The finance world is looking more like a funhouse mirror every week.

Wall Street’s oldest banks are diving headfirst into blockchain, while crypto’s biggest exchange is inching closer to traditional banking.

It wasn’t long ago that the idea of major banks handling digital tokens sounded like a bad joke. In 2017, BlackRock CEO Larry Fink called bitcoin an “index of money laundering.” Four years later, Donald Trump dismissed it as “a scam”.

Fast forward to today, and both men have flipped. Fink now calls tokenization “a revolution in investing” and wants to transform everything — stocks, bonds, real estate — into instantly tradable digital tokens.

Trump and his family are making so much money from crypto deals that the president has been accused of “open corruption”, a surreal twist considering critics once said criminals were the main users of bitcoin.

Wall Street’s tokenized leap

Two of the most established names in finance — BNY Mellon (BK) and Goldman Sachs (GS) — are now pushing the digital frontier.

Last week, they announced a partnership to launch tokenized money market funds (MMFs) designed for sophisticated institutional investors.

The system uses Goldman’s GS Dap blockchain platform, integrated with BNY’s LiquidityDirect and Digital Asset platforms, allowing:

- Subscriptions and redemptions of MMF shares via BNY’s LiquidityDirect

- Blockchain-based mirror tokens created through GS Dap

- Real-time, digital connectivity without losing regulatory oversight

“As the financial system transitions toward a more digital, real-time architecture, BNY is committed to enabling scalable and secure solutions that shape the future of finance,” said Laide Majiyagbe, BNY’s global head of liquidity, financing, and collateral.

“Mirrored tokenization of MMF shares is a first step in this transition, and we are proud to be at the forefront of this first-of-its-kind initiative.”

The pilot launch will include BlackRock, Fidelity Investments, Federated Hermes, BNY Investments Dreyfus, and Goldman Sachs Asset Management. So far in 2025, Goldman stock is up 27.3%, while BNY Mellon shares have jumped 31.4%.

Coinbase’s TradFi twist

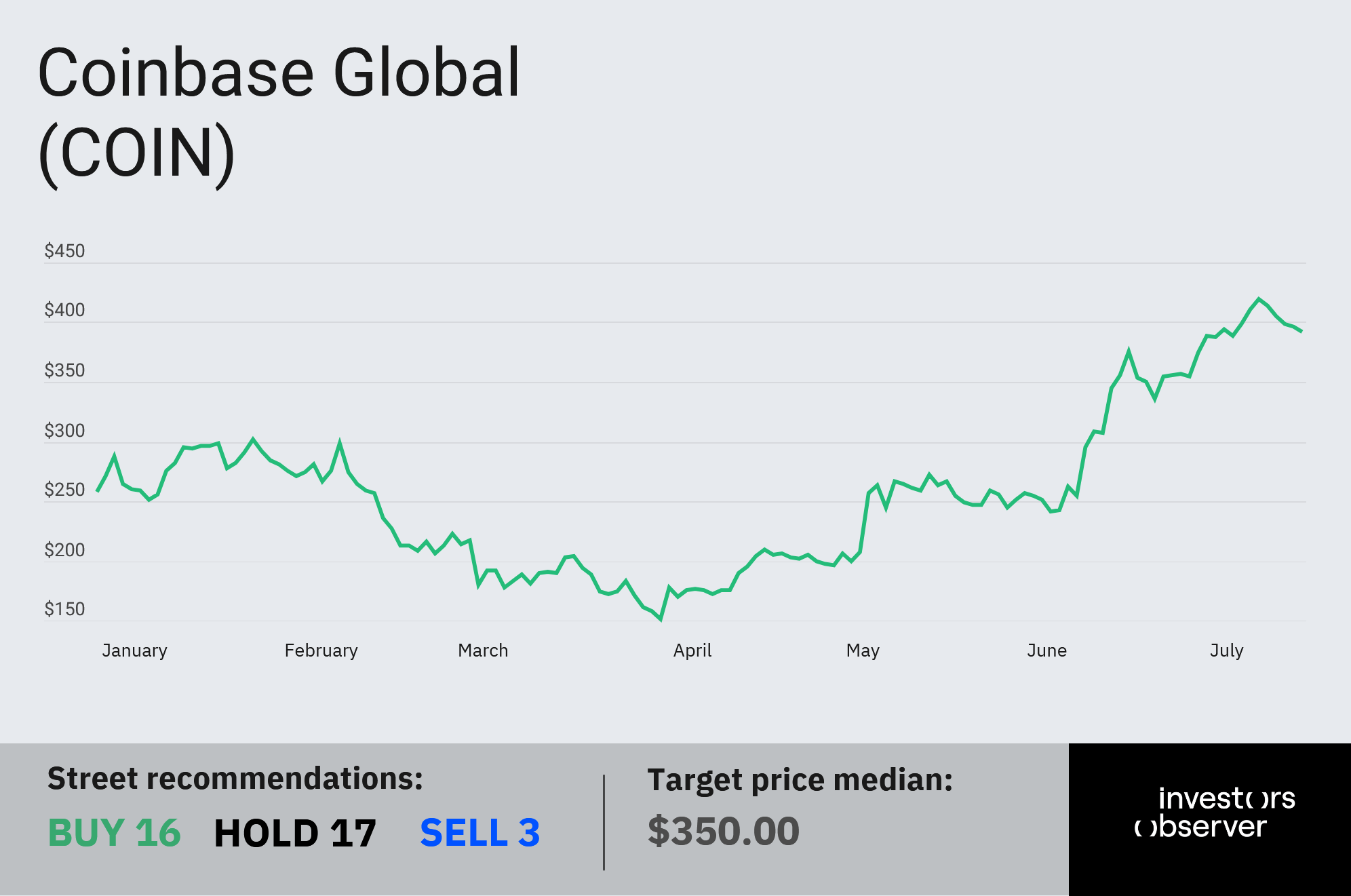

While Wall Street goes blockchain-native, Coinbase (COIN) — once the poster child of crypto’s rebellion against big banks — is making a move in the opposite direction.

The exchange has partnered with PNC Bank to expand digital asset services for institutional investors and banking clients through its Crypto-as-a-Service (CaaS) platform.

PNC will also provide “select banking services” to Coinbase, bridging the gap between regulated banking and the crypto-native exchange.

“Partnering with Coinbase accelerates our ability to bring innovative, crypto financial solutions to our clients,” said PNC CEO William S. Demchak.

Coinbase stock has surged 57.7% year-to-date, underscoring how blurred the line between crypto and Wall Street has become.

Your email address will not be published. Required fields are markedmarked