President Trump scored a major legislative victory Wednesday night after the House passed his “one big, beautiful” tax-and-spend bill, overcoming pushback from fiscal hawks.

The bill cleared the House by the slimmest of margins, 215 to 214, with just five Republicans breaking ranks to vote alongside Democrats in opposition.

While it still has pass the Senate, Trump wasted no time taking a victory lap.

“Thank you to every Republican who voted YES on this Historic Bill!” he posted on Truth Social. “Now it’s time for our friends in the United States Senate to get to work, and send this Bill to my desk AS SOON AS POSSIBLE!”

But while the White House and House Speaker Mike Johnson celebrated, the bond market sent a very different message.

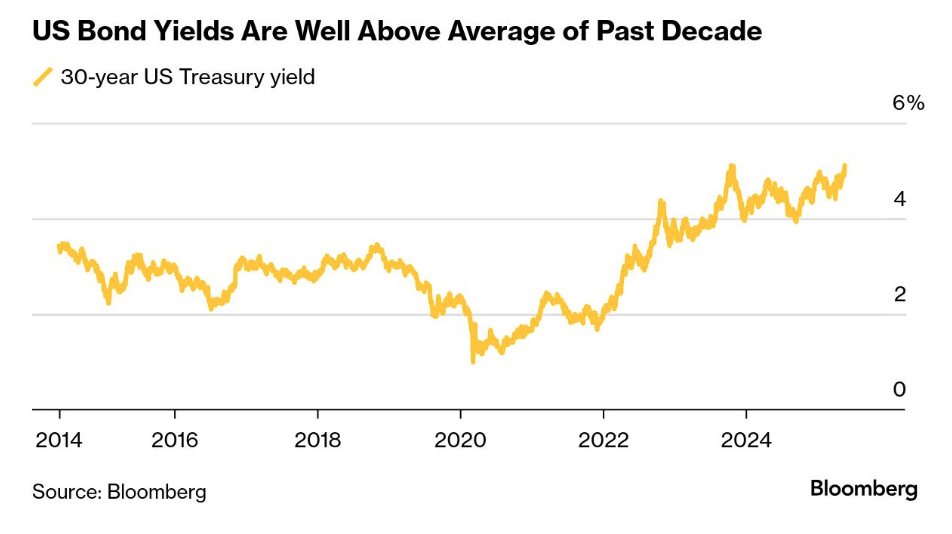

The 30-year Treasury yield crossed 5% on Wednesday, the highest level in 19 years, signalling that investors aren’t thrilled with Washington’s fiscal trajectory.

“What we think are the primary drivers of these higher Treasury yields is just the debt and deficit spending that’s coming out of Congress,” said Lawrence Gillum, chief fixed income strategist at LPL Financial.

“The big, beautiful bill is turning into something that the bond market, frankly, isn’t particularly excited about.”

Kathy Jones, chief fixed income strategist at the Schwab Center for Financial Research, seconded Gillum in a recent X post, noting that the bond market response says it all.

“Bond market's early response to House budget bill is negative with yields moving higher at the back end of the curve,” she wrote.

“The market is not yet feeling ‘yippee’ but the response is a resounding thumbs down.”

In a recent interview on the Schwab Network, Jones warned that investors are likely to demand higher risk premiums going forward, particularly as the supply of government bonds grows.

That’s not just due to Trump’s budget bill.

Jones pointed to a perfect storm of factors pushing yields higher, including trade wars, retreating globalization, and weakening demand from key foreign buyers.

“A lot of this is coming together all at once, and it’s just allowing yields to rise,” she said.

Trouble ahead for Treasury demand?

Foreign demand for U.S. debt has so far held up surprisingly well.

According to the Treasury Department, foreign holdings of U.S. government bonds hit a record $9.05 trillion in March, up $233 billion from the month prior. That’s a nearly 12% increase year-over-year.

But signs of drying demand are beginning to emerge.

A $16 billion auction for 20-year Treasuries on Wednesday was weaker than expected, which didn’t surprise Jones, given the recent yield spike. As of Thursday, 20-year yields stood at 5.1%, while the 10-year hovered at 4.6%.

Kelsey Berro, fixed income portfolio manager at JPMorgan Asset Management, told CNBC that investor concerns have shifted dramatically.

“The focus of bond investors has shifted from trade wars to deficit wars,” she said.

Berro said uncertainty over how the final Senate version of the bill will look is weighing on demand. Even if the current version doesn’t pass, investors are expecting more spending and more debt.

But while attention may have moved past the headline-grabbing tariff battles, Berro warned that their fiscal impact is still looming.

“I think another thing that people aren’t necessarily putting into their analysis is the impact of tariffs on the deficit and on growth,” she said.

According to the nonpartisan Congressional Budget Office, Trump’s budget proposal would add $3.8 trillion to the federal debt over the next 10 years, pushing the total beyond $40 trillion.

And as the deficit balloons, the Treasury Department will be forced to issue even more debt to keep the government running.

“There’s potential foreign buyers walking away from our markets,” Gillum said. “Central banks have started reducing their purchases of Treasuries.

So these supply-demand dynamics are another reason we’re seeing these higher yields on the Treasury curve right now.”

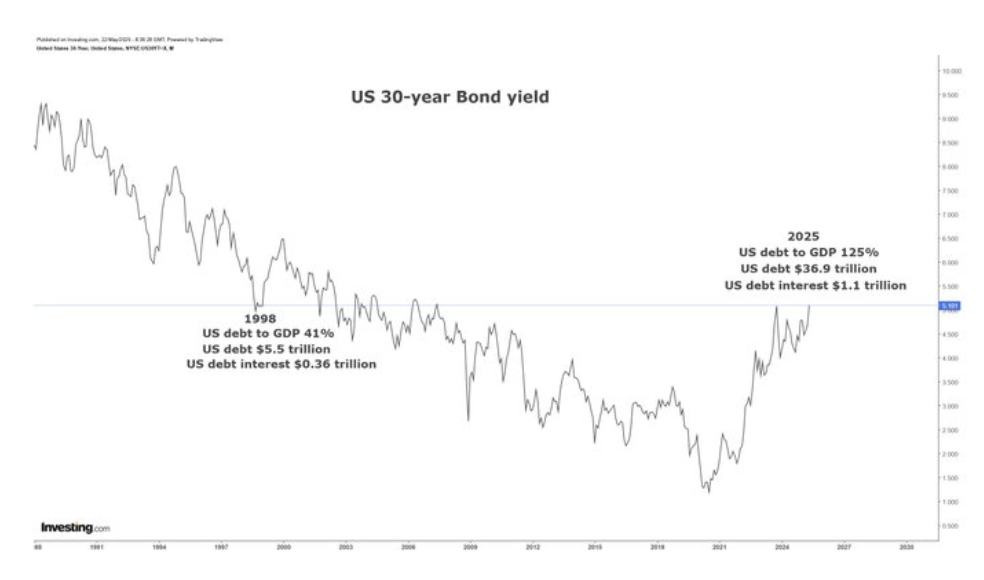

Jones agreed. Speaking to the Schwab Network, she said long-term Treasury yields are now in territory not seen since the 1990s.

Rashad Hajiyev, founder of RM Capital Consulting, noted in a post on X that the 30-year yield is now on par with levels last seen in 1998. But the context couldn’t be more different.

In 1998, the U.S. debt-to-GDP ratio was just 41%. Today, it stands at 125%.

“The problem is that there are fewer buyers of U.S. debt as the budget deficit grows and America needs more debt financing,” Hajiyev wrote.

He warned that the imbalance may eventually force the Federal Reserve to return to quantitative easing even as it insists on maintaining a hawkish stance.

“No matter how hard and bossy [the] FED is attempting to behave,” he said, “they may have no choice.”

A troubling disconnect

Perhaps the most jarring signal comes from the breakdown in the long-standing relationship between Treasury yields and the U.S. dollar.

Historically, rising yields tend to lift the greenback by making U.S. assets more attractive. But that’s not what has happened this year.

Despite surging yields, the dollar is falling, signaling that global investors may be losing faith in U.S. stability.

“The dollar is losing its haven appeal, and its divergence from rising bond yields is a clear sign that global investors are backing away from U.S. holdings,” Bryan Curtis wrote for data analytics firm TradeAlgo.

The Bloomberg Dollar Spot Index is now down nearly 1% for the week and more than 7% year-to-date, the worst start to a year since the index launched in 2005.

Curtis cited a recent note from Danske Bank strategist Jens Naervig Pedersen, who said the disconnect between the dollar, bond yields, and traditional risk indicators “resembles past periods of financial stress.”

That sentiment has investors rethinking what counts as a “safe” asset in a world of rising debt, geopolitical shocks, and central bank uncertainty.

Higher yields will keep investors tethered, though

There’s at least one reason for optimism.

Despite (or because of) weakened demand, Jones told the Schwab Network she still sees long-term bonds playing a key defensive role in diversified portfolios, especially as yields rise.

“Most of what you get when you buy a bond in total return is the income stream,” she explained. “The price change is not generally a big mover in terms of your total return.”

She argued that if bond yields remain in the 5% to 6% range, coupon income becomes far more attractive, especially compared to riskier asset classes like stocks.

“That’s a very attractive proposition for generating total return and offsetting risk,” she said. “So I won’t rule out bonds providing diversification.”

However, with deficits climbing, foreign buyers showing signs of fatigue, and investors demanding bigger premiums, it’s clear the Treasury market is on edge.

While Trump may be touting his legislative win, the real vote of confidence — or lack thereof — may come from the bond market in the weeks ahead.

Your email address will not be published. Required fields are markedmarked