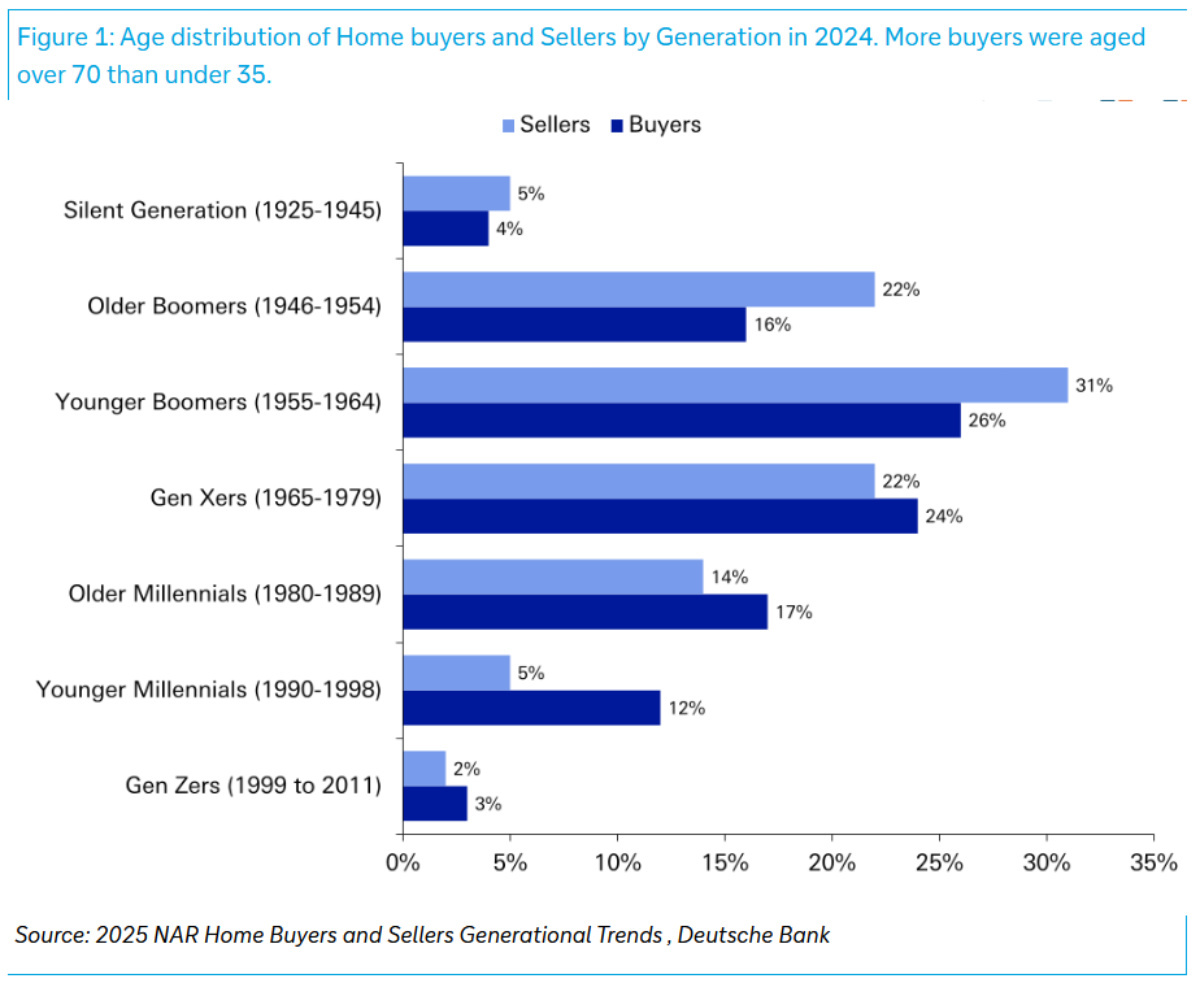

Despite owning at least 40% of America’s real estate wealth, Baby Boomers continue to dominate home purchases — a stark reflection of the affordability crisis squeezing younger generations out of homeownership.

According to new research from Deutsche Bank’s macro strategy team, 46% of all U.S. home purchases in 2024 were made by buyers aged 60 and older. Even more striking, there were more buyers aged 70 and above than those under 35, underscoring the generational imbalance in access to housing.

The findings add to mounting evidence that homeownership is increasingly out of reach for many Millennials and Gen Z. Separate research from InvestorsObserver found that the American middle class was priced out of nearly half of the nation’s 100 largest metro areas last year.

Deutsche Bank did offer a note of optimism - with a caveat.

“Over the long run, property is an asset that ultimately gets redistributed from one generation to the next. Right now, that handoff is being stalled by high interest rates and elevated home prices,” Deutsche’s research team said.

With borrowing costs still elevated and housing supply tight, the long-awaited generational handoff of property wealth appears unlikely to materialize anytime soon. Instead, Boomers’ grip on the housing market continues to tighten, while younger Americans face the steepest affordability barriers in decades.

Younger generations struggle to afford homes, even after inheriting them

As home prices continue to rise and real wages fail to keep pace, the profile of the typical U.S. homebuyer has shifted dramatically over the decades.

According to data from the National Association of Realtors (NAR), the median age of a U.S. homebuyer was just 28 in 1992. By 2024, that figure had climbed to 38, reflecting the growing difficulty younger Americans face in entering the housing market.

Baby boomers are “the winners in today’s housing market,” said Jessica Lautz, NAR’s deputy chief economist.

The trend is even more pronounced among repeat buyers. The average age of those purchasing a home for the second time or more has jumped from 42 to 61 over the same period - a shift that aligns with Deutsche Bank’s findings showing that Boomers continue to dominate housing transactions.

The affordability crunch has become so severe that it’s complicating the so-called “Great Wealth Transfer” — the expected handoff of assets from older to younger generations.

A recent survey by LegalZoom, an online legal services provider, found that 42% of younger Americans say they are not financially prepared to keep or maintain property they inherit from their parents. Rising property taxes, maintenance costs, and outstanding mortgage debt are making it increasingly difficult for heirs to hold onto family homes.

Your email address will not be published. Required fields are markedmarked