With the Trump administration rewriting regulations to foster a more friendly environment for digital assets, the mainstreaming of crypto has reached a feverish pitch in the U.S.

President Trump launched a strategic bitcoin reserve in March.

A growing number of companies are launching bitcoin and other crypto treasuries to emulate the business model of Strategy.

And now the recent passage of the GENIUS Act – the first-ever legislation in the U.S. that lays out rules for U.S. dollar-backed stablecoins – has got financial institutions like Bank of America, as well as corporations like Amazon (AMZN) and Walmart (WMT), talking about launching their own stablecoins.

Amid this explosion of interest in crypto – along with a much friendlier regulatory environment – the San Francisco-based fintech platform SoFi (SOFI) has announced that it is reentering the digital asset space.

The company said that it will be introducing international remittances through blockchain and stablecoins, and will also allow users to invest in cryptocurrencies later this year.

WIth the remittance service, eligible SoFi Money members will be able to transfer money via the SoFi app to people in dozens of countries, with the funds being “transmitted on secure, well-known blockchain networks.”

The money will then be converted into local currency at the destination.

Meanwhile, SoFi also said that its members will later this year be able to buy, sell, and hold a selection of crypto currencies, including bitcoin and Ethereum.

The company intends to additionally “offer stablecoins and a wide range of other services,” it said in its press release.

These services will include letting SoFi members borrow against their crypto assets. The company also plans to expand its payment options and introduce new staking features.

“The future of financial services is being completely reinvented through innovations in crypto, digital assets, and blockchain more broadly,” SoFi CEO Anthony Noto said in a statement. “We’re accelerating our efforts to give members more choice and more control, whether they’re investing, sending money across borders, or planning for their future.”

The company shutdown its crypto operations in 2023 after receiving a conditional approval from the Office of the Comptroller of Currency (OCC) under the Biden administration to operate as a holding company the previous year.

The company said in a regulatory filing in 2022 that the approval from the OCC hinged on the company not engaging in any crypto-related activity or services without approval from the agency.

However, with the Trump administration’s revised rules for digital assets, the OCC now allows nationally chartered banks to offer crypto custody and execution services on behalf of its customers.

“Thus, having a national bank license, as well as the vast technology expertise as a digital-only financial company, SoFi is uniquely positioned to bridge traditional financial systems and emerging technology, giving members the trust and confidence they deserve,” the company said in a statement. “We will innovate responsibly and in accordance with evolving U.S. regulations.”

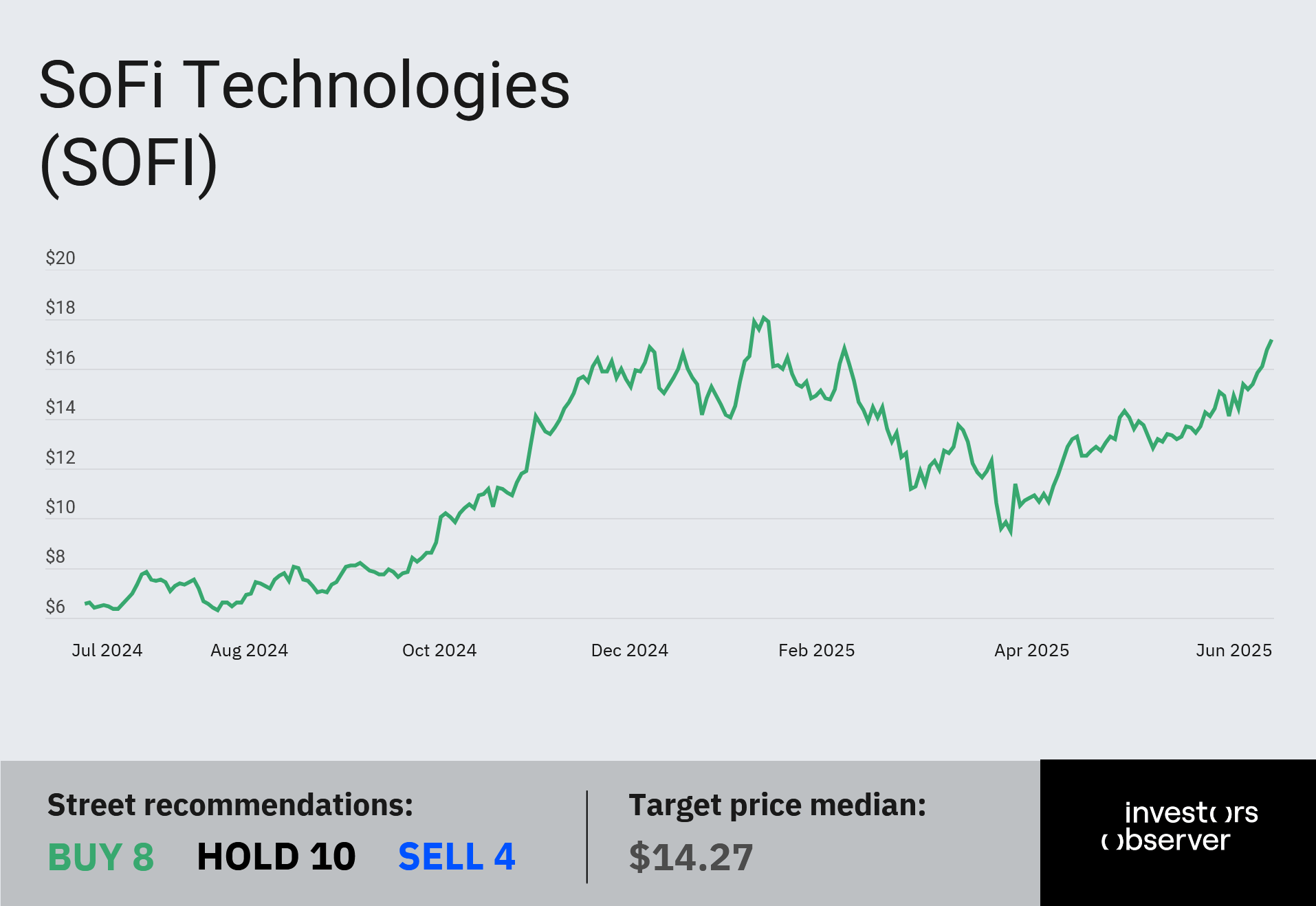

SoFi’s stock is up 11.6% YTD and has surged 162.7% over the past year.

Your email address will not be published. Required fields are markedmarked