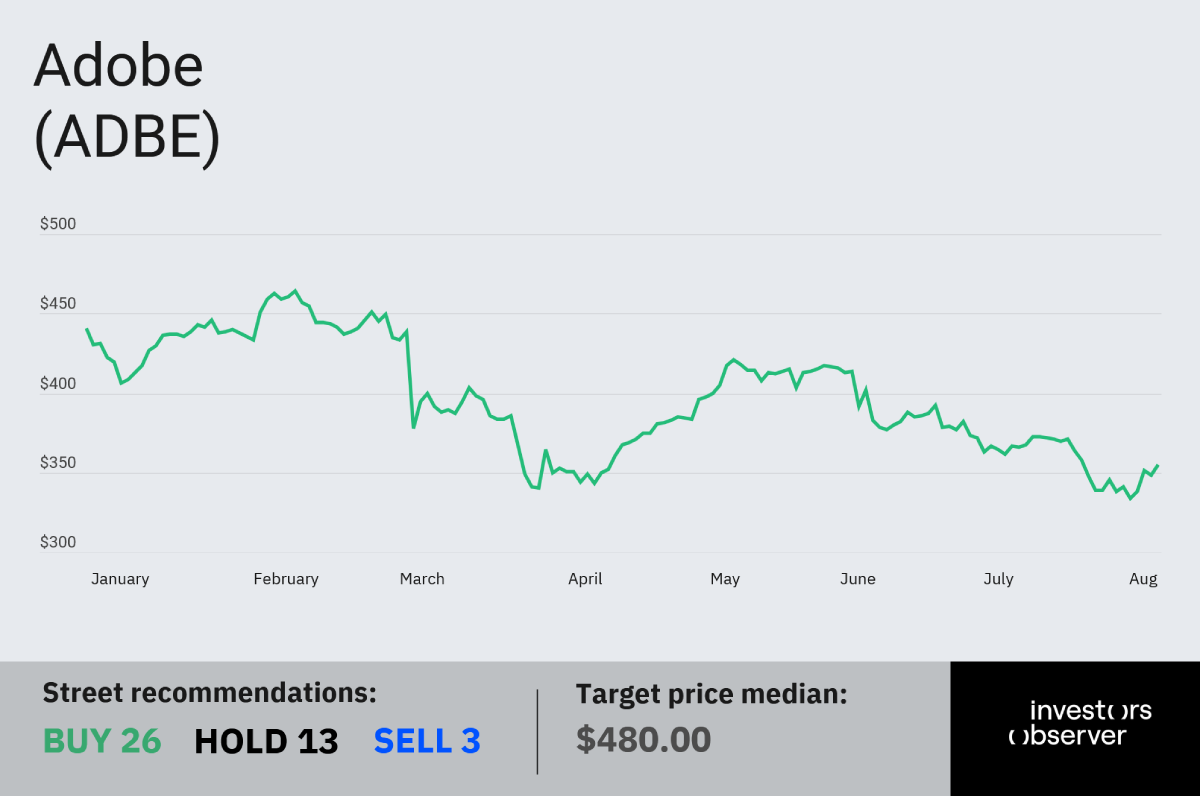

On paper, Adobe’s (ADBE) business looks as strong as ever, with rising revenue and a healthy cash position prompting an upgrade to its full-year growth forecast. However, investors remain unconvinced - selling ADBE shares heavily throughout the year and driving the stock down 22% year to date.

The drop might have been steeper if not for Adobe’s aggressive share buybacks, a strategy that can help support the stock price in the short term.

According to Fiscal.ai, the company has repurchased more than $12 billion worth of its own shares over the past 12 months - about 8.3% of its current market capitalization and the highest level in at least two decades.

Adobe has now bought back more than $12 billion in shares over the last 12 months.

undefined Fiscal.ai (formerly FinChat) (@fiscal_ai) August 13, 2025

That's equivalent to 8.3% of its current market cap.$ADBE pic.twitter.com/le6oNSfGpI

Analysts say the buybacks reflect Adobe’s effort to leverage its strong balance sheet, which includes roughly $5.7 billion in cash and short-term investments and relatively low long-term debt. That’s down from $7.4 billion the previous quarter, partly due to the share repurchases.

The buybacks may also be bolstering Adobe’s per-share earnings, which climbed to $3.95 in the second quarter from $3.50 a year earlier. Quarterly revenue reached $5.87 billion, up 11% year over year.

Despite stronger financial ratios, steady revenue growth, and confident forecasts from management, Adobe shares have struggled to attract buyers, even amid a resurgent bull market.

In a market crowded with flashy newcomers and high-flying AI plays, the company risks appearing outdated and too slow to reinvent itself.

Adobe’s latest downgrade

Earlier this month, Adobe shares were hit with another downgrade - this time from Melius Research, which cut its price target by more than 22%, according to Investors Observer.

Melius pointed to the growing narrative that “AI is eating software” and questioned Adobe’s ability to adapt.

Rothschild & Co. Redburn analyst Omar Sheikh also cut his price target for Adobe by 33% and downgraded the stock to a “Sell” rating, citing similar reasons as Melius.

Still, not all analysts see the company as an AI laggard. D.A. Davidson’s Gil Luria argued the stock’s weakness is driven more by “a misunderstanding of the technology” than by any real inability to compete.

Interestingly, Adobe isn’t without a clear AI strategy. The company has embedded generative and agentic AI across its product suite, particularly within its cloud services. In June, PwC even highlighted Adobe as an example of how AI is “reinventing business models.”

Even so, the company currently lacks a compelling growth story - a challenge made sharper by mounting competition from both direct and indirect rivals, including Figma, Canva, Midjourney, Veo, and others.

Your email address will not be published. Required fields are markedmarked