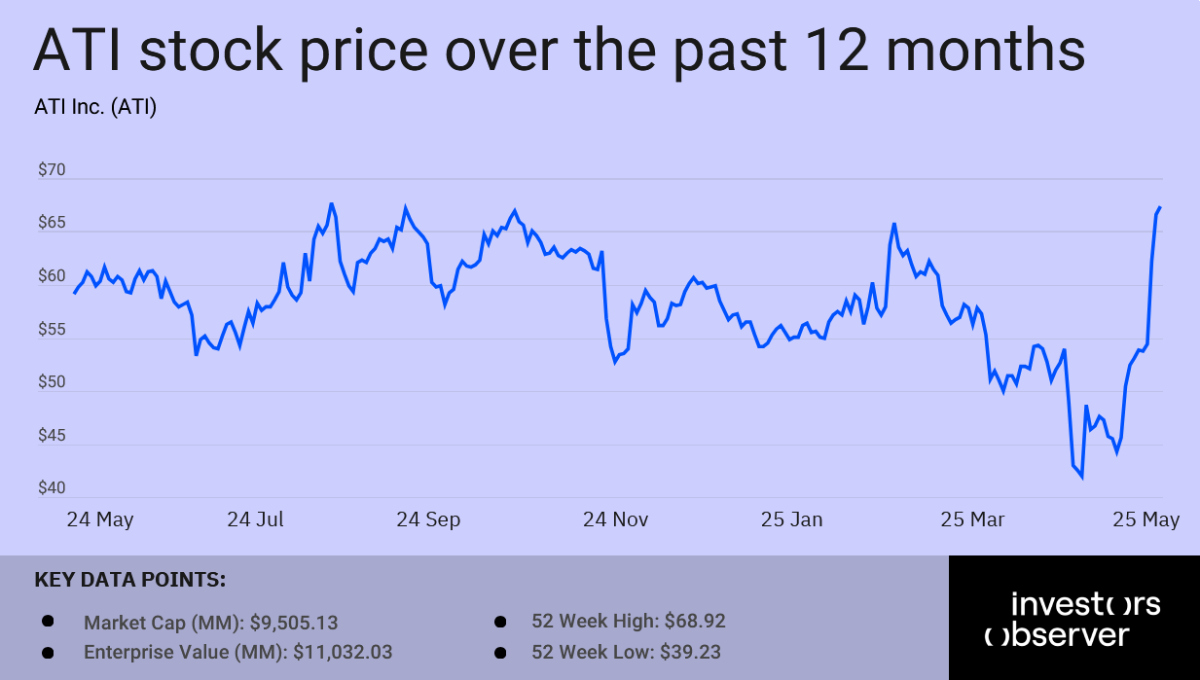

The stock is up 22.4% this year and has climbed nearly 16% over the past 12 months.

Your email address will not be published. Required fields are markedmarked