When Applied Digital (APLD) reported its earnings in April, the outlook was bleak to say the least.

Revenue had dropped 22% from the same period last year, operating income missed expectations, and its bread-and-butter hosting business was shrinking.

Even more unsettling for investors was the fact that Applied didn’t have a strong long-term vision.

The company revealed plans to ditch its cloud services altogether, pivoting instead toward becoming a real estate-style operator focused on renting out server space.

That shift came with a $900 million investment from Macquarie Asset Management to build out a new data center campus in Ellendale, North Dakota. But there was one glaring problem: no anchor tenant.

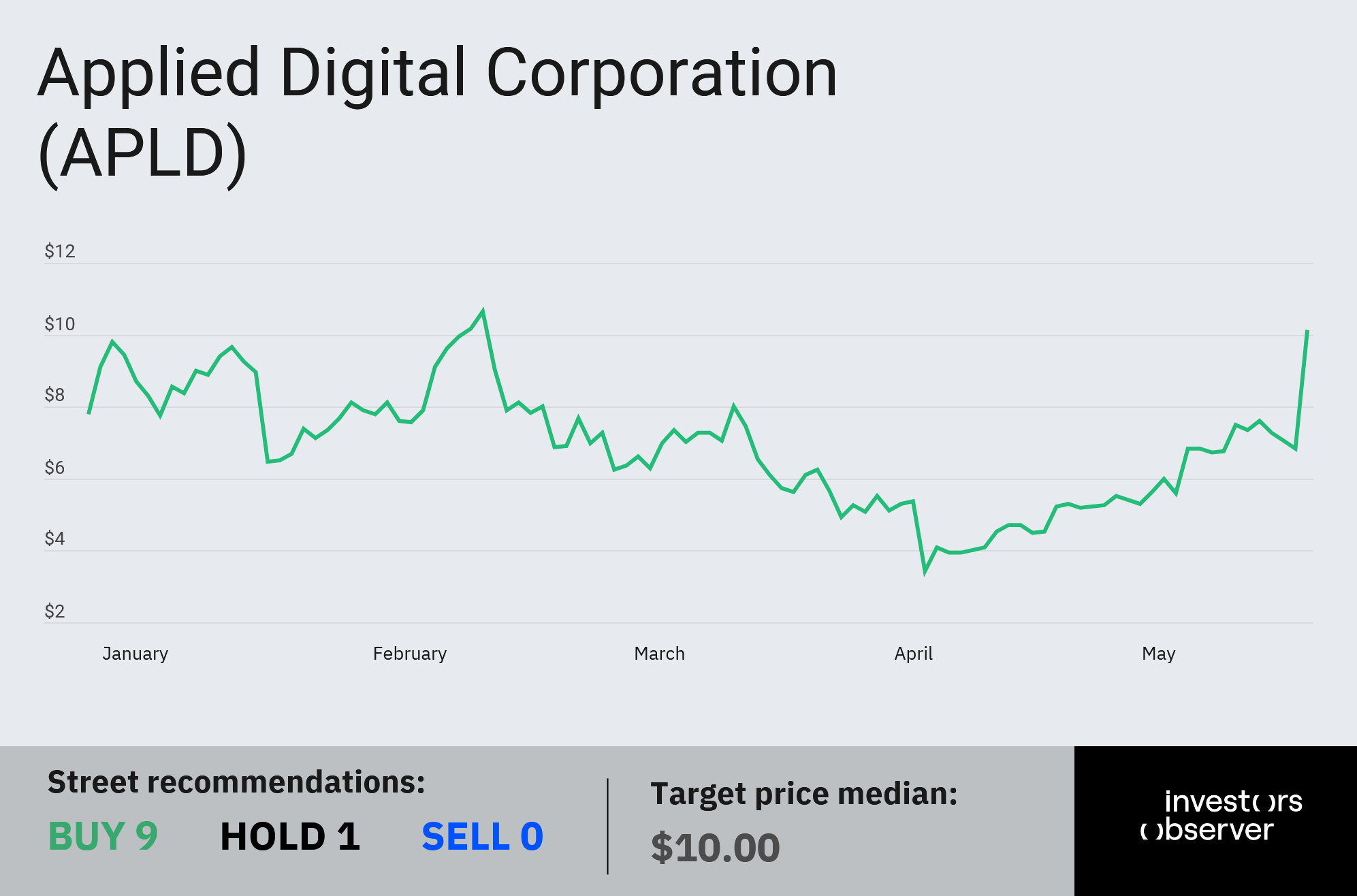

The lack of secured clients sent APLD’s stock plunging 36% after the April earnings call.

Now that narrative has flipped.

CoreWeave signs on for $7 billion in long-term leases

On Monday, Applied Digital announced it had inked two massive 15-year lease agreements with AI hyperscaler CoreWeave (CRWV).

Under the deal, Applied will deliver 250 megawatts (MW) of critical IT load to power CoreWeave’s AI and high-performance computing (HPC) infrastructure, all housed at the Ellendale campus.

The deal is expected to generate roughly $7 billion in total revenue over its lifetime.

“We believe these leases solidify Applied Digital’s position as an emerging provider of infrastructure critical to the next generation of artificial intelligence and high-performance computing,” Chairman and CEO Wes Cummins said in a statement.

Shares of APLD surged 48.5% on the news, bringing the stock up 33.5% year-to-date.

A data center built for AI-scale demand

Applied Digital said the first 100 MW building is slated to go live in Q4 2025. A second building, with 150 MW capacity, is expected to be operational by mid-2026.

CoreWeave also holds an option on a third building — another 150 MW — now in the planning stage for a 2027 launch.

The Ellendale facility was purpose-built for scale, with expansion plans up to 1 gigawatt, which is a key selling point for compute-heavy AI and HPC tenants.

“As demand for AI accelerates exponentially,” Cummins said, “we believe that we are uniquely positioned to deliver substantial returns while supporting the evolving and dynamic needs of these rapidly evolving sectors.”

After months of doubt, the CoreWeave lease gives Applied Digital exactly what it needed: validation of its pivot, revenue clarity for the next decade, and a second chance at growth.

A ‘ton of demand’ for AI data centers

While some analysts have started to question whether the AI data center boom is overhyped, Blackstone President and COO Jon Gray says what’s happening “in the trenches” is a very different story.

“There’s a disconnect between what’s being written and what’s actually happening,” Gray told CNBC last month. “Demand is strong.”

Blackstone has poured more than $100 billion into buying and financing AI data centers, making it the largest player in the space. According to Gray, the firm’s pipeline is up more than 25% from last year.

As for hyperscalers, “They’re spending 42% more this year than they did a year ago — $320 billion,” he said.

While he acknowledged that U.S. chip restrictions, especially those targeting China, could slow certain areas of growth, Gray sees little impact on the overall trajectory. “We still see a ton of demand for data centers,” he added.

If Gray’s right, Applied Digital’s CoreWeave deal may end up marking the start of another breakout growth story.

Your email address will not be published. Required fields are markedmarked