Cathie Wood made her name spotting breakout winners like Tesla (TSLA) and Coinbase (COIN). But her timing in nuclear energy has been less flawless, at least on the surface.

Wood was an early backer of Oklo (OKLO), a buzzy small modular reactor (SMR) startup now making waves in Washington. One of its former board members, Chris Wright, is currently U.S. Secretary of Energy.

Yet Wood’s ARK Autonomous Tech ETF (ARKQ) dumped 50,333 shares of Oklo in January. Then it offloaded another 97,238 shares — worth around $4.75 million — right before President Trump signed a sweeping executive order accelerating nuclear energy deployment.

Since then, Oklo’s stock has rocketed 220.4% year-to-date. And on Wednesday, it surged another 29.4% after announcing it had been selected as the “intended awardee” to supply clean power to Eielson Air Force Base in Alaska.

ARKQ no longer holds any Oklo shares, according to its latest filling. But Ark may have found a bigger winner elsewhere.

ARK’s favorite nuclear bet

When Wood first trimmed her Oklo stake, she picked up 31,548 shares of uranium mining giant Cameco (CCJ).

The fund now owns 275,329 CCJ shares worth roughly $17.6 million, even after selling 33,110 shares just before Trump’s nuclear orders lit a fire under the sector.

While Oklo rides the SMR wave, Cameco could benefit from something even bigger: full-scale nuclear reactor deployment.

The Financial Times reported last week that Westinghouse — 49% owned by Cameco — is in talks with the U.S. government to roll out 10 new large nuclear reactors in response to Trump’s executive orders.

Cameco already expects $170 million in additional adjusted EBITDA this year from its stake in Westinghouse, citing gains from nuclear projects in the Czech Republic.

Now the potential U.S. deal could dramatically expand that.

“There is active engagement with the administration,” Westinghouse interim CEO Dan Sumner told the FT, highlighting the importance of federal financing in getting the projects off the ground.

According to TD Cowen, the full project could carry a price tag of $75 billion, which would be a massive boost to the domestic nuclear supply chain and to Cameco’s long-term value.

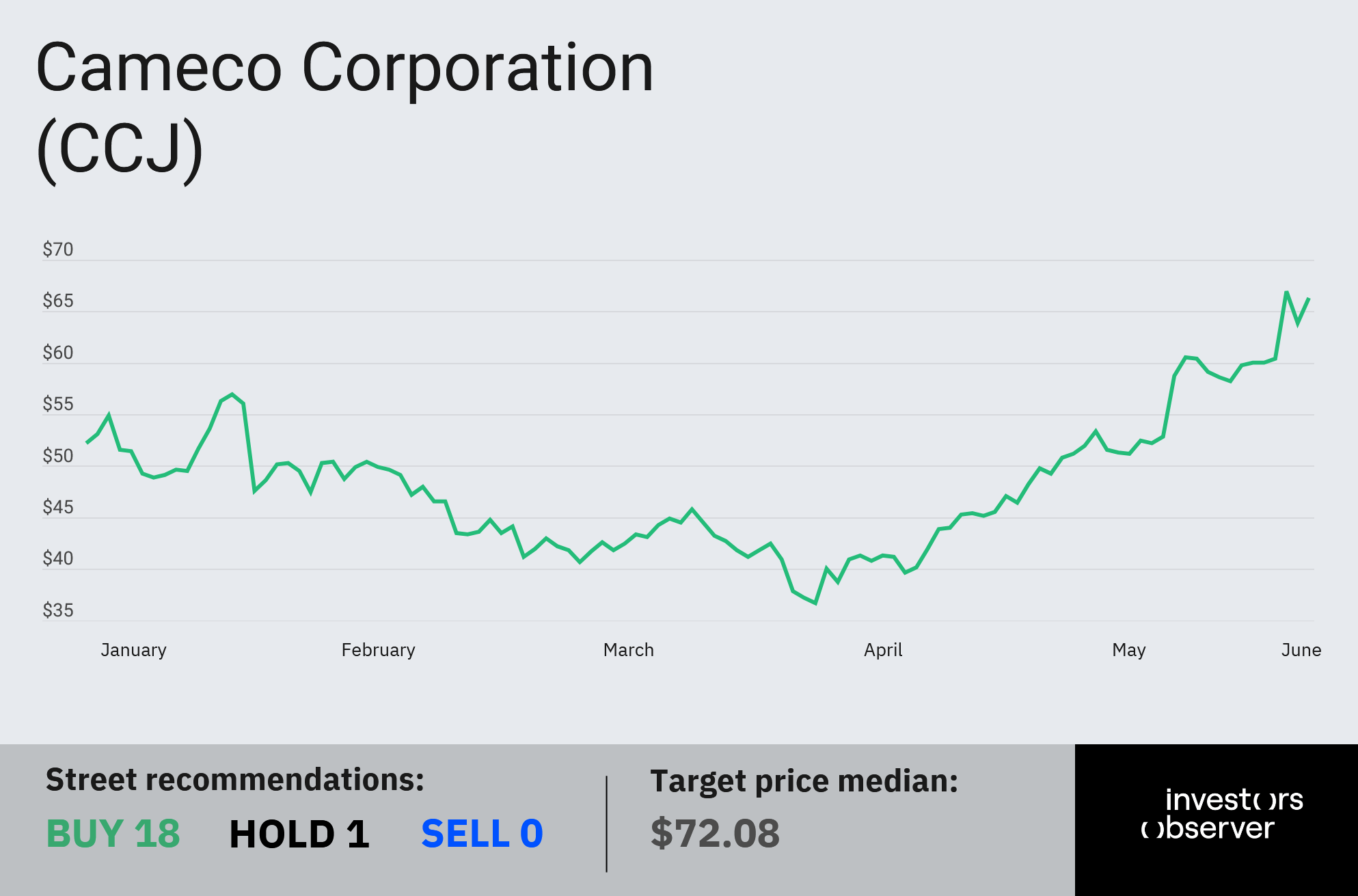

Cameco stock is up 29.2% year-to-date.

Your email address will not be published. Required fields are markedmarked