Shares of Arm Holdings (ARM) dropped last week after the chip designer issued a softer-than-expected forecast for the current quarter. But behind the dip is a company quietly riding the AI boom.

Investors sold off the stock even after Arm beat earnings and revenue expectations for its fiscal fourth quarter.

The market instead focused on its Q1 revenue guidance of $1.0 to $1.1 billion, just shy of analysts’ $1.1 billion estimate. The company cited tariffs as the main drag.

Zooming out, however, the company nailed a record-setting year.

“It was a record year for us: $4 billion in revenue, our first billion-dollar quarter, with records on both royalties and licensing,” said CEO Rene Haas.

He added that Arm’s future is increasingly tied to AI.

“70% of the world’s population uses Arm,” Haas said, listing devices from phones to cars to data centers. “All those devices are now running some level of AI workload, whether it’s training or inference.”

Unique business model

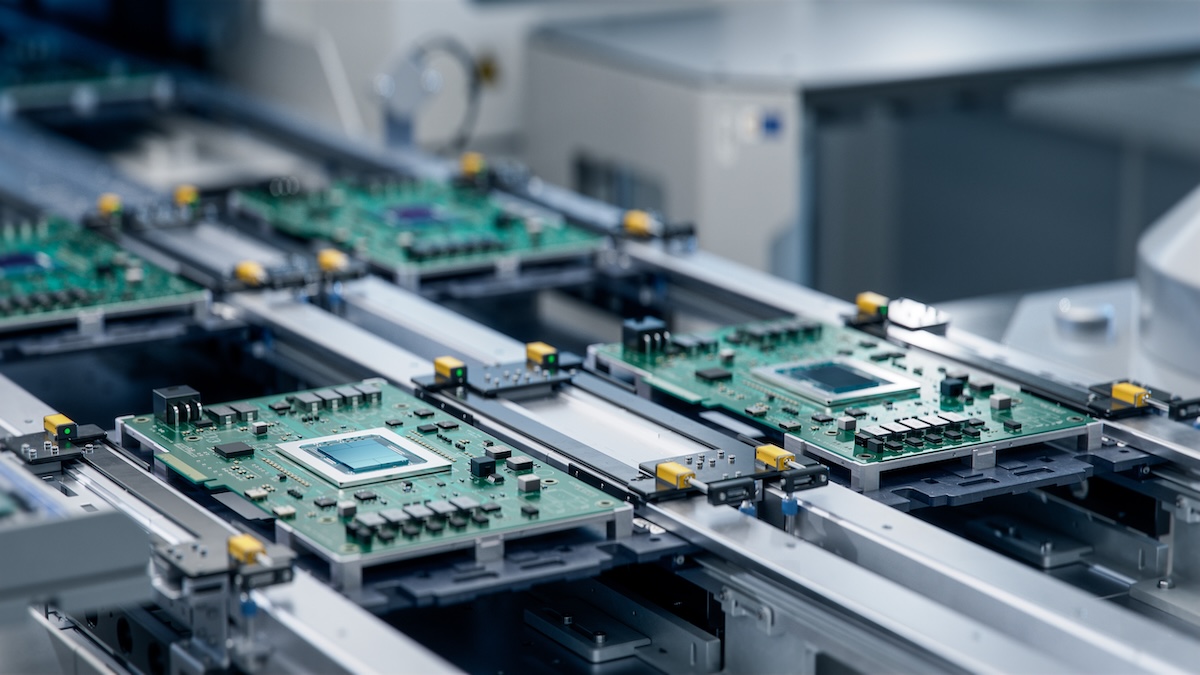

Arm’s unique business model — designing chips and collecting royalties on every device they go into — gives it broad exposure to AI without the heavy cost of manufacturing.

That’s one reason analysts still consider it a top AI play.

It’s also gaining ground on traditional rivals. According to Citigroup, which cited Mercury Research data, Arm grew its share of the microprocessor market to 13.6% in Q1, taking business from Intel (INTC) and AMD (AMD).

The company could also benefit from stronger U.S.-Saudi Arabia ties, as major customer Nvidia (NVDA) plans to send 18,000 AI chips to the kingdom, many of which use Arm-based designs.

Valuation and rebound

After falling more than 20% from its January peak, ARM stock has rebounded 29% in the past month.

The bounce tracks with easing U.S.-China trade tensions, which helped push the Nasdaq back into bull market territory.

Arm shares now trade around $133, giving the company a $141 billion market cap. The stock is up 14% over the past year and in the green for 2025.

That said, the stock isn’t cheap. Arm trades at a forward P/E ratio of 71, well above industry averages. But if AI demand keeps accelerating — and Arm keeps collecting royalties — investors may be willing to pay that premium.

Your email address will not be published. Required fields are markedmarked