Although SoundHound (SOUN) fell short of Wall Street’s revenue expectations last week, the voice recognition startup reported record growth and said it’s well-positioned for what comes next.

The company reported $29.13 million in first-quarter revenue, up 151% year-over-year, its highest quarterly total to date. That number came in just shy of the $30.46 million analysts had projected.

But earnings were much better than expected. Instead of losing 8 cents per share like analysts predicted, SoundHound made 31 cents per share.

The company reaffirmed its full-year revenue forecast of $157 million to $177 million. At the midpoint, that would mark 97% growth over 2024, when SoundHound’s revenue rose 85% to $84.7 million.

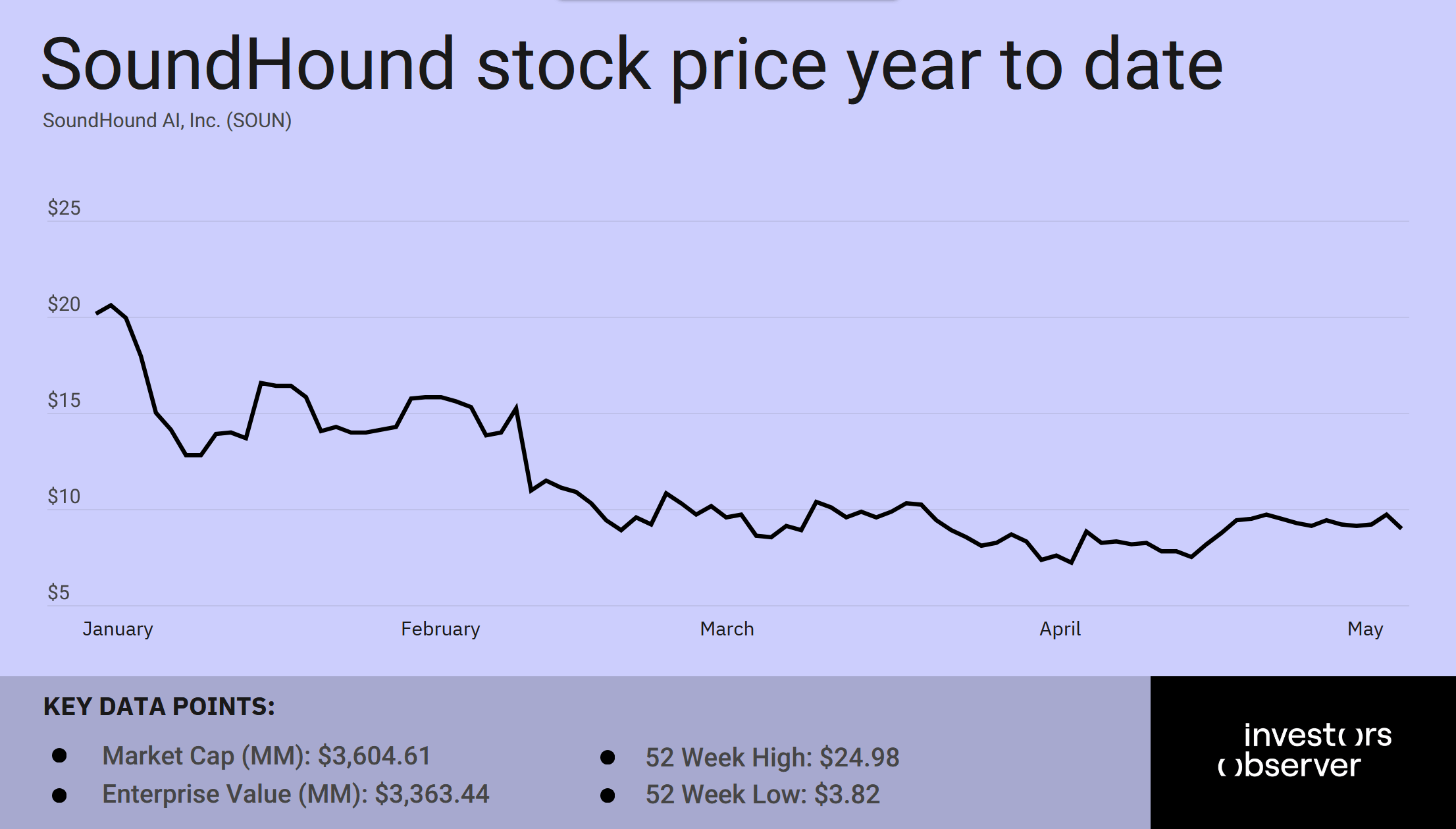

Wall Street hasn't been impressed so far. The stock crashed nearly 8% after the earnings miss and is down 54.2% year-to-date.

Growth potential and diversified customer base

On the earnings call, CEO and co-founder Keyvan Mohajer emphasized the company’s progress in scaling its AI platform.

SoundHound now supports 30 languages at what Mohajer called a “mature” level, which he says opens the door to faster international expansion — particularly in customer service applications.

“AI performance continues to improve exponentially,” Mohajer said. “Systems are also becoming more affordable and accessible… The cost of adoption is being driven further down.”

One positive for investors is that no single customer made up more than 10% of SoundHound’s revenue in Q1, which eliminates the risk of customer concentration.

“Enterprise investment is rapidly on the rise with no business wishing to be left behind the pace of change,” Mohajer said. “We are seeing more use cases move from the lab to real life across industries.”

SoundHound’s customer base now includes firms across automotive, restaurants, retail, and healthcare.

CFO Nitesh Sharan said the automotive sector — once 80% of SoundHound’s business — now accounts for a “low double-digit” percentage of revenue.

He acknowledged “relative softness” in auto due to macroeconomic uncertainty tied to President Trump’s tariffs but said the company remains optimistic about long-term growth.

Mohajer added that SoundHound sees demand from restaurants regardless of economic conditions.

“When the economy is good, people invest in innovation. That brings them to us,” he said. “When it’s challenging, they want automation and cost savings. That also brings them to us.”

In a March interview with Schwab Network, Mohajer said AI customer service tools will soon be as fundamental to business as internet access or electricity.

“So you start your business, and you sign up for the internet, you sign up for electricity, and you sign up for AI customer service,” he said. “And we build solutions for businesses of all sizes.”

Your email address will not be published. Required fields are markedmarked