Shares of AST SpaceMobile (ASTS) soared last week after the satellite communications company announced a new partnership with one of India’s largest telecom providers, opening the door to potentially billions of new users.

AST SpaceMobile is developing satellite technology to deliver uninterrupted 5G cellular broadband coverage directly from space. Its satellite constellation aims to connect unmodified smartphones to the internet, even in remote areas with no traditional cell service.

The company scored a significant win by partnering with Vodafone Idea, a major telecom provider based in Gandhinagar, India. Through this collaboration, Vodafone Idea customers will gain access to AST’s satellite network in regions with limited or no coverage.

Crucially, the deal enables AST to provide 4G and 5G access directly from space, helping to bridge connectivity gaps across underserved areas.

India, with more than 1.1 billion mobile subscribers, has one of the world’s largest mobile user bases. Yet rural regions still suffer from poor connectivity.

According to Statista, India has the highest number of people without internet access - an estimated 651.6 million. That’s more than double the second-largest offline population, China, which has 311.9 million people without internet.

“India, with its vast and dynamic telecom market, is the ideal place to demonstrate how our space-based cellular broadband can seamlessly complement terrestrial networks,” said Chris Ivory, AST SpaceMobile’s chief commercial officer.

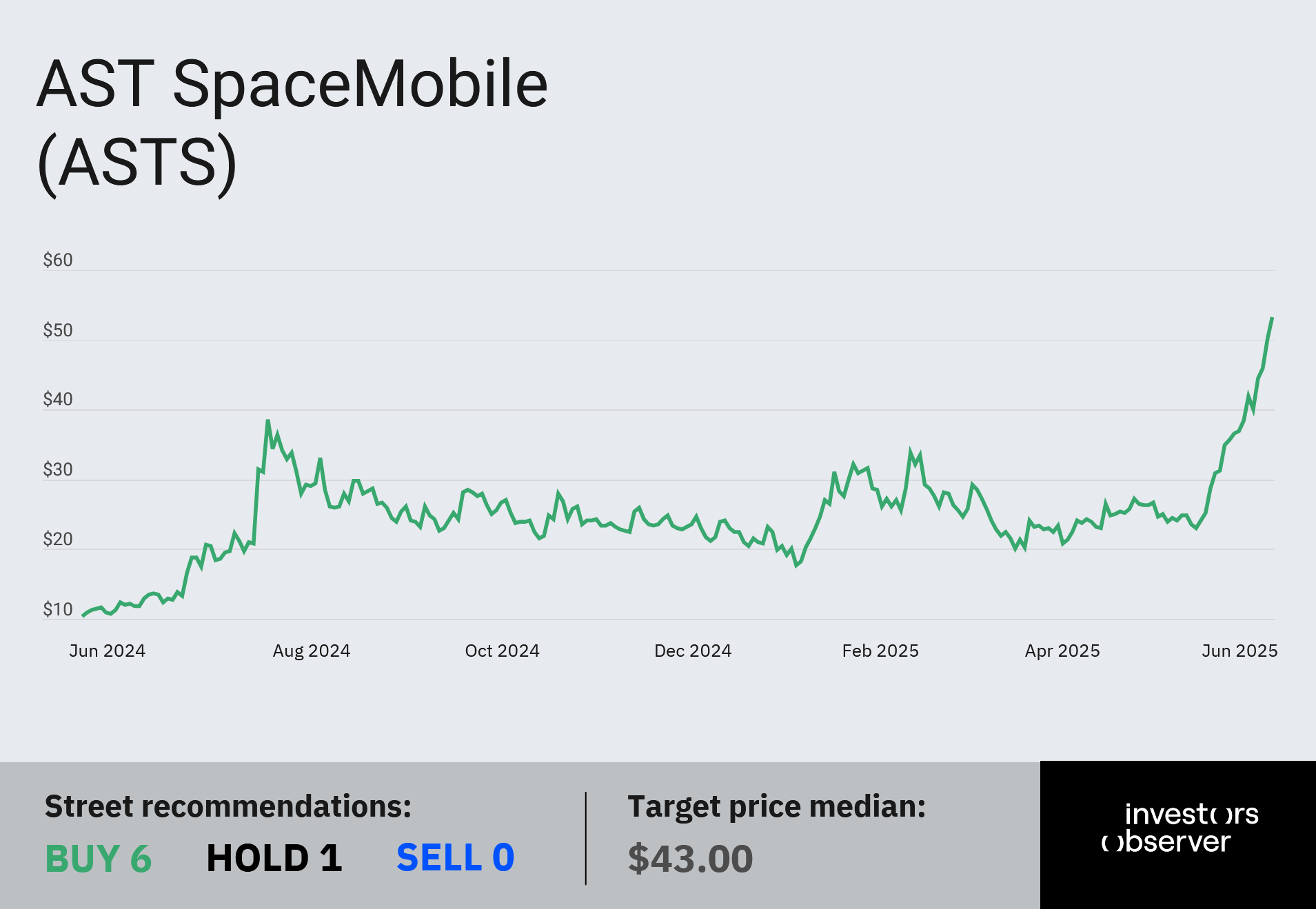

ASTS stock rallies to an all-time high

AST SpaceMobile’s share price surged more than 26% last week, closing Friday at an all-time high of $45.94. The stock has rallied 112% year-to-date and is up 355% over the past 12 months.

At its current valuation, the company boasts a market capitalization of $15 billion.

ASTS has significantly outperformed the Russell 2000 Index, a small-cap benchmark it joined in 2023. While the Russell 2000 is down 5.5% so far this year and up just 4% over the past 12 months, ASTS has delivered much stronger returns.

As a high-growth company, AST SpaceMobile is not yet profitable. In the first quarter, it reported a net loss of $0.20 per share, better than analysts expected. However, revenue came in at $7.18 million, falling short of analysts’ expectations.

On a more positive note, the company strengthened its balance sheet, boosting cash reserves to $874.5 million, up from $567.5 million in the previous quarter.

Looking ahead, AST SpaceMobile told shareholders it expects revenue to ramp up in the second half of the year, with full-year revenue projected between $50 million and $75 million.

Your email address will not be published. Required fields are markedmarked