A trust representing creditors to the bankrupt AI startup Vesttoo has sued Aon (AON), the world's second-largest insurance broker, accusing the company of fraud over its marketing of an insurance product that was meant to help startups raise money.

The complaint centers around Aon’s Intellectual Property (IP) Capital Market Solution, which it launched in 2020, and that it marketed as a product that would “provide innovative growth companies with a path to non-dilutive growth capital,” while also preserving “the ownership and value for their founders and early investors.”

With this “IP-backed lending” solution, the insurer said it was using “proprietary IP valuation tools” to estimate how much a company’s intellectual property would be worth in a default, which allowed the startup to take out loans based on the value of its IP alongside its tangible assets.

The company would then pay an insurance premium based on that valuation.

However, the lawsuit claims that Aon’s collateral protection insurance (CPI) product “was flawed at its core and built on fraudulent representations of Aon’s capabilities and undisclosed conflicts of interest.”

It also alleges that Aon’s valuations of a startup’s IP were “abysmal” and “resulted in vastly inflated IP valuations, with the liquidation value of the IP proving to cover just a small fraction (if any) of the debt it was meant to secure.”

And despite the insurance broker’s estimation that only about 3% to 6% of the companies it worked with would default, the lawsuit says that borrowers “overwhelmingly” defaulted, which led lenders to attempt to cover their losses through the IP collateral.

The legal filing includes internal emails from Aon in which concerns were raised about its IP-backed product, noting that “pre-revenue borrowers are not well suited to CPI [collateral protection insurance] loans.”

Aon’s concerns stemmed from the fact that it was “incredibly difficult to project the value of the IP” for a startup that has yet to generate any revenue.

Israeli-based Vesttoo had a valuation as high as $1 billion in 2022 – achieving so-called “unicorn” status – and was backed by Goldman Sachs.

The company filed for bankruptcy in 2023, and an internal investigation found that two senior executives for the startup had allegedly created fraudulent letters of credit when taking out the insurance policies.

But the lawsuit claims that “Aon disregarded glaring warning signs regarding a scheme orchestrated by a small group of co-conspirators” – including Vesttoo’s own senior leaders – to produce forged letters of credit.

A spokesperson for Aon called the lawsuit “a perverse attempt by Vesttoo’s bankruptcy estate to shift responsibility for Vesttoo’s deliberate fraud to Aon, one of the fraud’s biggest victims.”

“Vesttoo has already acknowledged in its own investigative report that executives of the company, along with other co-conspirators, were responsible for the fraud and intentionally sought to mislead Aon and other impacted parties,” the spokesperson added. “We will vigorously defend Aon against these meritless claims.”

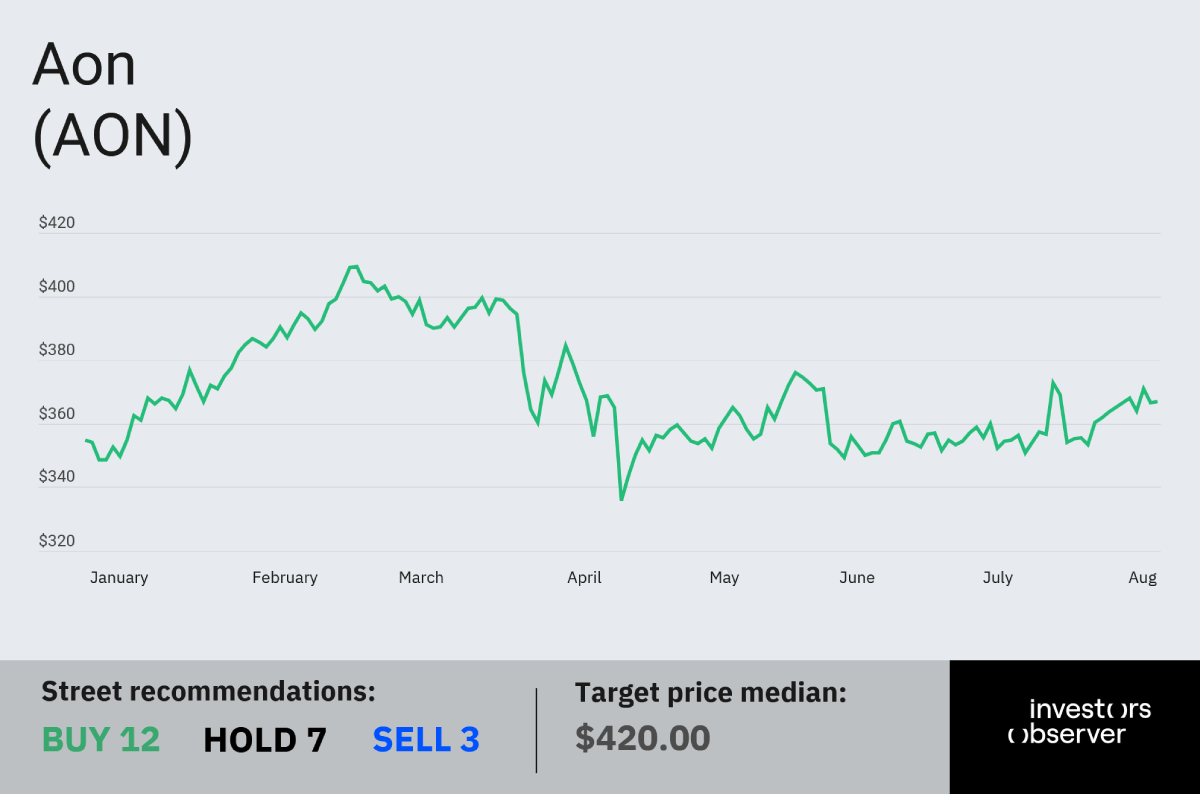

Aon’s stock is up 2% YTD.

Your email address will not be published. Required fields are markedmarked