Leading stablecoin issuer Circle Internet Group (CRCL) and digital-asset custodian Fireblocks are looking to make it easier for financial institutions to build out their own digital asset offerings as stablecoins continue to grow at breakneck speed.

The companies are combining Circle’s stablecoin network with Fireblocks’ custody and payments infrastructure platform to offer cross-border treasury and tokenization asset settlement.

Circle said the companies are providing the infrastructure that financial institutions need in order to meet the challenges they face as they come “under pressure to launch new stablecoin-based products at speed while meeting security and compliance requirements.”

These challenges include being able to access diverse liquidity providers who can fulfill the settlement and pricing needs of customers – while also adhering to “an evolving landscape of regulatory, operational, and technological demands.”

"The future of money is programmable, and this collaboration with Fireblocks can make that future real for institutions worldwide," Jeremy Allaire, co-founder, chairman and CEO of Circle said in a statement. "Together, we're creating a seamless infrastructure that makes it simple to harness the power of stablecoins for payments, treasury operations, and settlement.”

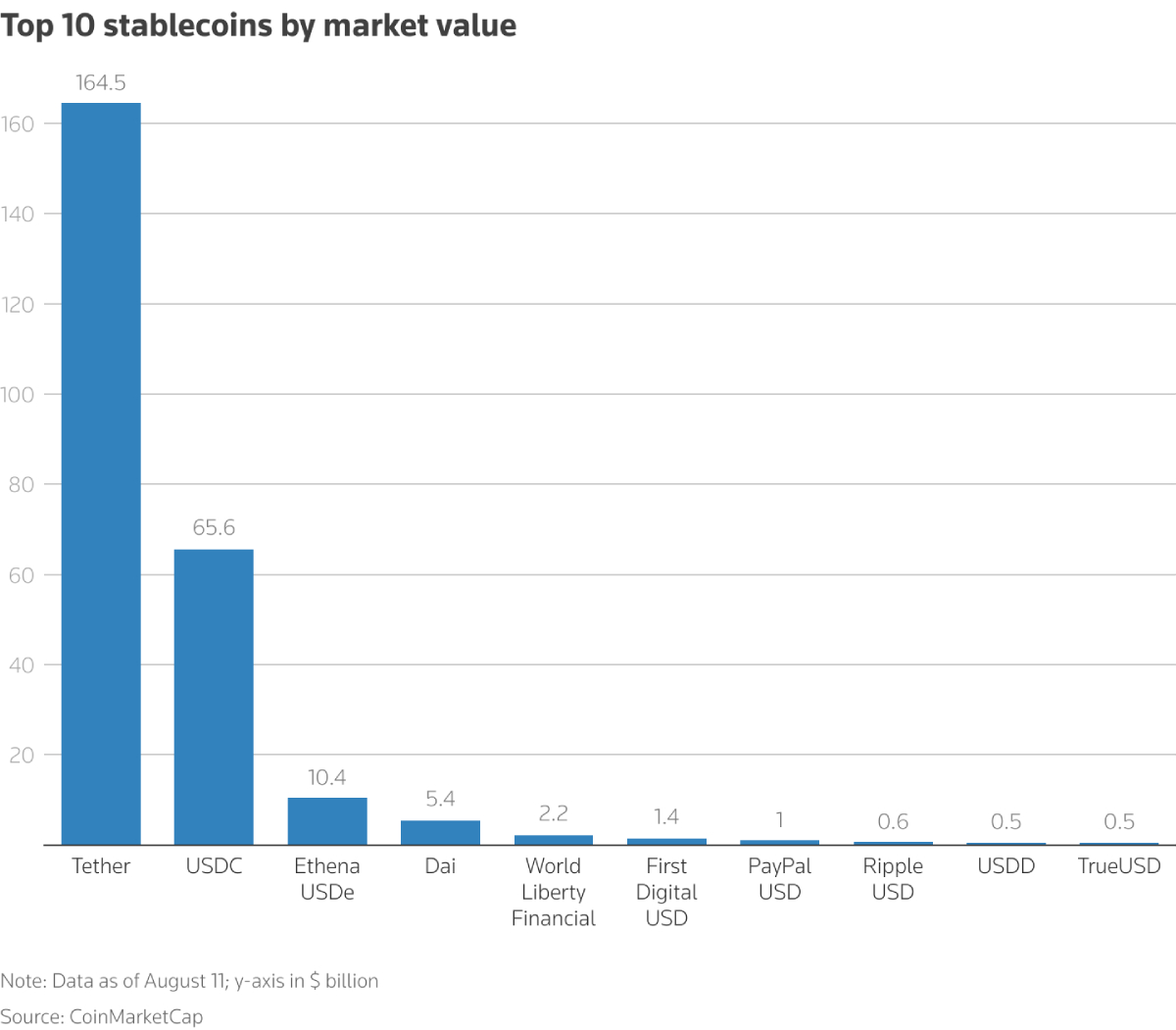

The combined market capitalization of stablecoins has more than doubled over the past 18 months to almost $280 billion, and some analysts see it reaching $2 trillion in the next three years, as Reuters reports.

Michael Shaulov, Co-founder and CEO of Fireblocks said in a statement that the two companies “are working to build the trusted rails that enable stablecoin-based finance at a global scale.”

“Those who move now won’t just keep pace, they’ll set the standard for tomorrow’s digital financial system," he added.

Circle’s shares closed up 17.6% on Thursday.

Its USDC stablecoin circulation is about $72 billion, representing a 107% increase YoY, according to Canaccord Genuity analyst Joseph Vafi.

Its USDC circulation has risen roughly 16% sequentially quarter-to-date.

Circle and Tether make up more than 80% of the entire stablecoin market.

But the number of stablecoins is expected to continue its rapid growth, especially after the U.S. Government passed the GENIUS Act in June that established the country’s first-ever stablecoin regulation.

Analysts say it could be one of the biggest catalysts yet for mass adoption.

“Stablecoins now present what I believe is the first credible opportunity to onboard a billion people into crypto,” said Daren Matsuoka, a data scientist at a16z’s crypto arm.

According to Matsuoka, stablecoins have settled $33 trillion in transactions over the past year, dwarfing PayPal and even approaching the volume of ACH bank transfers.

Stablecoins now present what I believe is the first credible opportunity to onboard a billion people into crypto.

undefined Daren Matsuoka (@DarenMatsuoka) June 6, 2025

If you haven't checked in on the latest stablecoin data recently, you might be surprised. Stablecoins have done $33 trillion in transaction volume in the last 12… pic.twitter.com/3E7uLEwwdQ

Circle rode this momentum to a blockbuster IPO in June, closing its first day of trading up 168%, and then soared 250% after two days.

Its shares have surged 93.8% for the year – and its market cap is now at about $33.6 billion.

Your email address will not be published. Required fields are markedmarked