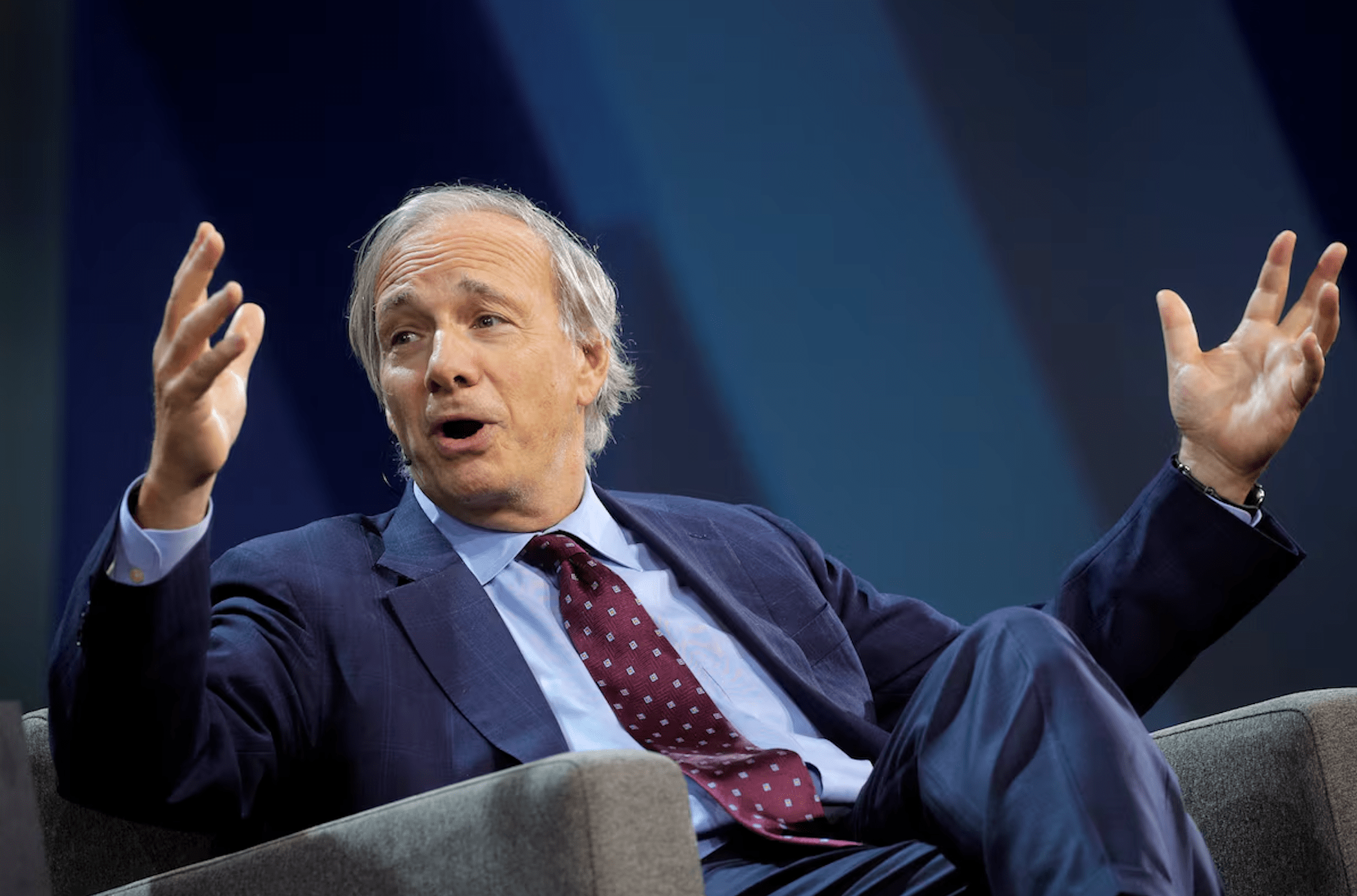

U.S. housing prices may be hitting record highs, but billionaire investor and Bridgewater Associates founder Ray Dalio says now isn’t the time to chase the market.

He warns real estate isn’t the wealth-building machine it used to be, especially when you factor in inflation.

"My view is that buying and holding real estate is not an effective investment strategy in our current economic environment," Dalio wrote in a recent social media post.

My view is that buying and holding real estate is not an effective investment strategy in our current economic environment, for a few reasons.

undefined Ray Dalio (@RayDalio) August 11, 2025

1) Real estate is more interest rate sensitive than it is inflation sensitive, so given our current circumstances it is likely to go… pic.twitter.com/AHMleaJcPj

He pointed to the sector’s vulnerability to interest rates and inflation: two forces that have disrupted markets since the Fed began its tightening cycle.

Dalio argued that while home values keep climbing in nominal terms, they’re losing ground once inflation is factored in. That means the “wealth effect” of rising housing prices may be more illusion than reality.

Another risk is political. Governments searching for new revenue sources are likely to keep leaning on property taxes, Dalio said. "It's a fixed asset that is easy to tax," he wrote.

Dalio also flagged a more structural disadvantage: real estate isn’t portable.

Unlike cash, equities, or digital assets, property locks up capital and makes it harder to reposition quickly in a global, digital-first economy.

Dalio built Bridgewater into the world’s largest hedge fund with a playbook focused on macro forces like debt cycles and inflation. That same framework now leads him to believe long-term property ownership isn’t the opportunity it once was.

Housing no longer a sure bet

Dalio’s skepticism is grounded in shifting consumer sentiment. A Gallup survey from October 2024 found that 76% of Americans believe housing in their community is becoming less affordable.

Younger generation in particular are questioning whether homeownership is even realistic, let alone the best investment.

That shift is showing up in where Americans say they’d rather put their money. Real estate still ranks first for long-term wealth building, but its margin has narrowed dramatically, according to Gallup.

Gold, not property, is now gaining favor as the safest long-term bet in an uncertain economy.

According to market strategist Charlie Bilello, U.S. home prices have climbed an average of 3.4% annually before inflation since 1891, but only 0.5% in real terms once inflation is included.

"Before 2000, we had never seen U.S. home prices outpace inflation by more than 30% on a cumulative basis," Bilello wrote.

Inflation remains the wild card. While the Consumer Price Index has cooled from its 2022 peak, July’s annual CPI still held at 2.7%, well above the Fed’s 2% target, according to the most recent BLS release.

For Dalio, that means real estate might still have cultural and emotional value, but as a pure investment, it looks less like a dream and more like dead weight in today’s markets.

Your email address will not be published. Required fields are markedmarked