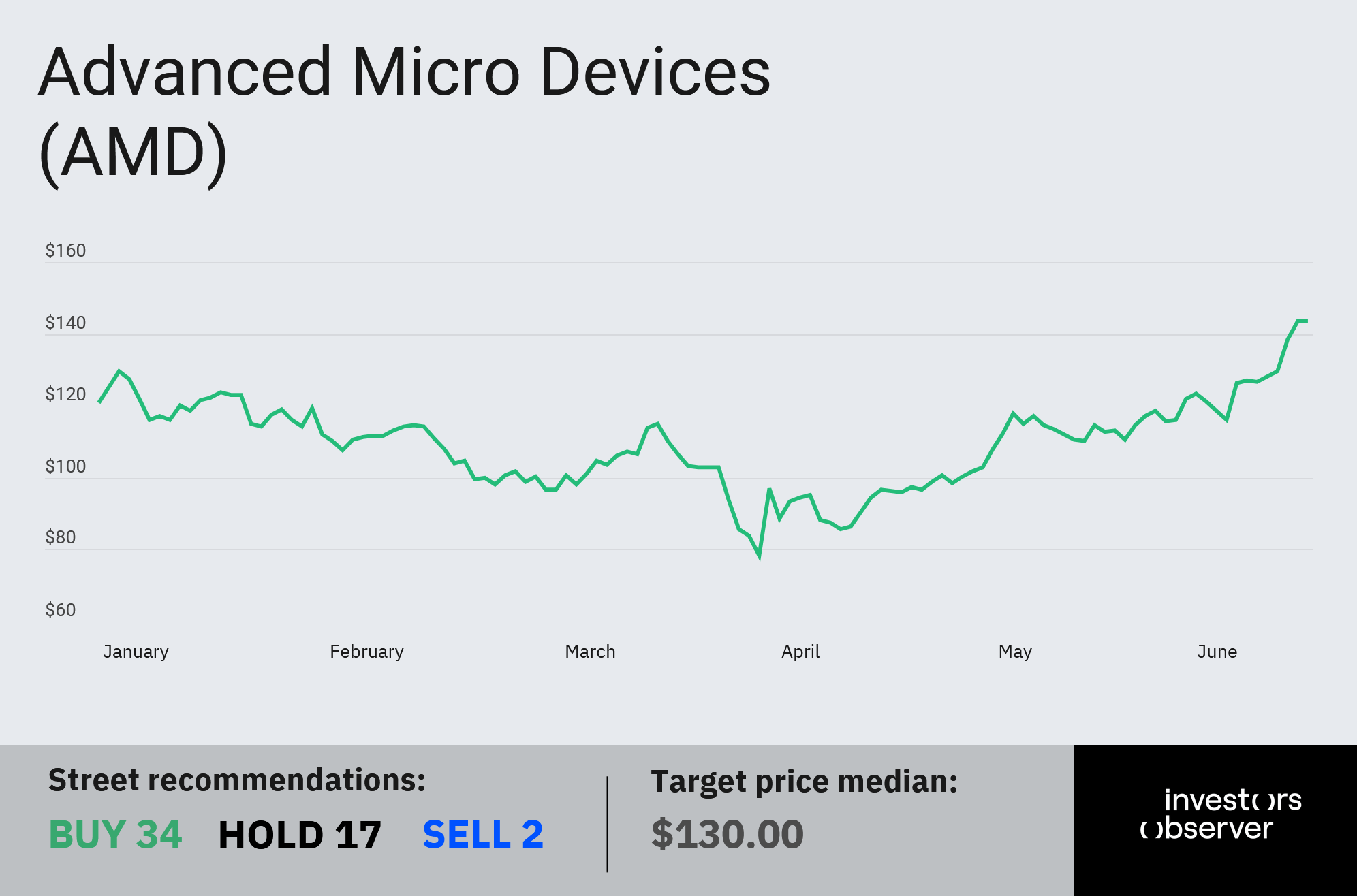

Shares of Advanced Micro Devices (AMD) have surged over the past month, and according to one closely followed trader, the rally may just be getting started.

In a recent post, Mike Investing — known for calling AMD’s rebound when it was trading below $80 — highlighted a bullish technical setup that mirrors the stock’s explosive run in 2023. That year, AMD soared from $100 to $230 in a matter of weeks.

Now, with AMD closing at $143.68 on Thursday, the analyst sees the potential for a rally to $250 in the second half of 2025, representing a 75% upside from current levels.

Year-to-date, AMD stock is up more than 19%, with most of the gains concentrated in recent weeks.

Beyond technicals, AMD’s bullish case is underpinned by robust business growth. In the first quarter, revenue from its data center segment surged 57% year-over-year, underscoring growing demand for the company’s AI and server chips.

AMD’s data center business is now valued at $3.7 billion, driven by strong demand for its EPYC CPUs and Instinct GPUs.

Companywide, AMD generated $7.4 billion in revenue during the quarter, with net income totaling $709 million.

In addition to its strong business fundamentals, AMD is benefiting from a sector-wide boost in semiconductors due to easing geopolitical tensions.

AMD stock has more room to grow, analysts say

Analysts at Melius Research believe AMD’s rally is just beginning, raising their price target by 56% to $211 per share, citing the company’s strengthening position in the AI landscape and GPU technology.

Analysts at TD Cowen and UBS were more measured in their outlook but maintained their “Buy” ratings on AMD stock.

Although AMD shares have been riding high for the past month, gains have accelerated over the past five days, rising 11% over that period. This is no coincidence, as it coincided with news of a ceasefire agreement between Iran and Israel.

Semiconductor stocks are particularly sensitive to geopolitical tensions due to their complex, global supply chains. The ceasefire — brokered by the Trump administration — eased concerns about potential disruptions and rising costs, providing a tailwind for the sector.

The next major catalyst for AMD could come in early August when the company releases its second-quarter earnings report.

AMD’s management said it expects revenues to be approximately $7.4 billion in the second quarter, with a gross margin of approximately $800 million.

Your email address will not be published. Required fields are markedmarked