Archer Aviation (ACHR) stock dropped more than 15% on Friday, but the company says the sell-off was a calculated trade-off to strengthen its position ahead of President Trump’s renewed push for electric vertical takeoff and landing (eVTOL) technology.

The crash followed news that Archer had sold $850 million worth of stock to bulk up its balance sheet ahead of the White House’s upcoming eVTOL pilot program.

Following the raise, Archer announced it had secured roughly $2 billion in liquidity, a self-described “fortress balance sheet” to fuel its engineering, certification, and commercialization efforts.

The funds will also help finance the company’s air taxi rollout, which is expected to debut at the 2028 Summer Olympics in Los Angeles.

“We now have the strongest balance sheet in the sector and the resources we need to execute both here in the U.S. and abroad,” Archer CEO Adam Goldstein said.

In response to the Archer gambit, ACHR shares dropped as much as 17% intraday Friday, with trading volume more than double the daily average.

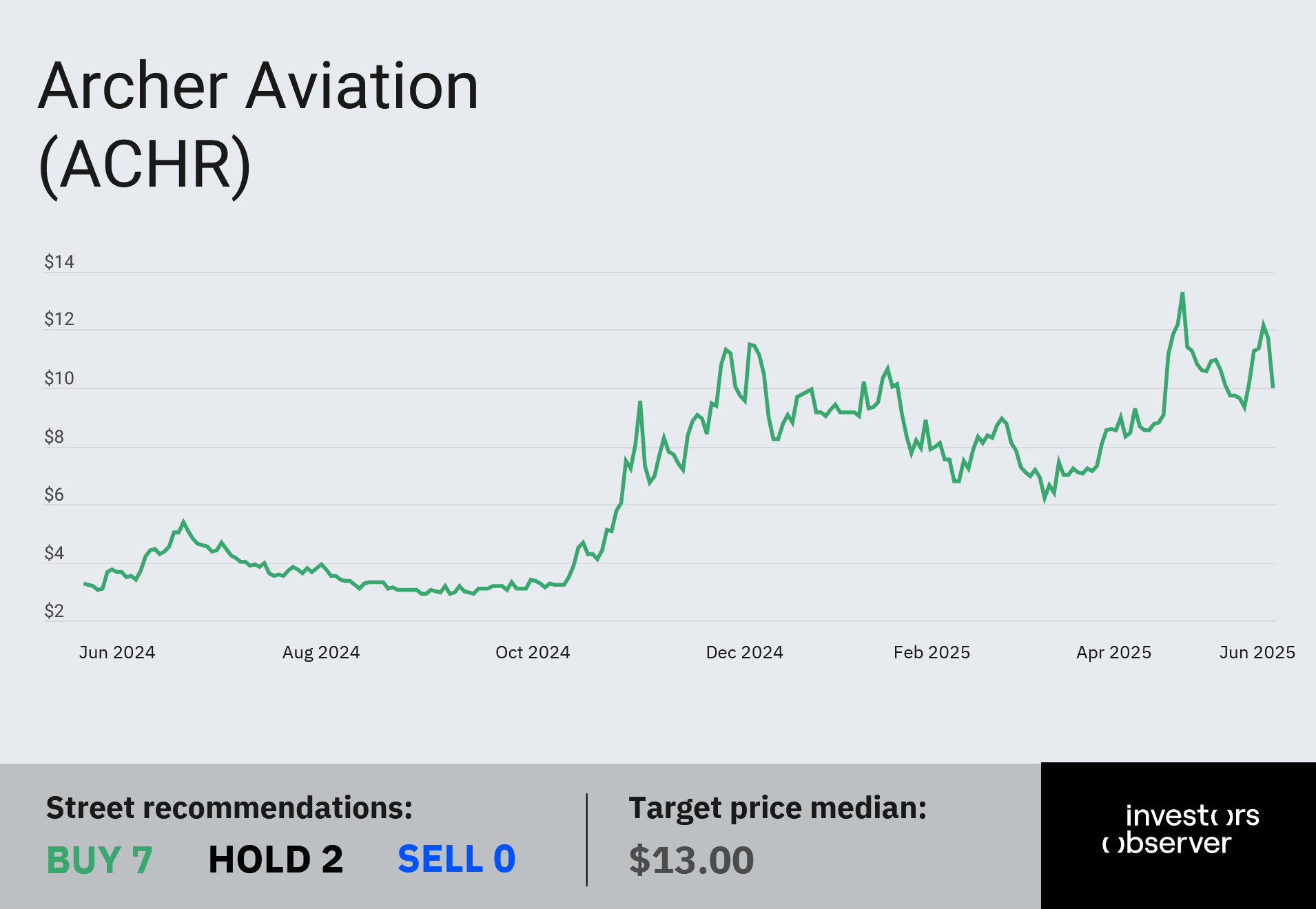

The dip knocked Archer’s 2025 gains down to 4.2%, though the stock remains up 210% over the past year. Archer currently carries a market capitalization of $5.6 billion.

🚁 Betting on the sky

Some analysts have compared Archer to a “culty” stock because the company has a multibillion-dollar valuation despite producing no revenue to date.

The company trades more on belief than fundamentals, with investors betting that urban air mobility will become a reality within a few years.

That futuristic faith is backed in part by Archer’s strategic partnership with Palantir, aimed at injecting advanced AI into its flight systems.

The company is also expanding into defense, working with ADRL to develop hybrid electric aircraft for U.S. and allied forces.

In the commercial sector, Archer is testing routes like a New York-to-airport air taxi service using its Midnight aircraft. The goal is to shrink multi-hour commutes to just 5 to 15 minutes.

But while the pitch is bold, the execution lags. Archer plans to begin delivering just two aircraft per month starting later this year.

In Q1, the company reported an adjusted loss of $109 million, with total operating expenses of $113.1 million, according to its latest financials.

Even so, Archer’s leadership insists the recent selloff is a bump on the road, not the end of the runway.

Your email address will not be published. Required fields are markedmarked