Satellite communications company AST SpaceMobile (ASTS) has had an eventful week following its inclusion in the Russell 1000 Index - a key benchmark for U.S. large-cap stocks. However, its addition to the index became a classic “sell-the-news” moment, sending ASTS shares lower.

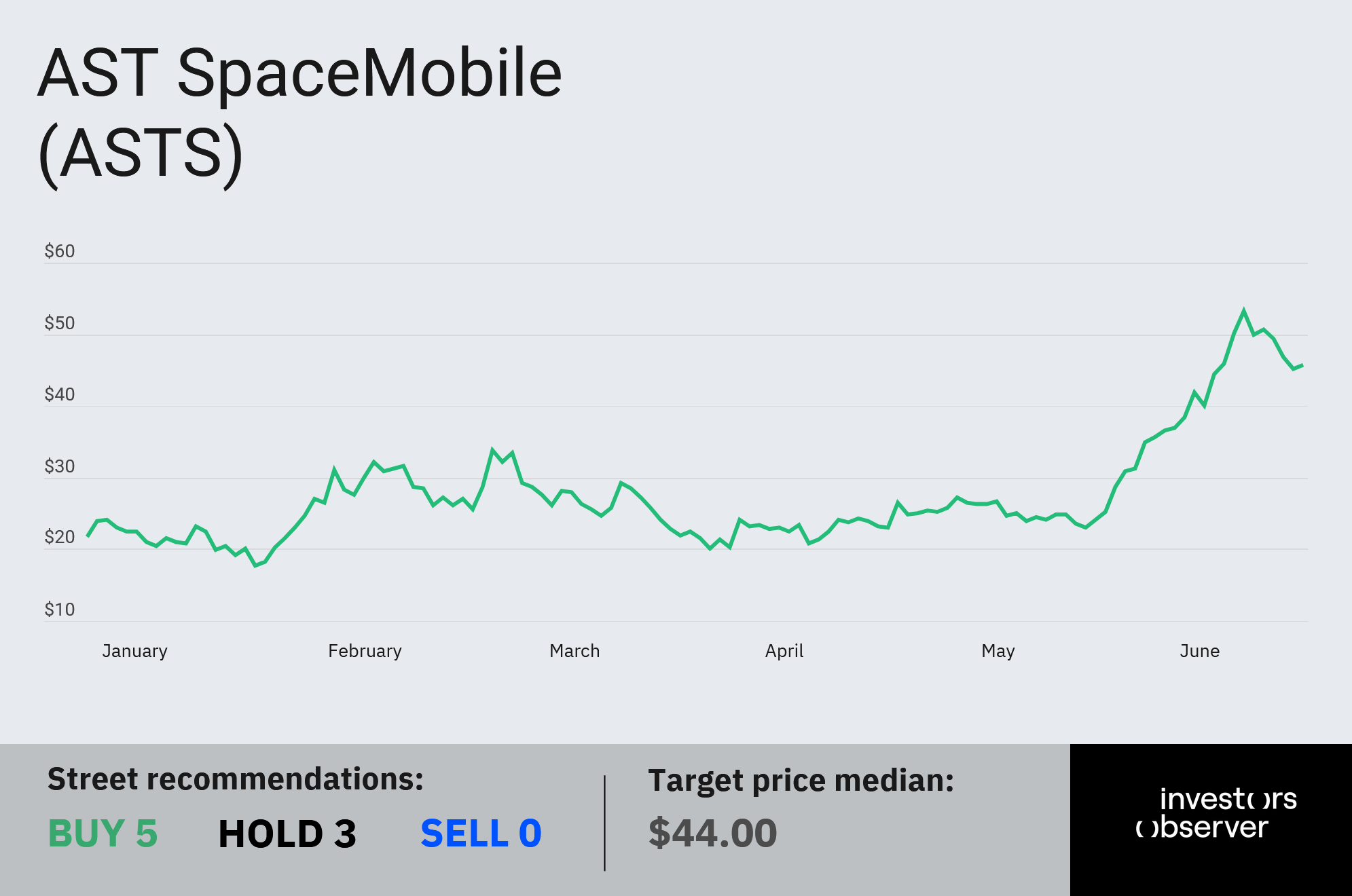

ASTS stock surged to record highs last week, closing at $53.22 on June 24, buoyed by the anticipation of its high-profile Russell inclusion, which had been announced earlier in the month.

Yet since June 27 — the day it officially joined the Russell 1000 — ASTS shares have fallen more than 8%, now trading around $45.

Still, context is key: the pullback appears to be mostly profit-taking after ASTS’s remarkable rally of over 100% since the start of 2025.

At its current price, the company has a market capitalization of more than $15 billion, making it one of the fastest-growing names on Wall Street.

AST SpaceMobile has come a long way since its founding in 2017 as AST & Science LLC.

Ironically, its meteoric rise has been driven less by strong underlying fundamentals and more by investor hopes that it will become a leader in the emerging cellular broadband-from-space market.

As Investors Observer noted, the reelection of U.S. President Donald Trump — who has pledged to expand private opportunities in the space industry — has also added fuel to the optimism around ASTS.

“A clear leader in the race”

So far, AST SpaceMobile’s actual business performance has been anything but meteoric. In 2024, the company generated just $4.42 million in revenue — a decline from the previous two years, according to MarketBeat data — while its net loss widened compared to the year before.

However, traditional financial metrics aren’t what attract investors to AST SpaceMobile.

The company operates at the forefront of the direct-to-device satellite market, which IDC Research expects to grow by nearly 400% over the next four years, from $554 million in 2025 to $2.27 billion in 2029.

ASTS is poised to be “the clear leader in the race,” according to Mike Crawford, an analyst at B. Riley.

Although satellite connectivity isn’t a winner-take-all market, Crawford argues it’s hard to bet against ASTS given its expanding international partnerships and mission to bridge internet coverage gaps in emerging markets.

As Investors Observer reported, AST SpaceMobile recently partnered with one of India’s largest telecom companies to connect unmodified smartphones directly to the internet.

Industry research estimates that India still has over 650 million people without internet access, highlighting the massive growth potential ahead.

Your email address will not be published. Required fields are markedmarked