Unlike the selloff that followed President Trump’s “Liberation Day” tariffs back in April, markets have so far kept their cool despite escalating tensions between Israel and Iran.

But with the economy now facing dual pressure — one geopolitical, one macroeconomic — the question is whether that confidence holds up.

Part of the market’s calm reflects the fact that multiple regional conflicts are already ongoing, with the wars in Ukraine and Gaza largely contained.

For now, many expect the Israel-Iran conflict to follow a similar pattern, avoiding a broader global spillover.

But unlike those other conflicts, this one sits directly atop one of the world’s most critical energy chokepoints.

All eyes on the Strait of Hormuz

A prolonged conflict raises the specter of Iran blocking the Strait of Hormuz, which carries roughly 20% of global oil supply.

Despite that risk, oil prices have remained surprisingly low. Crude prices have climbed slightly in recent days but remain well off highs seen earlier this year.

But not everyone is convinced markets are pricing this correctly. In a note this week, PVM oil broker John Evans warned that a “blanket of unease” hangs over the energy markets.

“We're settling into a world where missile exchanges are becoming routine, but the cynicism hasn’t fully taken hold yet because of how easily this could escalate,” Evans wrote.

The biggest escalation risk remains U.S. involvement, which President Trump has repeatedly hinted at.

“Listing the roll call of ‘what ifs’ should the U.S. get involved would run several pages and could be outdated before this note even hits inboxes,” Evans added.

Bulls betting on global oil supply holding up

Despite the geopolitical jitters, some analysts argue global oil supply may be robust enough to absorb even a worst-case scenario.

Neil Crosby of Sparta Commodities told Bloomberg that Western military forces could move quickly to reopen Hormuz if necessary.

Saudi Arabia exports roughly 5 million barrels per day through Hormuz, but Crosby notes that its East-West crude pipeline was specifically built for this scenario, allowing oil to flow through the Red Sea if necessary.

That infrastructure could rapidly shift much of Saudi’s supply westward, minimizing global disruption.

Meanwhile, the U.S. itself has become far less dependent on foreign oil.

As Kingsview Investment Management pointed out, American oil production hit a record 13.5 million barrels per day, making the U.S. the world’s largest oil and gas producer.

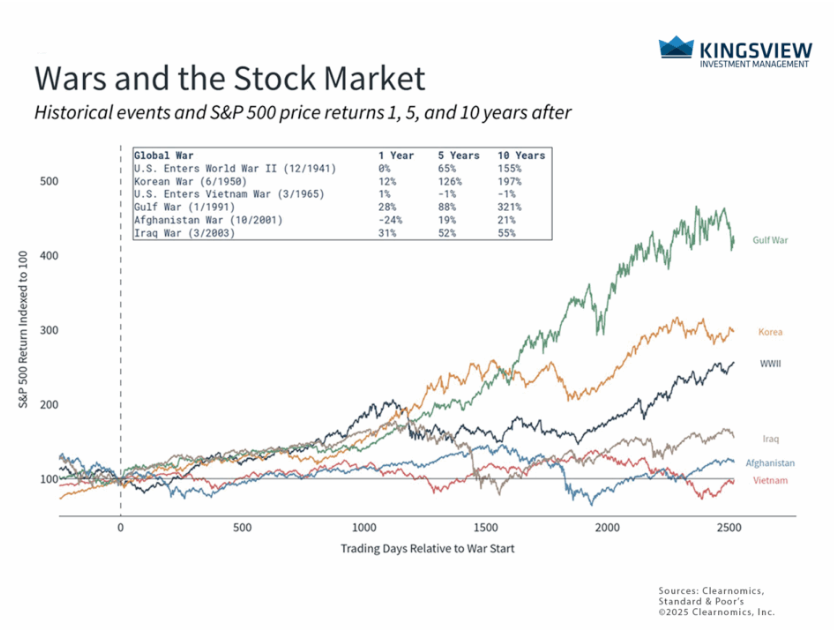

On the equity side, historical data suggests markets tend to digest geopolitical shocks quickly.

Deutsche Bank’s Jim Reid told Bloomberg the S&P 500 typically drops around 6% in the three weeks following a geopolitical shock only to fully recover within the next three weeks.

Kingsview seconds that view, writing that while conflicts can rattle markets in the short term, fundamentals ultimately take over.

In other word, a short-term market pullback could offer another buying opportunity if history repeats itself.

"A bad shock at an already fragile time"

While equity and oil markets remain mostly unfazed, some economists warn the global economy may not be as resilient.

Writing in the Financial Times, Mohamed El-Erian, former Pimco CEO and president of Queens College, called the conflict “a bad shock for the global economy at an already fragile time.”

“Central banks will now need to intensify their vigilance on inflation,” El-Erian wrote. “That makes it less likely we’ll see earlier or larger rate cuts in response to any slowdown.”

The Federal Reserve on Wednesday held rates steady, with Fed Chair Jerome Powell saying the central bank needs to assess the full impact of Trump’s tariffs before making moves.

Trump, who has repeatedly demanded rate cuts since launching his trade war, lashed out at Powell again, calling him “a stupid person.”

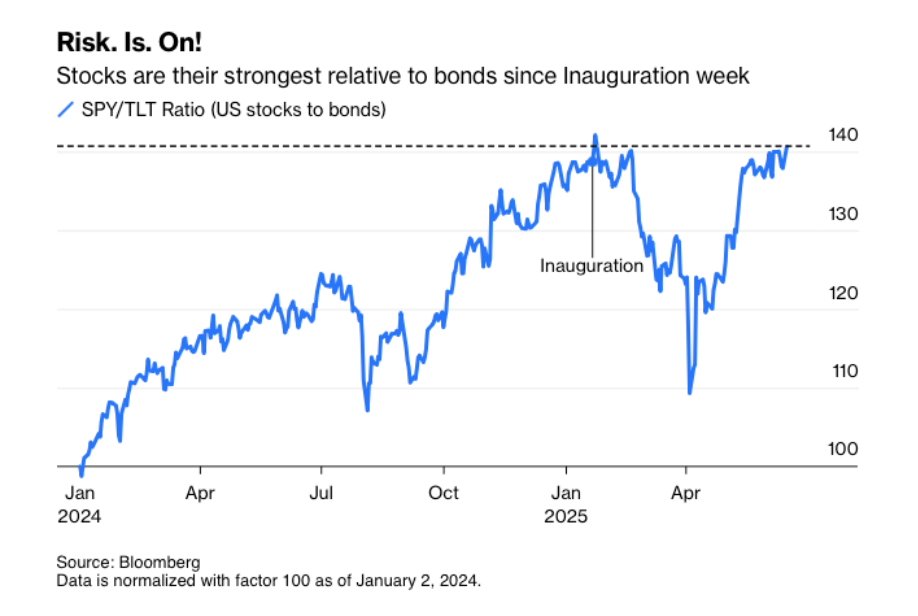

Despite Powell’s caution, stocks bounced while Treasury yields climbed on Monday, a classic risk-on move that defied the geopolitical backdrop.

But El-Erian sees longer-term risks mounting, warning that the “erosion of the U.S.-led global economic order” is accelerating.

He argues that as the dollar and Treasuries lose their safe-haven status, countries will increasingly focus on self-reliance over international coordination, undermining global economic efficiency.

Even so, Kingsview advises investors not to overreact.

“Even significant regional conflicts like this one between Israel and Iran are unlikely to cause lasting harm to global markets,” they wrote.

“Staying aligned with long-term financial goals remains the best approach during periods of geopolitical uncertainty.”

Your email address will not be published. Required fields are markedmarked