President Trump’s sweeping tariffs may have rattled markets, but the real economic fallout is likely still ahead, analysts say.

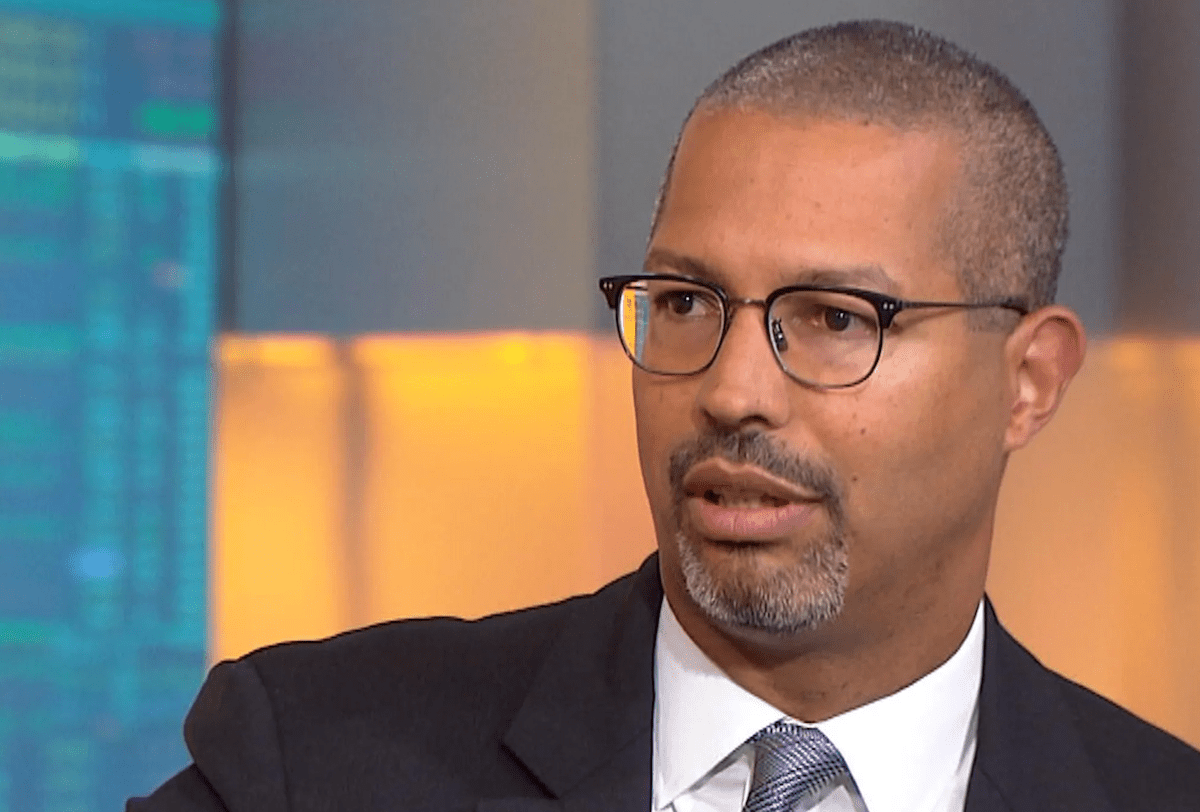

Speaking on the “Thoughts on the Market” podcast, Morgan Stanley’s chief global economist Seth Carpenter said that Trump’s uneven rollout of tariffs has delayed the damage.

“Tariffs have gone up, tariffs have gone down, tariffs have been suspended,” he said, describing what he called a chaotic policy cycle that has made it harder for the effects to show up in headline growth numbers.

But Carpenter made it clear that this delay doesn’t mean the impact won’t be felt and its likley coming with all force in the second half of 2025.

Tariffs aren’t the only problem. According to Carpenter, immigration policy is an often overlooked factor that will also weigh heavily on economic growth going forward.

Morgan Stanley’s warning lands just weeks after a better-than-expected Q1 earnings season.

While much of corporate America posted strong results, many companies withheld guidance, effectively glossing over the uncertainty and looming costs tied to tariffs.

Inflation up, growth down

While other countries have responded to U.S. tariffs with some of their own, Carpenter said the scale is vastly different and it’s the U.S. economy that will bear the brunt of Trump's tariffs.

“These policies are inflationary and they slow growth,” he explained. “The tariff scope from the White House is much broader than anything we’ve seen from U.S. trading partners.”

Meanwhile, immigration reform compounds tariffs by limiting labor force growth. “If the labor force grows more slowly, the economy grows more slowly,” Carpenter said.

If America sneezes, he added, the rest of the world will likely catch the flu. “We see weak growth in Europe and another year of underperformance in Asia.”

Although Trump’s trade strategy has sparked fears of retaliation, Carpenter expects a long-term policy path defined by “persistent, notable” tariffs on China, and relatively lower tariffs elsewhere.

Fed stuck in the middle

In the U.S., economic fallout will likely come in two stages: first inflation, then a slowdown.

“Both of those go in the wrong direction for the Fed,” Carpenter said. “But it’s the second — the growth slowdown and weakening labor market — that will ultimately get the Fed’s attention.”

So far, the central bank isn’t blinking. Despite President Trump calling on Fed Chair Jerome Powell to cut interest rates “sooner rather than later,” Fed officials have held the line.

“The Fed is not coming to the rescue,” said Schwab’s chief fixed income strategist Kathy Jones in a recent commentary.

“There have been a lot of speeches and interviews from Fed officials over the past few weeks. Each has reiterated the view that policy is on hold for a while, so expectations for Fed rate cuts this year have declined.”

Carpenter agrees. “The Fed is going to wait for hard data,” he said. “A real deterioration in the labor market is the key trigger.”

Your email address will not be published. Required fields are markedmarked