Shares of Arm Holdings (ARM) have rebounded sharply from their April lows, driven by a broad recovery in both the semiconductor sector and the wider stock market. Analysts at Mizuho believe the company is well-positioned to benefit from several sector-specific growth catalysts in the near term.

In a recent note, Mizuho reiterated its “Outperform” rating on ARM stock and raised its price target to $180 from $160, implying about 16% upside from current levels.

This upgrade aligns with a similar move by Guggenheim, which recently boosted its price target by 27% to $187 per share, citing growing optimism and heightened expectations for the company.

Mizuho analysts highlighted multiple drivers for Arm’s growth, including revenue from Cobalt, its collaboration with OpenAI on Project Stargate, a potential CPU partnership with Meta Platforms, and SoftBank’s acquisitions of AI chip companies Ampere and Graphcore, which could add around 1,500 engineers to Arm’s CPU development efforts.

Cobalt refers to the Azure Cobalt 100, Microsoft’s first-generation, Arm-based processor, with revenues expected to grow 100% year-over-year in 2025.

SoftBank’s acquisitions are significant for Arm, as the venture capital firm still controls about 90% of the company following its 2023 IPO.

Mizuho’s sentiment remains “strongly positive,” calling Arm a “key AI enabler,” underpinned by growing cloud market share, strategic partnerships, and long-term innovation in chip design.

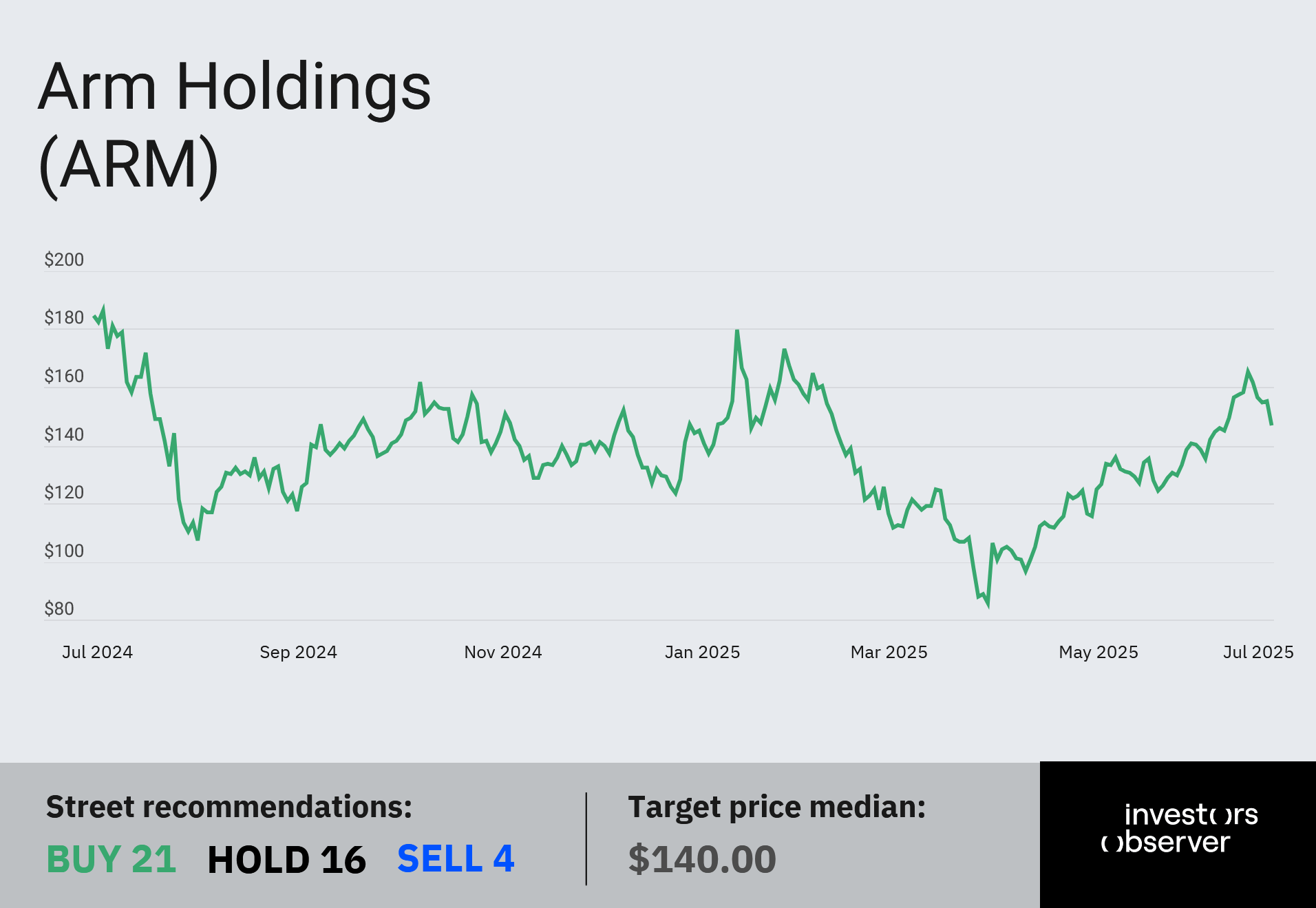

ARM stock rebounds from April low, but valuations are high

Like other semiconductor plays, ARM shares were hit hard by President Trump’s “Liberation Day” tariff announcement on April 2.

The stock eventually bottomed around $86 per share on April 8 before staging a strong relief rally.

As of Friday’s close, ARM was trading just above $155 per share, giving the company a market capitalization of about $164 billion. The stock has surged 80% from its tariff-driven lows but remains roughly 20% below its 52-week high.

However, Arm Holdings trades at about 208 times current earnings and 86 times forward earnings.

Its valuation also appears stretched when looking at its price-to-sales ratio - a measure of how much investors are paying for each dollar of revenue generated per share.

Arm recently reported a strong fiscal fourth quarter, beating estimates on both earnings and revenue. However, the company lowered its revenue outlook for its first fiscal quarter, targeting sales of between $1 billion and $1.1 billion, below the average analyst expectations.

The company attributed the downward revision to economic uncertainty, potential tariff impacts, and possible delays in licensing deals.

Your email address will not be published. Required fields are markedmarked