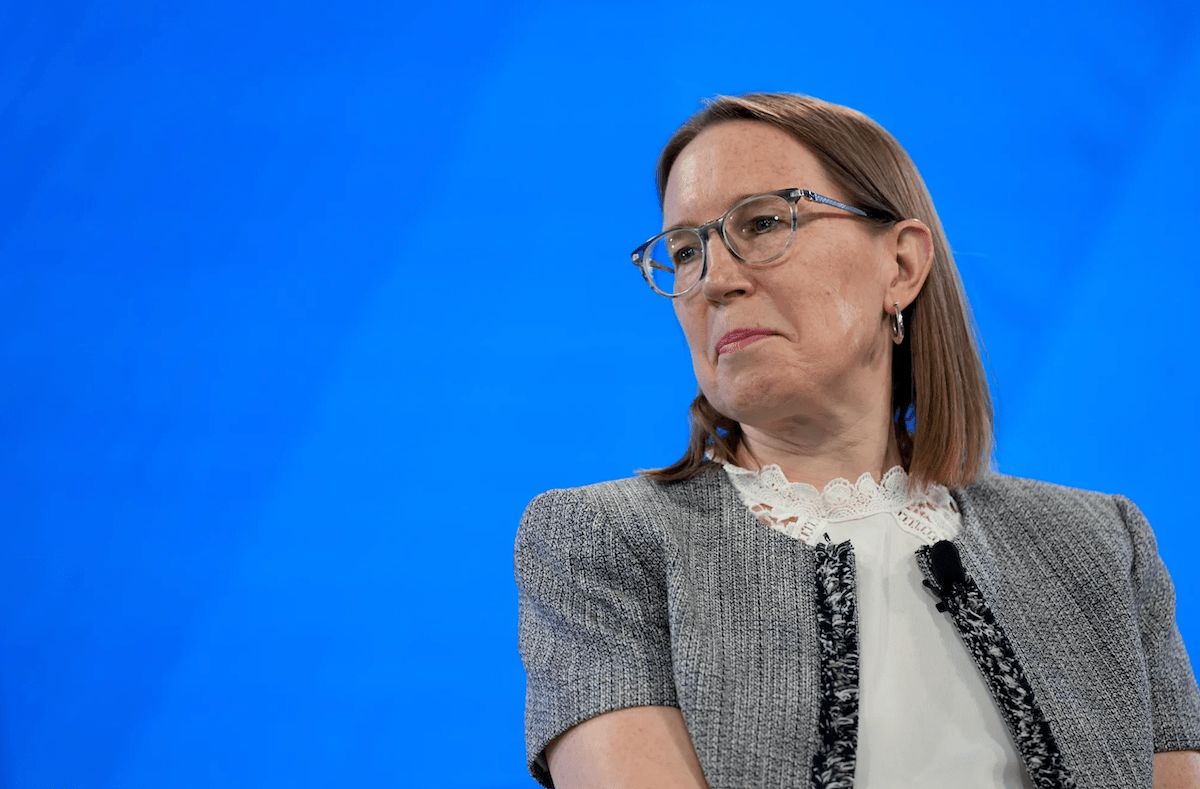

The SEC’s friendlier tone toward crypto lately might feel like vindication for Commissioner Hester Peirce, a longtime critic of the agency’s past hardline stance.

Even during Gary Gensler’s more combative tenure, Peirce stood apart from her colleagues with a steady defense of the industry.

Her consistent pushback earned her the “crypto mom” nickname from crypto insiders.

But while she’s defended the industry’s right to exist, Peirce isn’t exactly a crypto bull in the vein of Cathie Wood or Michael Saylor.

Her objections have always come from a free-market perspective, not because she’s all-in on Bitcoin.

“I come from the perspective of being ‘Let’s not jump to regulation as our first solution,’” Peirce told Axios in 2023.

That mindset has put her in ideological alignment with many crypto founders, even if she supports regulatory guardrails, especially when investor protection is at stake.

And this week, she made that clear again.

In a new statement widely interpreted as a warning shot at Robinhood (HOOD), Peirce sounded the alarm over the company’s plan to roll out "stock tokens."

In short, those are tokenized blockchain contracts that track a company’s stock price without actually offering ownership of the shares.

Unveiled by Robinhood CEO Vlad Tenev at a flashy event in the French Riviera, the tokens would even offer access to private companies, though some of those companies aren’t thrilled about being included.

Currently, the offering is limited to investors in the EU. But Peirce’s comments suggest she’s bracing for a potential U.S. rollout and laying down a legal marker in advance.

“As powerful as blockchain technology is, it does not have magical abilities to transform the nature of the underlying asset,” Peirce wrote.

“Tokenized securities are still securities. Accordingly, market participants must consider — and adhere to — the federal securities laws when transacting in these instruments.”

She went on to clarify that while some issuers tokenize their own shares for blockchain trading, others might issue new tokenized contracts based on securities they simply hold — introducing a host of counterparty risks for investors.

“Purchasers of these third-party tokens may face unique risks,” Peirce said.

The bottom line is that even crypto’s biggest ally inside the SEC has limits, especially when financial engineering starts looking like regulatory arbitrage.

Your email address will not be published. Required fields are markedmarked