One day after sliding on news of President Trump’s executive order targeting clean energy tax credits, shares of AES Corporation (AES) staged a stunning rebound.

The stock surged nearly 20% yesterday on reports of takeover interest from major infrastructure giants.

According to Bloomberg, AES is exploring strategic options, including a potential sale, after drawing interest from both Brookfield Asset Management and BlackRock’s Global Infrastructure Partners unit.

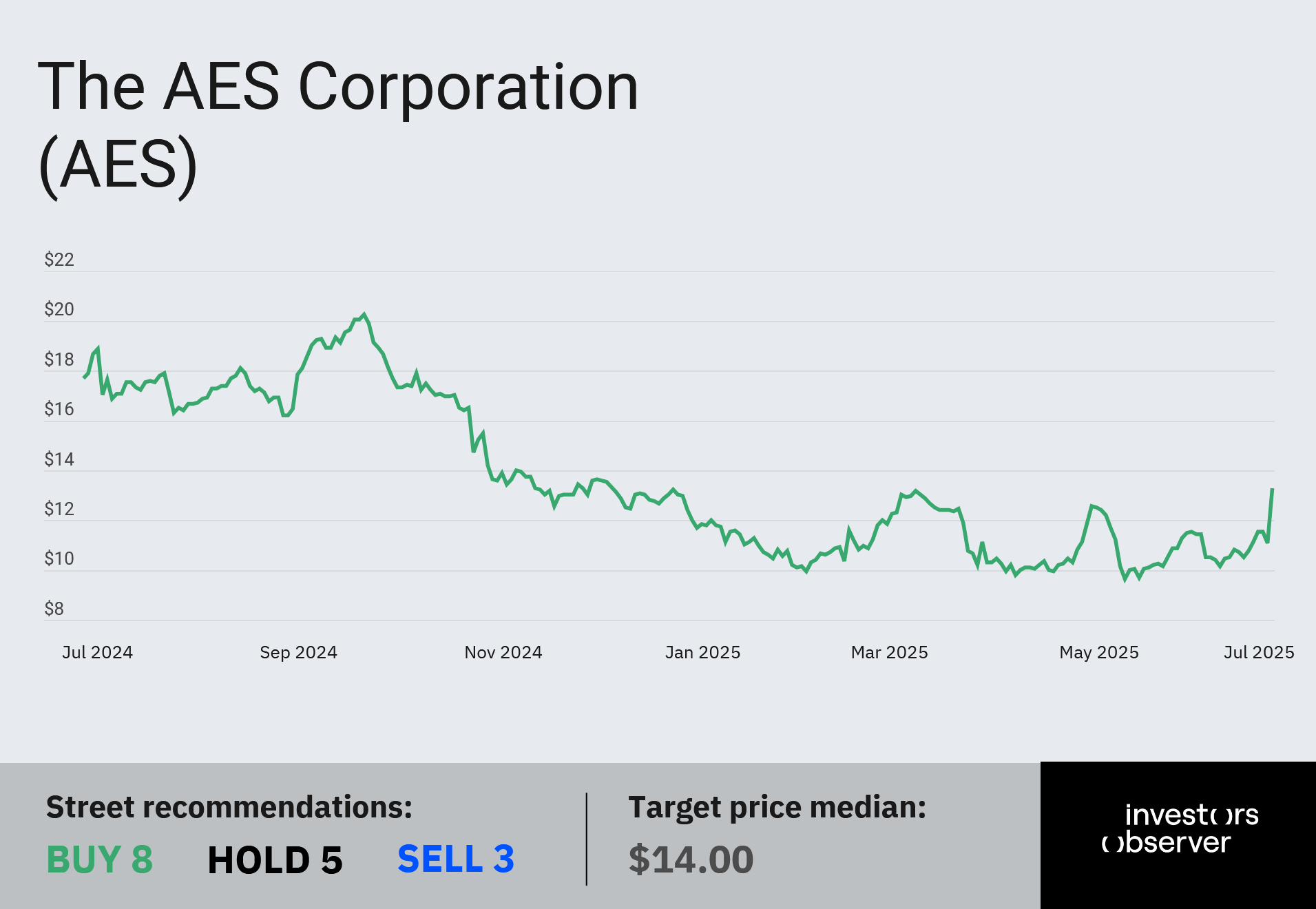

Despite losing over 60% of its value since late 2022, AES still commands a $9.4 billion market cap and carries an enterprise value near $40 billion.

That’s a level that would make any leveraged buyout one of the largest in infrastructure history.

“We understand the buyer interest here as AES stock trades at a fairly significant discount and has remained relatively suppressed over the past few years,” analysts at CreditSights wrote in a research note.

Why buyers are circling now

The renewed interest in AES comes just as the Trump administration moves to dismantle clean energy tax incentives carried over from the Biden era.

Although that’s a blow to wind and solar stocks, AES may be better positioned than many of its peers.

The company has secured long-term renewable energy deals with some of the biggest names in tech, including Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), and Amazon (AMZN).

All of them are ramping up their demand for clean power to run AI data centers.

In May, AES announced two long-term PPAs with Meta to deliver 650 megawatts of solar power for data centers in Texas and Kansas.

And just last month, it completed the first phase of what is expected to become the largest solar-plus-storage project in the U.S., built under a 15-year agreement with Amazon.

The catch: Debt

A deal for AES won’t be easy.

The company’s debt load stands at 7.3 times adjusted EBITDA, a level Jeffries analysts Julien Dumoulin-Smith and Paul Zimbardo flagged as a “significant hurdle” in a note Wednesday.

AES shares have fallen 63% from their December 2022 highs and are down 25% over the past year. But after Wednesday’s surge, the stock is now up 3% year-to-date.

Your email address will not be published. Required fields are markedmarked